Markets rally against negative economic data

Markets mostly finished in the green this week despite a string of disappointing economic data and continued turmoil in China’s property market.

The FTSE 100, Germany’s Dax and the Stoxx 600 grew by 1.1%, 0.2% and 0.6% respectively despite business activity contracting in the UK and the eurozone in August.

Over in the US, indices showed mixed results after several major retailers reported falling earnings, and consumer sentiment fell. The labour market remained strong as weekly unemployment claims fell to 230,000 in the week ending 19 August, the lowest level in three weeks. The Dow dropped 0.3%, the S&P added 0.1% and the Nasdaq grew by 0.7%.

In Asia, Hong Kong’s Hang Seng added 1.9% and Japan’s Nikkei 225 added 0.2%. China’s Shanghai Composite fell 0.9% as the country’s economy continued to struggle and fears of economic contagion continued to grow.

Last week’s market update*

• FTSE 100: +1.11%

• S&P 500: +0.14%

• Dow: -0.34%

• Nasdaq: +0.69%

• Dax: +0.18%

• Hang Seng: +1.89%

• Shanghai Composite: -0.93%

• Nikkei 225: +0.19%

• Stoxx 600: +0.61%

• MSCI EM ex Asia: +1.12%

*Data from close of business Friday 18 August to close of business

Friday 25 August

Asian market performance boosts global indices

Markets closed on a high note on Tuesday (29 August). The FTSE 100 rose 1.7% on the back of strong performance in Asian markets. Chinese stocks were boosted by China introducing a 50% stamp duty cut on share dealing, with the Shanghai Composite rising 1.3%. The Hang Seng added nearly 2% while the Nikkei 225 edged up 0.2% despite a stronger-than-expected Japanese unemployment rate of 2.7%. Meanwhile in the US, the Dow added 0.9%, the Nasdaq gained 1.7% and the S&P 500 rose 1.5% as investors looked ahead to inflation, growth and employment data being released later this week.

UK property sales volumes are expected to be 21% lower in 2023 than last year, according to Zoopla’s House Price Index for August. If accurate, this will be the lowest number of property sales since 2012. The fall is primarily caused by a decline in mortgaged sales, which is expected to drop 28% compared to last year.

UK economic activity slows

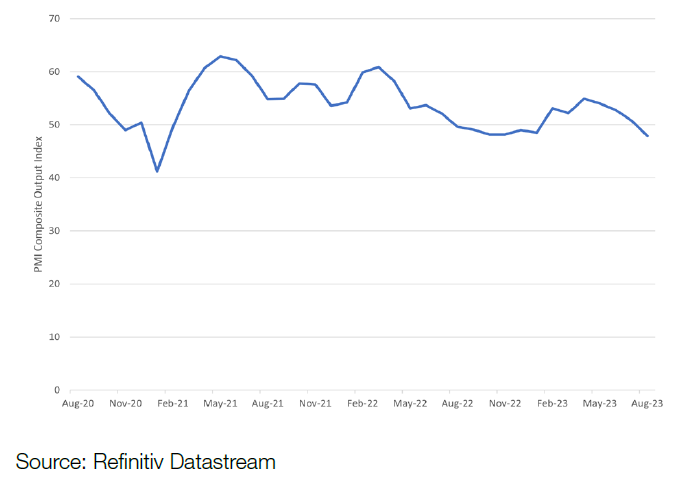

UK economic activity slowed in August, with the S&P Global/CIPS Flash UK Purchasing Managers Index (PMI ) falling to 47.9, down from 50.8 in July, and below the 50.0 threshold indicating growth. Falling short of economists’ forecasted 50.3, August’s figure was also the lowest since January 2021.

Services sector output declined to 48.7 from 51.5 in July, a seven-month low, while manufacturers saw a sharp and accelerated fall in production volumes; output declined to 43.3 from 47.2 in July, the worst result in 12 months. Businesses across both sectors that saw a drop in new orders said many clients were reluctant to spend due to higher interest rates and stretched disposable incomes.

UK PMI

The eurozone also saw business activity contract for the third consecutive month, with the flash PMI falling to 47.0 in August from 48.6 in July, the lowest result since November 2020. It is the third consecutive month that output has fallen.

The steepest decline was recorded in Germany, where output across goods and services fell for the second month in a row, at a rate not seen since May 2020. August saw a sharp fall in manufacturing output and the first decline in the services sector since last December.

Over in the US, the S&P Global Flash US Composite PMI fell to 50.4 in August from 52.0 in July, a six-month low. Firms reported a slower rise in output as the private sector neared stagnation due to a drop in client demand. New orders declined for the first time in six months and were unsurprisingly linked to inflation pressures and higher interest rates.

UK retail sales slump

August saw UK retail sales fall for the fourth consecutive month and at the fastest pace since March 2021, data from the Confederation of British Industry (CBI) show. Its monthly balance of retail sales, which compares volumes to those a year before, fell to -44 in August from -25 in July. It is expecting a further, albeit slower, contraction of -21 in September.

The Office for National Statistics estimated retail sales volumes have fallen 1.2% in July following a revised rise of 0.6% in June. Food store volumes declined 2.6% with wet weather named a contributing factor for a slump in clothing sales. Food sales also reduced. Retailers indicated that cost of living and food price increases continued to affect sales.

Non-food store sales volumes dropped 1.7% in July after a 0.6% rise in June, which was also attributed to poor weather. Rain and increased promotions boosted online retail sales by 27.4% in July, up from 26% in June, and the highest proportion since February 2022.

US consumer confidence drops

The US Conference Board Consumer Confidence Index fell to 106.1 in August from a downwardly revised 114.0 in July. Its Present Situation Index, which measures consumers’ assessment of current business and labour market conditions, fell to 144.8 from 153.0. Meanwhile, the Expectation Index, which measures consumers’ shortterm outlook for income, business and labour market conditions fell to 80.2 from July’s 88.0.

Although consumers were less worried about a recession, the Conference Board says it is expecting one before the end of the year. Consumers were concerned about rising prices, particularly for groceries and gasoline.