Stocks fall as Fed lifts rate expectations

Stock markets fell last week after the US Federal Reserve increased its interest rate expectations in response to stronger economic activity.

The surprise adjustment saw the S&P 500 record its largest one-day loss in six months on Thursday, before ending the week down 3.0%. The Dow and Nasdaq fell 1.9% and 3.6%, respectively.

European indices followed Wall Street lower, with the pan-European Stoxx 600 and Germany’s Dax shedding 0.8% and 1.1%, respectively. The depreciation of the pound versus the dollar supported the FTSE 100, which rose 0.4%.

The Federal Reserve’s hawkish outlook also weighed on Japan’s Nikkei 225, which declined 3.4%. In contrast, China’s Shanghai Composite gained 0.2% amid growing optimism about the country’s economic outlook.

Last week’s market update*

• FTSE 100: +0.40%

• S&P 500: -3.00%

• Dow: -1.91%

• Nasdaq: -3.64%

• Dax: -1.08%

• Hang Seng: +0.71%

• Shanghai Composite: +0.21%

• Nikkei 225: -3.37%

• Stoxx 600: -0.76%

• MSCI EM ex Asia: -0.80%

* Data from close of business Friday 15 September to close of business Friday 22 September

China’s property crisis deepens

Indices in Europe and Asia fell on Monday amid ongoing concerns about China’s troubled property sector. Embattled property developer Evergrande said on Sunday that an investigation into its subsidiary Hengda Real Estate would prevent it from issuing new notes under its debt restructuring plan. Yesterday, Hengda announced that it had missed a 4 billion yuan bond payment. The Shanghai Composite fell 0.6% on Monday (25 September) while Hong Kong’s Hang Seng declined 1.8%.

The FTSE 100 started Tuesday’s trading session down 0.2% after Moody’s warned about the impact of another government shutdown on the US’s economy and credit rating. This came after White House officials said a shutdown was becoming increasingly likely. Congress must come to an agreement to fund government agencies by 30 September.

US rates to stay higher for longer

Last week’s economic headlines focused on key interest rate decisions by several central banks. First up was the US Federal Reserve, which chose to keep the fed funds rate steady at between 5.25% and 5.5%. This was widely expected, but the Fed surprised the markets by increasing its interest rate projections. The Fed’s so-called dot plot suggests there will be one more rate increase this year, followed by two rate cuts in 2024 – two fewer than were indicated during the last update in June.

Federal Reserve chair Jerome Powell said the change reflected optimism about economic growth rather than concerns about inflation. Gross domestic product (GDP) is expected to grow by 2.1% this year, more than double the June estimate, and by 1.5% in 2024, up from the previous estimate of 1.1%.

Bank of England keeps rates on hold

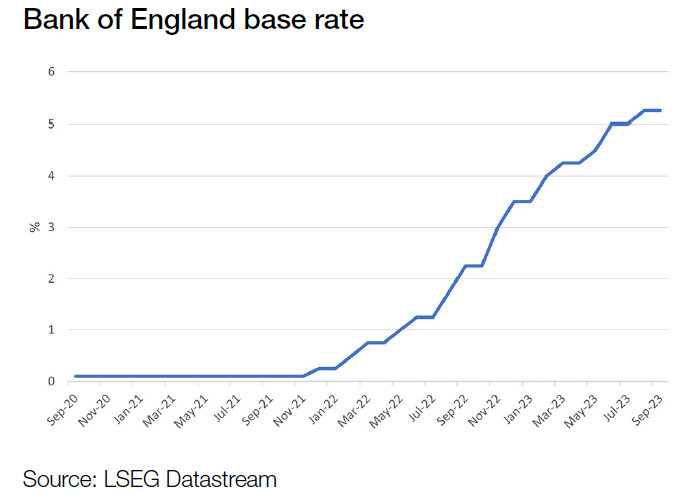

Here in the UK, the Bank of England (BoE) kept the base interest rate unchanged at 5.25%, marking the first pause in rates since December 2021. The decision was a close call, with five policymakers voting to keep rates steady and four voting for a 0.25 percentage point increase.

The decision came a day after data from the Office for National Statistics showed a surprise easing in UK inflation. The annual rate of inflation slowed to 6.7% in August from 6.8% in July. Food prices rose by just 0.3% month-on-month, compared with a rise of 1.5% a year ago, while accommodation services prices fell. This offset a steeper month-on-month increase in petrol prices. Core inflation – which excludes volatile food and energy and is considered a better indicator of underlying price pressures – declined to 6.2% year-on-year from 6.9% the previous month.

At the moment, it is too early to tell whether the BoE has reached the end of its rate hiking cycle. In its statement, the BoE said it was prepared to raise interest rates again if there was evidence of more persistent inflationary pressures.

BoJ maintains ultra-low rates

Over in Japan, the Bank of Japan (BoJ) chose to keep short-term interest rates at -0.1% and maintain its yield curve control policy. BoJ governor Kazuo Ueda said the bank was continuing with its ultra-loose monetary policy because it had yet to foresee inflation settling at the target level of 2.0%. According to a translation provided by Reuters, Ueda also said that while inflation wasn’t overshooting its target sharply, it wasn’t slowing as much as expected. “When we can foresee inflation stably and sustainably hitting 2%, we will consider ending yield curve control or revising negative interest rates,” he said.

Eurozone new business orders drop sharply

Last week also saw the release of the latest purchasing managers’ indices (PMI) for the eurozone. These painted a grim picture. Manufacturing new orders contracted rapidly again in September, and the services sector saw the fastest decline in new business since the pandemic. Overall, the HCOB Flash Eurozone Composite PMI Output Index posted 47.1 in September, up marginally from 46.7 in August but still well below the 50.0 mark that separates growth from contraction. Input costs increased at the fastest pace in four months, but a weakening demand environment meant that companies increased their selling prices to a lesser extent than in August.

“The eurozone’s HCOB PMI figures for services are serving up a bitter pill for the European Central Bank (ECB) to swallow,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. “The input prices, where wages play an important role, have sped up in September for the second month in a row. Output prices continue to be on the increase as well, but upward pressure has softened a bit again. While the latter may bring some comfort to central bankers, the heat on input prices shows that the risk of a wage-price spiral must remain very much on the radar of the ECB.”