Guy Foster, Chief Strategist, discusses global market performance following the S&P 500 surpassing its previous all-time high, while Janet Mui, Head of Market Analysis, analyses the latest Chinese economic data.

Last week was a tumultuous week for investors but it ended on a bright note. Markets saw a slight pickup in volatility and a mixed performance over the week. There was plenty of news flow, enough that you might ordinarily have expected a more adverse reaction. Investor sentiment is a complex beast. There are gauges which suggest bullish sentiment amongst some shorter-term investors, but in general, institutions are gradually overcoming their risk aversion. Often when markets climb, we describe them as climbing the wall of worry, rising as investors anxiety dissipates.

One of the longstanding risks for the market is that of China invading Taiwan. The stakes would be high due to China’s 13% share of world trade, but the chances are low. The challenges faced by Russia when invading Ukraine, with which it shares a land border, would pale in comparison to an amphibious assault across the Taiwan strait, landing on largely mountainous terrain with only a handful of viable landing sites. There are more challenges too. Russia’s military was exposed as being underprepared despite having seen action over recent years. China’s military has grown but remains untested, and is perceived to be riddled with corruption and vested interests which are symptomatic of the party-controlled state.

Recent months have seen evidence of a purge of the Chinese military as president Xi Jinping has found it to be unfit for purpose despite billions having been spent on modernisation.

The restructuring is believed to push back the potential date of any viable intervention in Taiwan.

Last week also marked China’s failure to make progress on the diplomatic front, with Taiwan’s incumbent president strolling to re-election, albeit with a plurality that was well down on the majority achieved by his predecessor. The Democratic Progressive Party (DPP) is a Taiwanese nationalist and anti-communist party that is opposed to stronger links with China. This year’s election was seen as an opportunity to break the DPP’s rule, but infighting amongst the opposition allowed the DPP a relatively clear path to re-election.

Chinese economy

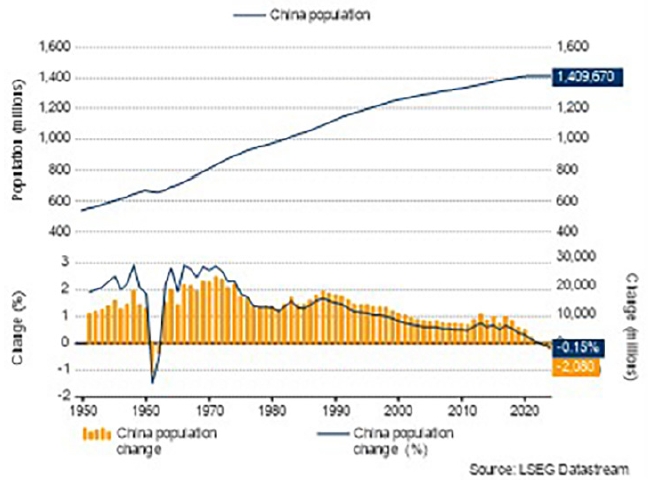

It was an inauspicious start to last week, which contained little cheer for China. Internationally traded Chinese stocks underperformed. A release of Chinese economic data provided mixed news. An eye-catching headline was the decline in the population growth rate. This was broadly expected and simply a continuation of a trend of slowing, and now reversing, population growth, which has been in place for a decade and was accelerated by COVID. The Chinese population contracted by two million people (or just 0.15%) last year. That contraction will accelerate over the coming years.

The more timely measures of Chinese activity were reasonable, but property prices declined for the seventh straight month, and with most Chinese wealth tied up in property assets, declines in property prices have a big impact on consumer balance sheets.

The likely result is that China will step up economic stimulus after a year in which it took many piecemeal measures that failed to address weak demand. Leaks from policymakers’ deliberations suggest that China is expecting to increase the budget deficit to try and recover growth momentum.

Inflation

For the rest of the world, the very well-ingrained hopes are for monetary stimulus during 2024. But the start of the year has suggested that it might be premature to expect rate cuts. Inflation has generally been higher than forecast in December (as seen in numbers released in January).

There are explanations of course; in the UK, many forecasters failed to account for an increase in tobacco duties. We find it useful to look at a measure of the median price level, looking further than the normal weighted average price level. On this basis, UK inflation has been between 0.2% and 0.3% each month for the last seven months. That’s much more stable than the official core inflation metric, although still slightly higher than the Bank of England (BoE) would want it.

So, inflation is a little too high and the housing market showed signs of life. Rightmove’s house prices improved nationally, and the RICS (Royal Institution of Chartered Surveyors) house price balance also ticked higher. House prices will reflect the declines in expected interest rates, which have dragged five-year swap rates down and led to lower rates on mortgages. The fly in the ointment for the UK is the labour market, where the latest payrolls numbers suggest a net decline in employment. These data are volatile and subject to revision, so should be treated sceptically, but wouldn’t seem out of place with the longer trend of declining UK employment growth.

It provides a dilemma for the BoE’s Monetary Policy Committee (MPC), which is replicated around the world. If inflation is currently still too high, can it respond to tentative signs of a slowing economy?

The Red Sea

It is particularly hard to do so when inflationary pressures are rising. Shipping costs continue to rise as the Yemeni Houthi rebels attack freights navigating the Red Sea. Conflict has intensified but remains a series of proxy wars rather than a hot Middle Eastern war, which might disrupt oil supply. But there seems a reduced path of free navigation of the Suez Canal now that the US and UK launched airstrikes against the Houthis. Far from discouraging them, the rebels now see US shipping as legitimate targets. Freight rates continue to rise.

Houthis activity is facilitated by Iranian weapons supplies. The Iranians themselves launched attacks on militants in Iran and Pakistan, as well as what they claimed was a Mossad facility in Syria.

With the prospect of ongoing Houthi disruption, and a complex web of proxy conflicts taking place within the Middle East, foreign policy is likely to become a topic of the upcoming US election.

Interest rates

Around most of the world, expected interest rate cuts have been pushed back with economic news still seeming to be reasonably upbeat and inflation slightly higher than expected. A couple of weeks ago, we referenced JP Morgan CEO Jamie Dimon’s comments, which he had just made when delivering the company’s Q4 results. He said, “The US economy continues to be resilient, with consumers still spending, and markets currently expect a soft landing. It is important to note that the economy is being fuelled by large amounts of government spending and past stimulus. There is also an ongoing need for increased spending due to the green economy, the restructuring of global supply chains, higher military spending and rising healthcare costs.”

These factors would suggest that inflation and real interest rates should be higher than they have been previously, as we have discussed in the past.

Earnings season

Finally, we can check in on the US earnings season. Although only 45 companies have reported at the time of writing, the earnings season has already settled into a ratio of 80% positive earnings surprises. Regular readers will know that this is normal and not as bullish as it might seem. With the banks sounding upbeat on economic activity, it will take another view to be able to draw more meaningful conclusions from a good spread of non-bank companies.