Guy Foster, Chief Strategist, discusses recent economic growth data, while Janet Mui, Head of Market Analysis, analyses US inflation and

consumer spending data.

The trend of the market reaching new highs continued at the end of February. The S&P 500 had already broken new ground but was joined by the NASDAQ, which

surpassed its previous high seen at the end of 2021.

Japan has seen very strong index performance. Part of that has been aided by rapid yen depreciation. As a result, the Nikkei 225 also reached a new all-time high the week before last. But while the US markets are surpassing levels seen in 2021, the Nikkei is making a first all-time high since an extraordinary bubble in stocks and real estate at the end of the 1980s.

The Nikkei index is one of a few price-weighted indices (another being the Dow Jones in the US) where each company’s weight reflects how big its share price is rather than the relative size of the company. Japan’s more conventional TOPIX index remains well short of its late 80’s high.

The FTSE 100 remains 4% off its record high, experienced early last year. Like many regions, the UK has underperformed the US recently, but the performance of indices exaggerates the extent. Overall, The UK market generates a dividend yield of 4% which is significantly driven by the energy sector.

Over the past couple of weeks, the stock market experienced fluctuations near record highs as traders awaited a barrage of economic data and remarks from Federal Reserve speakers on interest rates. The market absorbed heavy Treasury and corporate sales amidst month-end positioning, with US yields rising after government note auctions. Blue-chip companies sold a record amount of bonds in February to capitalise on investor demand amid lower borrowing costs.

The most obvious banana skin for the market overall was the US personal consumption expenditure (PCE) data. This ostensibly measures spending and feeds into gross domestic product (GDP). GDP is normally quoted in real terms, meaning it is adjusted for inflation. The Federal Reserve has typically preferred to measure consumer price changes through the PCE over the consumer prices index (CPI). PCE covers a broader range of goods and services, as well as a broader definition of consumers. The PCE process for changing the weightings of categories over time is perceived to be better, and its treatment of housing costs is more reflective of actual costs suffered by homeowners.

CPI, on the other hand, is released earlier during the month and certainly sounds more like the measures of inflation used in other regions (although some argue PCE is methodologically closer to other countries’ inflation calculations).

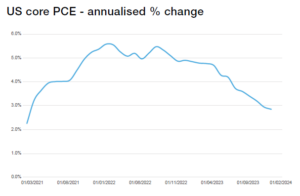

Perhaps the most critical difference between CPI and PCE in recent months is that core PCE, which excludes food and energy, has declined faster than core CPI, and thus paints a rosier picture of the consumer environment, which puts less pressure on policymakers to maintain high interest rates.

It was therefore a boon to investors to see the core PCE price index rising by just 2.8% over the twelve months to January (PCE data are released late relative to CPI). This is the slowest pace of price increases since March 2021. The data were taken positively by the market, seeming to justify hopes of lower interest rates later in the year. Afterall, real spending by consumers declined. But despite the slowdown in the annual rate of inflation, the monthly data were pretty strong, seeming more consistent with the CPI data from earlier in the month.

Gauging trends in inflation is difficult during January when a significant seasonal adjustment needs to be made. There were also a lot of one-off factors distorting consumer activity (such as weather), a strong month for dividend income, and a jump in cost-of-living adjustments for social security payments.

For now, markets expect to see interest rates declining as soon as June, but that will depend upon how policymakers interpret these data.

Federal Reserve speakers continued to influence market sentiment, with officials expressing readiness to lower rates if necessary. However, they emphasised the economy’s strength and the need for caution in policy adjustments.

Boston Federal Reserve president, Susan Collins, and New York’s John Williams, believe it will be appropriate to cut rates for the first time later this year, which is consistent with Raphael Bostic of the Atlanta Federal Reserve, who expects to cut this summer. Federal Reserve governor Michelle Bowman expects inflation to continue to decline further, with interest rates held at their current level — but said it’s too soon to begin rate cuts.