Stock markets rally on US debt ceiling deal

Several indices enjoyed solid gains last week after US lawmakers passed the debt ceiling deal, averting what would have been the country’s first-ever default.

The House of Representatives and the Senate passed the legislation after US president Joe Biden and speaker Kevin McCarthy reached an agreement following several weeks of tense negotiations. Stocks were also boosted by the release of a forecast-busting nonfarm payrolls report on Friday. The Nasdaq rose 2.0% in its sixthconsecutive weekly gain, while the S&P 500 added 1.8% to close at its highest level in over nine months.

The positive sentiment helped the pan-European Stoxx 600 claw back earlier losses to end the week up 0.2%. In Asia, disappointing factory data from China saw the Hang Seng hit a six-month low on Wednesday before finishing the week up 1.1%. The FTSE 100 was the only major index to end the week in the red, as news of the debt ceiling deal failed to outweigh concerns about China’s economic recovery.

Last week’s market update*

• FTSE 1001: -0.26%

• S&P 5001: +1.83%

• Dow1: +2.02%

• Nasdaq1: +2.04%

• Dax: +0.42%

• Hang Seng: +1.08%

• Shanghai Composite: +0.55%

• Nikkei 225: +1.97%

• Stoxx 600: +0.16%

• MSCI EM ex Asia: +0.68%

*Data from close of business Friday 26 May to close of business

Friday 2 June

1Closed on Monday 29 May

US services sector figures disappoint

Stocks slipped on Monday (5 June) following the release of disappointing US services sector readings. The S&P 500 fell 0.2% after the Institute for Supply Management’s (ISM) non-manufacturing purchasing managers’ index (PMI) fell to 50.3 in May, just above the 50.0 mark that separates growth from contraction. This was well below the 52.2 forecast by economists in a Reuters poll.

Monday also saw the release of services sector data for the UK. The S&P Global / CIPS services PMI measured 55.2 in May, down slightly from April’s one-year high of 55.9. Services sector cost inflation hit a three-month high as increased salary payments more than offset lower fuel costs. The FTSE 100 ended Monday’s trading session down 0.1% after enjoying an earlier rally on the back of higher oil prices.

Nonfarm payrolls smash forecasts

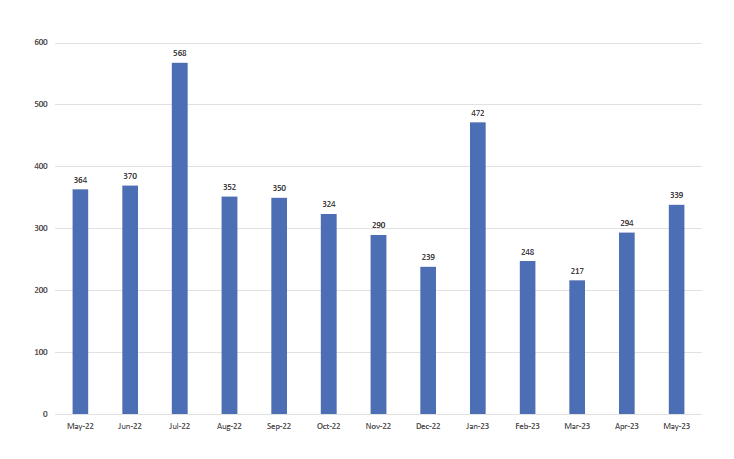

The release of the closely watched US nonfarm payrolls report last Friday saw stock markets end the week on a high note. The US economy added 339,000 new jobs in May, according to the Bureau of Labor Statistics. This was almost double expectations of around 195,000. Figures for the previous two months were also revised upwards.

US nonfarm payrolls – monthly change (thousands)

Source: Refinitiv Datastream

However, not everything in the report signalled strength. The ‘household’ survey, which is based on a survey of around 60,000 US households, showed that jobs growth fell sharply in May. In contrast, the ‘establishment’ survey, which incorporates the payroll records of some 144,000 nonfarm establishments and government agencies, rose. Taking an average of both surveys suggests jobs growth was the weakest in over a year. The unemployment rate also rose to 3.7%, higher than any estimate in Bloomberg’s survey of economists.

The data came two days after figures showed US job openings unexpectedly rose in April, indicating persistent strength in the labour market. There were 1.8 job openings for every unemployed person in April, up from 1.7 in March.

US manufacturing contracts further

The latest US manufacturing sector data added to an increasingly mixed picture for the US economy. ISM’s manufacturing PMI fell to 46.9 in May, the seventh-consecutive month it has stayed in contraction territory. The new orders sub-index dropped to 42.6.

In contrast, companies continued to increase hiring in May and inflation eased. The survey’s measure of prices paid by manufacturers decreased sharply to 44.2 from 53.2, defying expectations for a modest increase.

Eurozone inflation eases

In the eurozone, headline inflation fell by more than expected in May to 6.1% year-on-year from 7.0% in April. This marked the lowest level since February 2022. Core inflation, which excludes volatile food and energy prices, also eased more than anticipated to 5.3% from 5.6%.

Nevertheless, European Central Bank (ECB) president Christine Lagarde said inflation was still too high and “set to remain so for too long”. The ECB is expected to raise interest rates by a further 0.25 percentage points when it meets on 15 June and again in July or September, according to Reuters.

Separate data showed economic sentiment in the eurozone fell by more than expected in May. The European Commission’s index declined to 96.5, the lowest level since November 2022. The decrease was driven by lower confidence in industry, services and, particularly, retail trade. Construction confidence remained broadly unchanged, while consumer confidence continued recovering, albeit at a reduced pace.

China factory activity slumps

Over in Asia, markets tumbled last Wednesday following the release of China’s official manufacturing PMI. The index dropped from 49.2 in April to 48.8 in May, the weakest level since the country ended its zero-Covid policy in December. Production activity fell into contraction for the first time since January, dragged down by declines in new orders and exports. The non-manufacturing PMI, which measures sentiment in services and construction sectors, fell to a weaker-than-expected 54.5 in May, which was also the lowest level in four months.