Stocks rally on interest rate optimism

Global equities rallied last week on expectations that interest rates may have finally reached their peak.

The S&P 500 rose 4.6%, its strongest weekly gain in almost a year, after the Federal Reserve indicated that the recent increase in long-term Treasury yields could mean that a further rate hike is not required. The Dow added 3.4% and the Nasdaq surged 5.4%.

In Europe, the Stoxx 600 and Germany’s Dax both added around three percentage points after eurozone inflation fell to its lowest level since July 2021. The FTSE 100 gained 1.2% as the Bank of England voted to keep interest rates unchanged.

The positive sentiment carried over to Asia, where Japan’s Nikkei 225 advanced 4.1% and China’s Shanghai Composite rose 0.3% despite concerns about China’s economy.

Last week’s market update*

• FTSE 100: +1.23%

• S&P 500: +4.60%

• Dow: +3.44%

• Nasdaq: +5.39%

• Dax: +3.21%

• Hang Seng: +1.48%

• Shanghai Composite: +0.31%

• Nikkei 225: +4.08%

• Stoxx 600: +3.04%

• MSCI EM ex Asia: +5.72%

*Data from close of business Friday 27 October to close of business

Friday 3 November.

Eurozone business activity contracts further

European stock markets slipped into the red on Monday (6 November) as investors took profits after five-consecutive days of gains and data painted a gloomy picture of the eurozone economy. The latest HCOB eurozone purchasing managers’ index (PMI) showed the rate of decrease in business activity accelerated in October. The index fell to a 35-month low of 46.5 in October, down from 47.2 in September. New orders for goods and services fell at the quickest pace since May 2020. Over in Asia, South Korea’s Kospi surged 5.7% on Monday after the country re-imposed a ban on short selling.

UK and European indices were flat at the start of trading on Tuesday as investors analysed weaker-than-expected economic data from Germany and China. German industrial production slumped 1.4% in September, driven by a 5% decline in automotive industry production. Chinese exports dropped 6.4% year-on-year in October, much worse than the 3.5% decline expected by analysts. Imports unexpectedly rose by 3.0% over the same period.

Fed delivers dovish policy statement

Last week saw the US Federal Reserve vote to leave interest rates unchanged, as widely expected. The November meeting did not contain any new economic projections, which meant that all eyes were on the postmeeting press conference.

During the conference, Federal Reserve chair Jerome Powell noted that the recent surge in long-term US bond yields and mortgage rates had done some of the Fed’s job for it. He said Fed officials will be watching the effects of higher yields as they consider whether to hike rates again. Powell also said the Fed has come far in terms of its tightening campaign and that it takes time for higher interest rates to impact the real economy.

The comments were interpreted to mean that interest rates may have reached their peak, which drove steep declines in bond yields across different maturities.

US labour market cools

The drop in bond yields was further fuelled by a weakerthan- expected nonfarm payrolls report, released on Friday. Nonfarm payrolls increased by just 150,000 in October, while job growth in August and September was revised down by 101,000. Manufacturing was a notable area of weakness, with the sector experiencing net job losses of 35,000 last month. The Bureau of Labor Statistics said this reflected a decline of 33,000 in motor vehicles and parts that was largely due to strike activity. Average hourly earnings increased by 0.2% month-on-month, the lowest reading since February 2022, and the unemployment rate ticked up to 3.9%.

Although the data suggests the economy is slowing, markets reacted positively because it added to the conviction that the Fed will abandon its plan of one more rate hike in December.

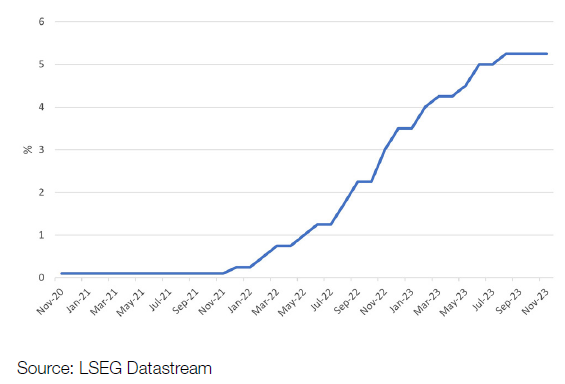

BoE holds base rate at 5.25%

Here in the UK, the Bank of England (BoE) chose to leave interest rates unchanged for the second time in a row at 5.25%. The vote was 6-3, with three of the nine Monetary Policy Committee members favouring another 25-basis point increase.

Bank of England base rate

While the BoE’s hiking campaign might have come to an end, the Bank went out of its way to flag that monetary policy will remain restrictive for some time as inflation and wage growth remain elevated. BoE governor Andrew Bailey said it was “much too early to be thinking about rate cuts”, adding: “We will keep interest rates high enough for long enough to make sure we get inflation all the way back to the 2% target.”

The most recent year-on-year inflation figure was 6.7%. The BoE expects inflation to fall sharply in the coming

months, remain at around 3% next year, and drop below the 2% target at the end of 2025 – later than previously forecast. It also expects the UK economy to grow by 0.1% for the rest of this year and remain flat in 2024.

Japan approves stimulus package

Over in Asia, the Japanese government approved a $113bn stimulus package that aims to boost growth and help households cope with the rising cost of living. According to Reuters, the package includes temporary cuts to income and residential taxes, payouts to lowincome households, and subsidies to curb petrol and utility bills. The government estimates that the plan will boost Japan’s gross domestic product (GDP) by around 1.2% on average over the next three years.

Last week also saw the Bank of Japan (BoJ) announce a further relaxation of its yield curve control policy. The BoJ said the 1.0% ceiling for ten-year Japanese government bond yields will now be regarded as a reference rather than a strict cap on rates.