Stocks in the green as inflation cools

Most markets finished the week in the green as inflation cooled in the US and eurozone.

The UK’s FTSE 100 added 0.9% as house prices continued to recover and the manufacturing sector showed signs of improvement in November. Germany’s Dax added 2.7% while pan-European Stoxx 600 gained 1.7% as eurozone inflation cooled in November.

In the US, the S&P 500 added 1.0%, the Dow grew 2.6% and Nasdaq rose 0.5% as the Federal Reserve’s preferred inflation gauge showed the rate of inflation slowed in October. Meanwhile in Asia, Hong Kong’s Hang Seng dropped 4.0% while China’s Shanghai Composite ended the week flat amid ongoing concerns about China’s economic recovery.

Last week’s market update*

• FTSE 100: +0.92%

• S&P 500: +0.97%

• Dow: +2.58%

• Nasdaq: +0.45%

• Dax: +2.70%

• Hang Seng: -3.96%

• Shanghai Composite: 0.00%

• Nikkei 225: -0.05%

• Stoxx 600: +1.70%

• MSCI EM ex Asia: +1.48%

* Data from close of business on Friday 24 November to close

of business on Friday 1 December.

Rising bond yields affect investor sentiment

US markets closed in the red on Monday (4 December) as investor sentiment was marred by Treasury bond yields rising to 4.29%. The increase raised concerns among investors that Fed rate cuts may be further away than initially thought. The S&P 500 lost 0.5% and the Nasdaq dropped 0.8%, while the Dow fell 0.5%.

European markets were mixed as investors awaited US jobs data, including job openings and non-farms payroll data. The Stoxx 600 lost 0.1% and the FTSE 100 lost 0.2%, while the Dax made a marginal rise.

Eurozone inflation cools

Inflation in the eurozone area cooled more than expected to an annualised 2.4% in November, down from 2.9% in October, according to Eurostat. Economists had predicted a more modest decline to 2.7%.

The main inflation driver – food, alcohol and tobacco – saw price growth weaken from 7.4% in October to 6.9% in November. Services and non-energy and industrial goods also fell to 4.0% and 2.9%, respectively, in November – down from 4.6% and 3.5%, respectively, in October. Energy prices continued to fall to -11.5%, down from -11.2% in October.

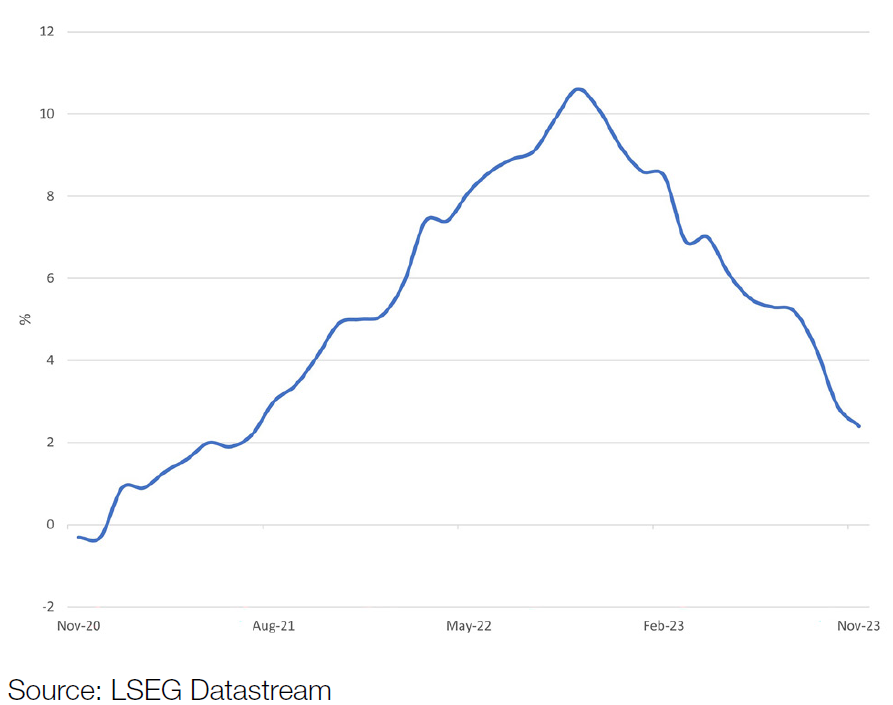

Eurozone consumer price index – YoY % change

The core annual inflation rate, which excludes energy, food, alcohol and tobacco, fell to 3.6% in November, down from 4.2% in October.

Although the headline inflation rate is moving closer to the European Central Bank (ECB)’s target of 2.0%, it’s “too soon to declare victory over inflation”, said Joachim Nagel, president of the Bundesbank and a member of the ECB Governing Council, which sets the central bank’s rates.

UK house price recovery continues

UK house prices rose 0.2% month-on-month in November, the third consecutive monthly increase. The average house price is now £258,557. On an annualised basis, price growth improved from -3.3% in October to -2.0% in November, the strongest result in nine months.

Falling interest rate expectations among investors have led to lower swap rates, which underpin mortgage pricing, said Robert Gardner, Nationwide’s chief economist. “If sustained, this will help to ease the affordability pressures that have been stifling housing market activity in recent quarters, where the number of mortgage approvals for house purchases has been running at c. 30% below prepandemic levels.”

OPEC+ agrees to voluntary production cuts

Members of the Organization of the Petroleum Exporting Countries (OPEC+) agreed on Thursday to voluntarily cut oil production by around 2.2 million barrels per day (bpd) in the first quarter of 2024. The decision, which aims to bolster the market, will see Saudi Arabia extend its existing voluntary cut of one million bpd until the end of the first quarter. Meanwhile, Russia will see its current voluntary export reduction deepen from 300,000 bpd to 500,000 bpd.

The announcement was followed by a drop in Brent crude oil prices, with the February contract declining 2.4% to $80.86.

Fed’s preferred inflation gauge rises

In the US, the core measure of the personal consumption expenditures (PCE) price index – which excludes food and energy and is the Fed’s preferred inflation gauge – rose 3.5% year-on-year in October, down from 3.7% in September, according to the US Commerce Department. Headline PCE increased by 3.0% in the 12 months to October, the smallest annualised gain since March 2021. It followed a 3.4% increase in September. On a monthly basis, headline PCE rose less than 0.1% in October, while core PCE increased 0.2%.

Consumer spending, which accounts for two thirds of the US economy, increased 0.2% in October after gaining 0.7% in September. Americans spent 0.4% more on services, including healthcare, housing and utilities, as well as international travel. This was partially offset by a 0.2% drop in spending on goods such as new light trucks, which was likely driven by shortages caused by nowended strikes at a number of factories owned by General Motors, Ford, and Chrysler parent company Stellantis.

China PMI falls in November

China’s official manufacturing purchasing managers’ index (PMI) fell to 49.4 in November from 49.5 in October, the second consecutive monthly contraction. A level of 50.0 indicates growth. The non-manufacturing PMI fell short of economists’ expectations, dropping to 50.2 in November from 50.6 the month before.

Meanwhile, the Caixin/S&P Global manufacturing PMI, which focuses on smaller companies, showed Chinese manufacturing activity rose from 49.5 in October to 50.7 in November, exceeding economists’ predictions. New order growth reached the highest level since June.