Markets respond to mixed economic data

Markets were mixed in a week that saw the release of differing economic data.

The UK’s FTSE 100 dropped 0.1% despite growing consumer confidence and the autumn statement containing a number of measures to stimulate business investment and economic growth.

Over in the US, markets saw a shorter trading week due to the Thanksgiving holiday. The S&P 500 and Dow added 0.3% and 0.7%, respectively, rallying against disappointing economic data – including a drop in durable goods and weak purchasing managers’ index (PMI) data. In contrast, the tech-heavy Nasdaq fell 0.2%.

In Asia, Japan’s Nikkei 225 added 0.7%. Meanwhile, China’s Shanghai Composite lost 0.9% due to continuing worries about the country’s economic recovery. Hong Kong’s Hang Seng lost 1.2%.

Last week’s market update*

• FTSE 100: -0.11%

• S&P 5001: +0.26%

• Dow1: +0.68%

• Nasdaq1: -0.24%

• Dax: +0.81%

• Hang Seng: -1.23%

• Shanghai Composite: -0.89%

• Nikkei 2252: +0.71%

• Stoxx 600: +0.81%

• MSCI EM ex Asia: -0.76%

1 Closed on Thursday 23 November and closed early on

Friday 24 November

2 Closed on Thursday 23 November

* Data from close of business on Friday 17 November to close

of business on Friday 24 November

Chinese economy dents investor sentiment

Markets fell marginally on Monday (27 November) as investors reacted to news that industrial profit growth in China fell sharply to 2.7% year-on-year in October, down from 11.9% in September and 17.2% in August.

In the US, the Dow and S&P 500 fell 0.2%, respectively, after closing at their highest levels since early August on Friday. The Nasdaq dropped 0.1%.

In the UK, the FTSE 100 declined 0.4% as figures from the Confederation of British Industry (CBI) showed that the decline in retail sales eased in November. The CBI’s monthly retail sales balance rose to -11 in November from -36 in October. Although an improvement, this still marked the seventh consecutive monthly decrease. Despite the upcoming Christmas season, sales growth was expected to be marginally negative next month.

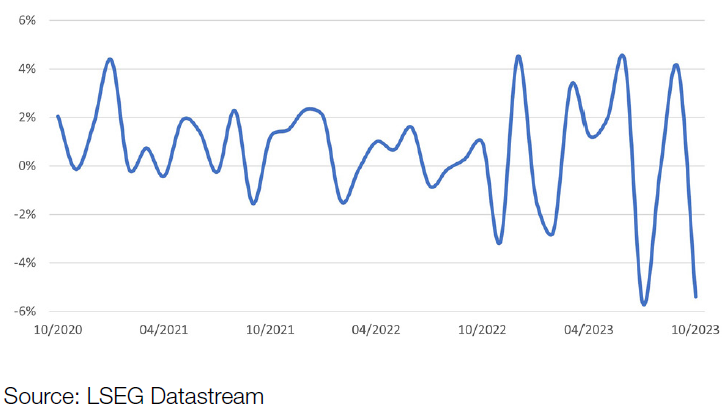

US durable goods fall more than predicted

The value of new orders for US durable goods (items meant to last three years or longer) fell by 5.4% to $279.4bn monthon- month in October, according to the Census Bureau.

The result fell short of economists’ predicted -3.4%. It was primarily driven by a decline in orders for transportation equipment (-14.8%), likely due to strikes at a number of factories owned by General Motors, Ford, and Chrystler parent company Stellantis. Civilian aircrafts also fell 49.6% while motor vehicle and parts declined 14.8% in October after increasing 11.6% in September. Data for September was revised down from 4.6% to 4.0%.

On an annualised basis, new orders increased 4.0% in October.

US durable goods – MoM % change

Eurozone PMI contracts

Eurozone business activity continued to contract in November, according to the HCOB flash eurozone PMI. While the index rose to 47.1 in November, the highest level in two months and an increase from 46.5 in October, it still fell below the 50.0 level that indicates growth. The main driver of the overall reduction in business activity was a decline in new orders. Both manufacturing and service sectors saw a decline in business activity.

US PMI remains flat

There was a further marginal expansion in US business activity in November, with the rate of growth in line with that seen in October. The S&P Global flash composite PMI remained at 50.7. While manufacturers saw a slower pace of expansion, this was offset by the service industry, which recorded a small uptick. The manufacturing PMI fell to 49.4 in November, down from 50.0 in October and the lowest level for three months. Meanwhile, the flash services sector PMI rose to 50.8 in November, up from 50.6 the month before.

UK consumer confidence grows

The GfK consumer confidence index, which measures how people in the UK view their personal finances and the broader economy, rose six points to -24 in November. Consumer confidence came in at -44 in November 2022.

The personal financial situation index rose three points to -16, an increase of eight points compared to November 2022. The forecast for personal finances over the next 12 months increased five points to -3, 26 points higher year-on-year.

Autumn statement measures to stimulate growth

Chancellor Jeremy Hunt delivered the autumn statement on Wednesday, with the key announcements including reductions to National Insurance and a permanent extension of the ‘full expensing’ regime for businesses. Other measures included raising the National Living Wage from £10.42 to £11.44 per hour, freezing alcohol duty, and reforms to ISAs.

There were also pledges to speed up planning applications, extend financial incentives for investment zones, and invest an additional £500m in artificial intelligence. To encourage investment in UK high-growth companies, new investment vehicles will be introduced, including a ‘growth fund’ within the British Business Bank.

The autumn statement was accompanied by the Office for Budget Responsibility’s (OBR) economic and fiscal outlook, which gave a mixed review of the UK economy.

Borrowing was £19.8bn lower than expected in the first half of the current financial year, and gross domestic product (GDP) is now forecast to expand by 0.6% this year, rather than contracting by 0.2%. The next two years are expected to be more muted, with GDP growing by 0.7% in 2024 and 1.4% in 2025, down from previous estimates of 1.8% and 2.5%, respectively. Inflation isn’t expected to return to the Bank of England’s 2% target until the second quarter of 2025.

Japanese inflation rises year-on-year

Over in Japan, the core consumer price index (CPI), which excludes fresh food, rose 2.9% year-on-year in October, according to data from the Bank of Japan (BoJ). It’s a slight increase from October’s 2.8%, but below economists’ predicted 3.0%.

The so-called core-core index, which strips away fresh food and fuel costs, rose 4.0% year-on-year in October, slowing from 4.2% in September. It is the seventh consecutive month the index has stayed above 4.0%.