Stocks fall as Bank of England hikes rates

Stock markets fell last week as the Bank of England (BoE) hiked UK interest rates by a larger-than-expected 0.5 percentage points.

The FTSE 100, Stoxx 600 and Dax declined 2.4%, 2.9% and 3.2%, respectively, on concerns that interest rate hikes could lead to a recession in the UK and eurozone. Norway’s central bank also announced a 0.5 percentage point increase in its key interest rate, while the Swiss National Bank raised rates by a quarter of a percentage point.

Interest rate fears also weighed on US indices. The S&P 500 suffered its first drop in six weeks, finishing the week down 1.4%, while the Nasdaq recorded its first decline in two months, also down 1.4%. This came after Federal Reserve chair Jerome Powell indicated that further rate hikes could be on the cards this year.

Over in Asia, the Shanghai Composite finished its holiday-shortened trading week down 2.3% amid ongoing concerns about China’s post-pandemic economic recovery. Hong Kong’s Hang Seng slid 5.7%, its biggest drop in three months.

Last week’s market update*

• FTSE 100: -2.37%

• S&P 5001: -1.39%

• Dow1: -1.67%

• Nasdaq1: -1.44%

• Dax: -3.23%

• Hang Seng2: -5.74%

• Shanghai Composite3: -2.30%

• Nikkei 225: -2.74%

• Stoxx 600: -2.93%

• MSCI EM ex Asia: -1.97%

* Data from close of business Friday 16 June to close of business

Friday 23 June

1 Closed on Monday 19 June

2 Closed on Thursday 22 June

3 Closed on Thursday 22 June and Friday 23 June

Failed Russia coup weighs on markets

Stock markets started this week in the red as geopolitical concerns dented investor sentiment. The S&P 500 lost 0.5% on Monday (26 June), while the FTSE 100 and the Stoxx 600 both edged down 0.1%. Russian mercenary leader Yevgeny Prigozhin embarked on an armed rebellion over the weekend, but called it off after 24 hours.

In economic news, German business sentiment deteriorated for the second consecutive month in June. The Ifo institute’s index fell to 88.5 from 91.5 in May, a steeper drop than had been expected. In the manufacturing sector, business expectations fell to their lowest level since November 2022.

BoE surprises markets with 0.5pp rate hike

Last week saw the Bank of England announce a surprise 0.5 percentage point (pp) increase in the UK base interest rate. This was bigger than the 0.25pp hike that markets and economists were expecting. The increase takes the base rate to 5.0%, the highest level in 15 years. Andrew Bailey, governor of the BoE, said inflation was still too high and “we’ve got to deal with it”. He added: “If we don’t raise rates now, it could be worse later.”

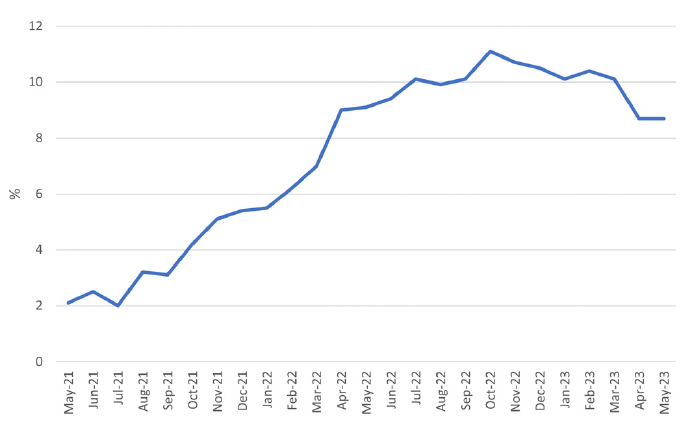

The announcement came after figures from the Office for National Statistics (ONS) showed the UK headline inflation rate remained stubbornly high at 8.7% year-on-year in May. It was the fourth month in a row that the consumer price index (CPI) exceeded forecasts. On a monthly basis, the CPI rose by 0.7%, driven by particularly strong increases in prices for air travel, recreational and cultural goods and services, and second-hand cars.

UK consumer price index (YoY % change)

Source: Refinitiv Datastream

Even more concerning was the rise in core inflation, which excludes volatile food and energy prices. The core CPI rose from 6.8% in April to 7.1% in May, the highest rate since 1992.

Markets now expect the BoE to increase the base rate to 6.0% by the end of the year to try to combat inflation.

Eurozone business output weakens

In the eurozone, business output growth came close to stalling in June, according to the HCOB flash purchasing managers’ index (PMI) from S&P Global. The index declined from 52.8 in May to 50.3 in June, its lowest since January and just above the 50.0 mark that separates growth from contraction. “Although recording an expansion of output for a sixth consecutive month in June, the latest increase was only marginal and far weaker than the gains seen in the previous four months to signal a considerable loss of growth momentum,” S&P Global said.

Factory output fell for a third straight month and at the fastest rate since last October. Services sector output growth slowed sharply as the recent resurgence in spending on services lost momentum. Expectations for the year ahead deteriorated markedly in manufacturing, down to a seven-month low in June, but also sunk to a six-month low in the services sector.

US manufacturing activity falls

Data painted a similarly sombre picture of the US manufacturing sector. S&P Global’s flash manufacturing PMI fell from 48.4 in May to 46.3 in June, a six-month low and well below estimates. The decline was the most severe in 2023 to date and stemmed from a marked reduction in new orders. The report also showed that cost pressures eased, as suppliers sought to boost their sales and offer reduced prices. The pace at which input prices fell was the quickest since the pandemic lockdown in May 2020.

Japan core CPI rises to 3.2%

In Japan, consumer inflation rose by more than expected in May. The core CPI, which excludes fresh food prices, rose by 3.2% in May from a year ago. This was lower than the previous month, but was above forecasts and well above the Bank of Japan’s 2.0% target. The ‘core-core’ index, which strips out fresh food and fuel, rose to 4.3% in May, the highest reading since 1981. The data has increased expectations that the Bank of Japan will increase its inflation forecasts at its quarterly review in July. The jury is out on whether it will tweak its yield curve control policy.