What is Environmental, Social and Governance (ESG) Criteria in Investing?

If you’re interested in investing, but you want to make sure your money is directed into organizations that share your values – or, at the very least, don’t go against them – then you’ve probably been researching different methods of ethical investment.

The bread and butter of ethical investment standards, through which investors can screen companies they’re thinking of investing in, is ESG – Environmental, Social and Governance – investing.

What is ESG?

ESG refers to a set of criteria comprising environmental, social, and governance standards that a company must uphold to be a candidate for an investor’s portfolio.

These standards will differ depending on what’s important to the investor. However, they also take into account the impact that certain detrimental practices are likely to have on the value of the investment long-term.

The criteria used to define acceptable environmental company standards could include:

- comprehensive environmental reports, including on carbon emissions, energy usage, waste production and sustainability as a whole

- limits the amount of damage they do to habitats (or have measures in place to negate their impact on natural habitats)

- has measures in place to reduce their energy/non-renewable resource usage

- limit of the volume of harmful pollutants or chemicals used/produced

- use renewable resources where possible

- avoids animal testing/cruelty

The criteria used to define acceptable social standards within a company could include:

- supports the fight against inequality, including gender, LGBTQ+ and race inequality

- has programmes in place to support communities or charitable causes

- has measures in place to prevent sexual harassment and assault

- treats its workers and its customers fairly

- pays its workers fairly

The criteria used to define acceptable governance practices by a company could include:

- carries out regular audits/risk assessments to identify problems, which could include everything from ensuring employee needs are met and making sure the working environment is safe to check for security vulnerabilities

- prioritizes diversity on the board and at all levels of the company hierarchy

- haven’t – and don’t currently – engage in illegal practices

- provides accurate, transparent accounts

Why are more and more investors considering ESG when making investments?

More and more, investors are taking into account ethical concerns, and looking at Environmental, Social and Governance standards, which comprise criteria covering a diverse range of the top considerations when investing.

This is particularly true in the case of younger generations such as millennials, who prefer to invest in line with their values as an individual, ensuring that their money isn’t contributing to problems they want to see eradicated.

Moreover, more than just the younger generations are concerned about companies’ environmental, Social and Governance practices, as the whole world takes more notice and holds companies accountable.

This is particularly true in the case of environmental concerns. As the climate crisis grows ever direr, the need for renewable energy increases, and we become more aware of humanity’s profoundly negative influence on the planet.

As a result of these factors, sustainable practices have become one of the most attractive consumers, improving the odds of success of sustainably-minded businesses in the future.

Simultaneously, the fight for gender and race equality, in addition to LGBTQ+ rights and stamping out practices such as workplace harassment, has reached new heights in the last decade. Similarly, companies that don’t support these causes with their methods or policies are future scrutiny targets.

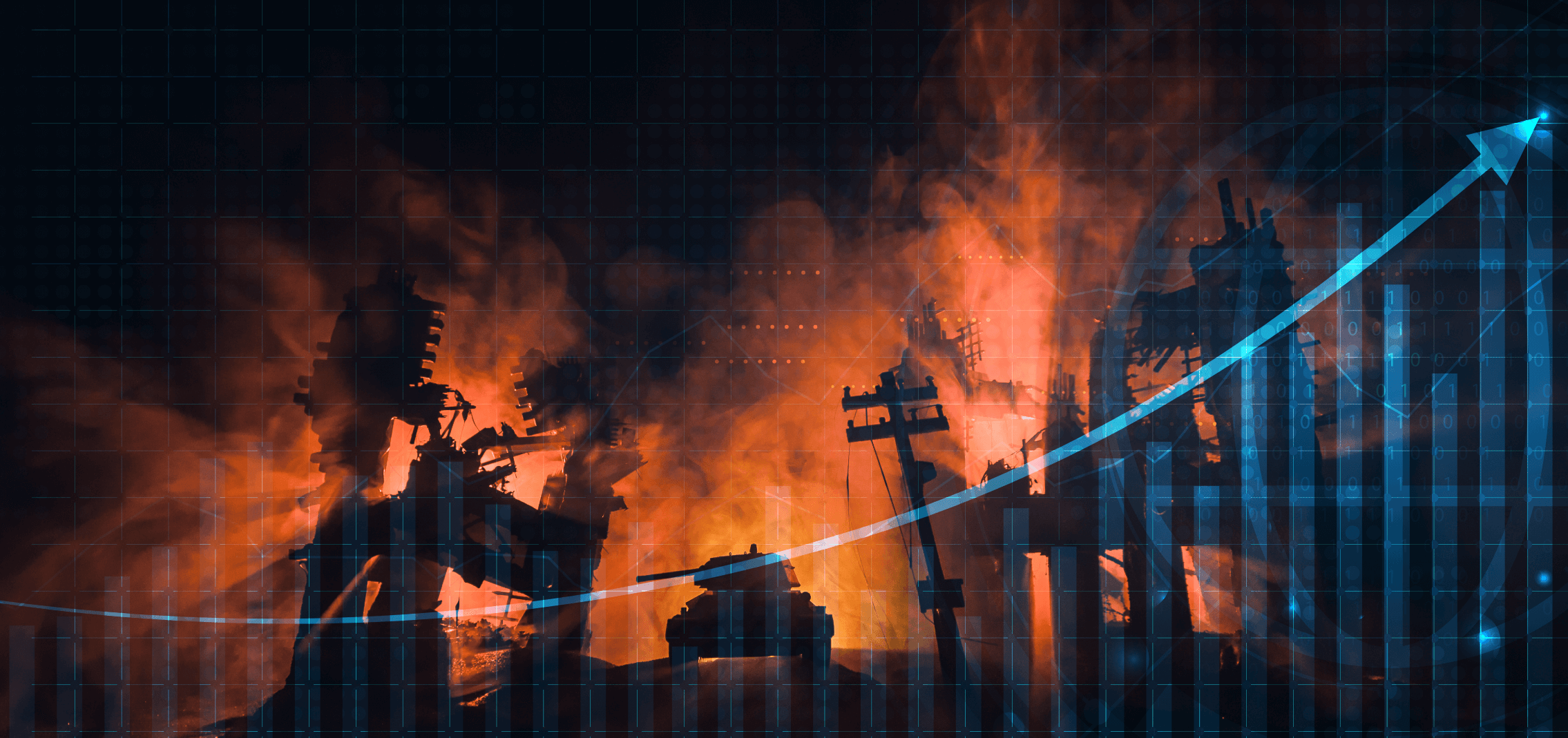

In the past, if investors wanted to make ethical investments, then there would often be a trade-off, where investors achieved lower returns in return for appeasing their conscience. Unethical practices or a disregard of the environment could further a company’s success, making for more lucrative investments – particularly in fossil fuel and non-renewable energy companies.

However, as the sociopolitical attitude towards these issues has changed and society has become a more socially and environmentally responsible body, it’s thought that screening investments according to ESG standards could improve the success of an investment portfolio over time.

One notable example that could spell the future of non-ESG investments in the fall of stock prices after the BP oil spill in 2010 on the Gulf Coast of Mexico, which polluted the water and killed much of the local marine life.

As a result, the realm of ESG investing has grown astronomically over the past decade, with assets worth more than $17 trillion being chosen due to their being in line with ESG criteria, representing an increase of $5 trillion in just two years.

So, suppose you want to make more socially and environmentally conscious investment decisions. In that case, there are countless investments you can make inline with ESG guidelines, as investment firms have caught onto their popularity and created numerous funds and ETFs, in addition to myriad stocks, in line with investors’ values.