Stocks rise as US labour market cools

Most major stock markets rose last week after US jobs data raised hopes of a pause in interest rate hikes.

On Tuesday, the S&P 500 recorded its best one-day gain since June following an unexpected decline in US job openings. The index finished the week up 1.9%, while the Dow and Nasdaq added 0.8% and 2.4%, respectively.

Indices in Europe also rose as core inflation in the eurozone eased. The pan-European Stoxx 600 gained 0.6%, while Germany’s Dax edged up 0.3%. The FTSE 100 also ended the week in the green, despite another steep decline in UK house prices.

In China, the Shanghai Composite added 1.1% after the government announced measures that aim to bolster the world’s second-largest economy.

Last week’s market update*

• FTSE 1001: +1.72%

• S&P 500: +1.86%

• Dow: +0.80%

• Nasdaq: +2.38%

• Dax: +0.30%

• Hang Seng2: +1.39%

• Shanghai Composite: +1.12%

• Nikkei 225: +1.68%

• Stoxx 600: +0.60%

• MSCI EM ex Asia: -0.88%

*Data from close of business Friday 25 August to close of business

Friday 1 September

1 Closed on Monday 28 August

2 Closed on Friday 1 September

UK retail sales bounce back in August

It was a quiet start to the week for investors on Monday (4 September) with US markets closed for Labor Day and very little economic news. Tuesday saw the release of the British Retail Consortium’s (BRC) latest UK retail sales figures, which showed sales rose by 4.1% over the four weeks to 26 August. This was well above the 1.0% growth in August 2022 and the three-month average of 3.6%. Non-food products had their best month since February.

Helen Dickinson OBE, chief executive of the BRC, said the figures reflected the improvement in consumer confidence in August. However, she added that high interest rates and high winter energy bills will put pressure on many households to spend cautiously.

US unemployment rate rises to 3.8%

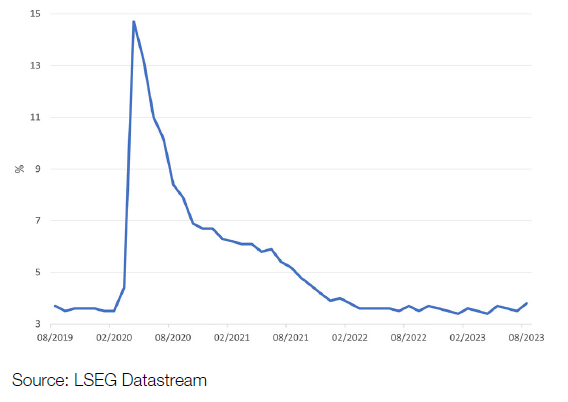

Last week saw mounting evidence of a slowdown in the US labour market, raising hopes that the Federal Reserve will keep interest rates on hold when it meets later this month. Data released on Friday showed the unemployment rate unexpectedly rose from 3.5% in July to 3.8% in August, the highest rate since February 2022.

US unemployment rate

The report from the Labor Department also showed employers added 187,000 jobs in August. This was above expectations, but gains for the previous two months were revised lower by a combined 110,000. Meanwhile, average hourly earnings rose by just 0.2% in August, slightly below expectations. The figures came a few days after data showed job openings unexpectedly fell by 338,000 in July to their lowest level since March 2001.

Although the US labour market is cooling, it remains strong. Economists are increasingly hopeful that the Federal Reserve will achieve a ‘soft landing’ for the US economy – where inflation is brought under control without sparking a recession.

US consumer spending accelerates

There was further evidence of a resilient US economy in the latest consumer spending data. Consumer spending, which accounts for more than two-thirds of US economic activity, increased by 0.8% in July, the most in six months, according to the Commerce Department. When adjusted for inflation, consumer spending rose by 0.6%, which was also the largest gain since January. Data for June was revised slightly higher to show a 0.6% increase in consumer spending instead of 0.5%.

UK house prices fall by most since 2009

Here in the UK, figures from Nationwide showed another steep decline in house prices in August. House prices fell by 5.3% year-on-year, the weakest rate since July 2009. In the first half of the year, the number of completed housing transactions was nearly 20% below pre-pandemic levels and around 40% lower than in the first half of 2021.

Robert Gardner, Nationwide’s chief economist, said the relative weakness of mortgage activity “reflects mounting affordability pressures as a result of the sharp rise in mortgage rates since last autumn”.

Eurozone core inflation eases

Preliminary data released by the European statistics office on Thursday showed that while headline inflation in the eurozone held steady at 5.3% in August, core inflation eased. Core inflation, which strips out volatile food and energy prices and is a gauge of underlying price pressures, fell by 0.2 percentage points to 5.3%.

The figures come ahead of the European Central Bank’s (ECB) policy meeting on 14 September, when it will decide whether to press ahead with further interest rate hikes. As well as a slowdown in core inflation, last week saw signs of weakening economic activity. In Germany, the eurozone’s largest economy, monthly retail sales fell by a worsethan- expected 0.8% in July. The number of unemployed people in the eurozone rose by 73,000 in July, although the unemployment rate remained at a record low of 6.4%.