Stocks rise on positive economic data

Stock markets rose last week as a slew of positive economic data and signs of easing inflation boosted investor sentiment.

In the US, the S&P 500 surged 2.4% and the Nasdaq added 2.2% to post its best first half since 1983. Investors were cheered by a slowdown in the Federal Reserve’s preferred inflation gauge and further signs of a resilient US economy. Last week also saw Apple become the first public company to achieve a market capitalisation of $3trn.

In Europe, the pan-European Stoxx 600 added 1.9% after eurozone inflation slowed for a third consecutive month. The FTSE 100 climbed 0.9%, despite comments from Bank of England governor Andrew Bailey that UK interest rates are likely to stay higher for longer than markets expect.

In China, the Shanghai Composite edged up 0.1% as hopes of economic support measures were offset by weak data.

Last week’s market update*

• FTSE 100: +0.93%

• S&P 500: +2.35%

• Dow: +2.02%

• Nasdaq: +2.19%

• Dax: +2.01%

• Hang Seng: +0.14%

• Shanghai Composite: +0.13%

• Nikkei 225: +1.24%

• Stoxx 600: +1.94%

• MSCI EM ex Asia: -0.15%

* Data from close of business Friday 23 June to close of business

Friday 30 June

Manufacturing downturn deepens

Stock markets started this week on a lacklustre note. The FTSE 100 and Stoxx 600 fell 0.1% and 0.2%, respectively, at the close of trading on Monday (3 July), whereas the S&P 500 registered a small gain of 0.1%. This came after manufacturing purchasing managers’ indices (PMIs) for the UK, US and eurozone all showed a steeper contraction in activity in June.

S&P Global’s manufacturing PMI for the UK fell to a six-month low of 46.5, while the index for the eurozone dropped to 43.4, the lowest since the height of the pandemic. The readings were well below the 50.0 mark that separates growth from contraction. In the US, economists had been expecting a slight improvement in manufacturing activity, but the Institute for Supply Management’s index slipped to 46.0 from 46.9 in May. In China, meanwhile, the manufacturing sector registered slower growth, with the Caixin / S&P Global PMI falling to 50.5 from 50.9.

Fed’s preferred inflation gauge falls to 4.6%

Last week saw the release of the US personal consumption expenditures (PCE) price index, which measures the prices consumers pay for goods and services. The core PCE, which excludes food and energy and is the Federal Reserve’s preferred inflation gauge, showed prices rose by just 0.3% in May from the previous month. This took the year-on-year rate to 4.6%, down from 4.7% in April. When including food and energy, inflation was even lower with prices up just 0.1% monthon-month and 3.8% year-on-year. This was the lowest annual rate since April 2021.

While the data suggests inflation is moving in the right direction, Fed chair Jerome Powell said the central bank’s 2% target wouldn’t be achieved for a few years. Speaking at the European Central Bank’s (ECB) annual conference in Sintra, Powell said inflation was being kept high by the very strong labour market and that further interest rate increases were on the cards.

US new home sales beat forecasts

Sales of new US single-family homes rose to the highest level in nearly 18 months in May, boosted by a very low inventory of existing homes for sale. New home sales jumped by 12.2% to a seasonally adjusted annual rate of 763,000 units. Sales were 20% higher than a year ago, according to the US Census Bureau and the Department of Housing and Urban Development.

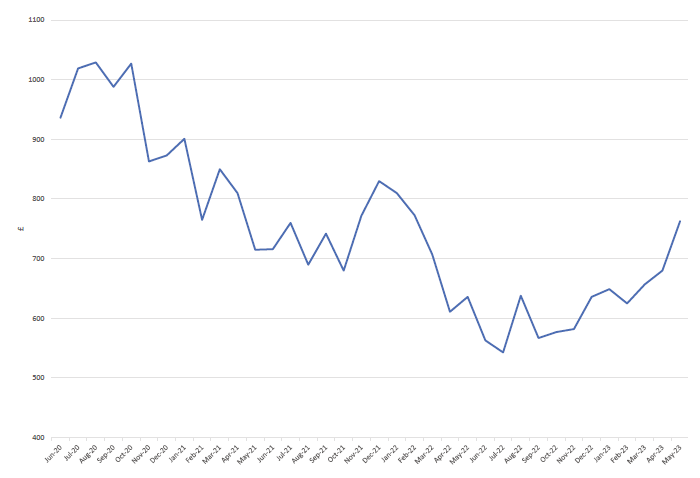

Sales of new US single-family homes (thousands)

Source: Refinitiv Datastream

Existing home sales also improved in May. However, pending home sales (where the contract has been signed but the sale has not yet closed) shrank 2.7% in May from the previous month and by 22.2% year-on-year, according to the National Association of Realtors. This could be reflected in declining existing home sales when June’s data is published.

Weekly jobless claims plummet

In another sign of economic strength, US weekly jobless claims fell by 26,000 to 239,000 in the week ending 24 June, the steepest drop for 20 months. This reversed a recent jump, which saw claims hit levels last seen in October 2021 and led economists to speculate that layoffs could be increasing.

A separate report from The Conference Board showed consumers’ perception of the labour market was upbeat in June. More people viewed jobs as ‘plentiful’ relative to May, and there was a slight decline in the proportion who believed jobs were hard to get. Consumer confidence increased to the highest level in nearly 18 months to 109.7 from 102.5 in May. Nevertheless, the expectations gauge continued to signal that consumers anticipate a recession at some point over the next six to 12 months.

Eurozone inflation eases to 5.5%

Over in Europe, an initial estimate from the European Union’s statistics office showed annual inflation in the eurozone slowed for the third month in a row in June. Headline inflation measured 5.5%, down from 6.1% in May and lower than forecasts. This was driven by a 5.6% yearon-year decline in energy prices.

However, core inflation (excluding food and energy) rose to 5.4% year-on-year in June, up from 5.3% in May. At the conference in Sintra, ECB president Christine Lagarde said the bank could not declare victory yet in the fight to tame inflation. “We will face several years of rising nominal wages, with unit labour cost pressures exacerbated by subdued productivity growth,” Lagarde said.