Stocks fall as China’s economy impacts sentiment

All major indices ended the week in the red as fears over China’s economic recovery impacted investor sentiment.

The FTSE 100 dropped 3.3% as UK core inflation remained flat and wage growth accelerated, indicating the Bank of England may need to raise interest rates further. In Europe, the Dax fell by 2.1% and the Stoxx 600 declined 2.5% amidst fears that interest rates may remain high for a prolonged period.

Over in the US, the S&P 500 fell by 2.7%, the Nasdaq dropped 3.6% and the Dow lost 2.3% as the benchmark ten-year US Treasury yield reached its highest level since October.

Meanwhile in Asia, Hong Kong’s Hang Seng lost 4.4%, China’s Shanghai Composite dropped 1.5% and Japan’s Nikkei 225 declined 1.9% after disappointing economic data out of China.

Last week’s market update*

• FTSE 100: -3.26%

• S&P 500: -2.67%

• Dow: -2.29%

• Nasdaq: -3.61%

• Dax: -2.07%

• Hang Seng: -4.38%

• Shanghai Composite: -1.46%

• Nikkei 2251: -1.90%

• Stoxx 600: -2.48%

• MSCI EM ex Asia: -1.46%

* Data from close of business Friday 11 August to close of business

Friday 18 August

1 Closed on Friday 11 August

China reduces key interest rate

Markets were mixed on Monday (21 August), with sentiment affected in part by the People’s Bank of China reducing its key interest rate for the second time in three months.

The central bank reduced its one-year prime loan rate, which is primarily used for corporate lending, by 10 basis points to 3.45%. The bank’s five-year loan prime rate remained unchanged. The decisions surprised economists, who had anticipated a 0.15 basis point reduction to both rates. Investors will now be looking ahead to the Federal Reserve’s annual Jackson Hole Symposium conference, which will run from Thursday to Saturday.

Over in the UK, house prices fell by 1.9% in August to an average £364,895, the sharpest decline so far this year, Rightmove’s House Price Index shows. The average fiveyear fixed mortgage rate has fallen to 5.81% from 6.08% three weeks ago.

UK public sector net borrowing (which excludes public sector banks) was £4.3bn in July, £3.4bn less than in July 2022, and below economists’ forecasts of around £5bn. It was the fifth highest July borrowing since records began in 1993.

UK headline inflation falls sharply

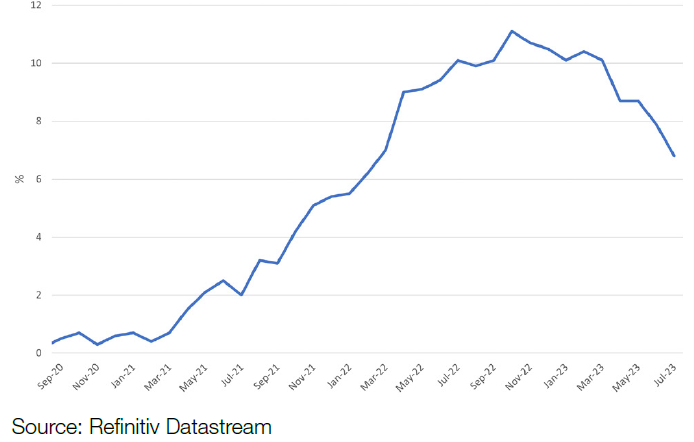

The UK Consumer Price Index (CPI) rose by an annualised 6.8% in July, down from 7.9% in June and the lowest figure since February 2022, figures from the Office for National Statistics (ONS) show. The decline was primarily driven by falling gas and electricity prices. On a monthly basis, CPI fell 0.4% in July, after a 0.1% rise in June.

UK headline CPI – YoY % change

Core CPI, excluding energy, food, alcohol and tobacco, rose by 6.9% in the 12 months to July, remaining unchanged from June.

Producer price inflation (PPI) also fell in July, with input prices declining 3.3% in the year to July, down from a fall of 2.9% in the year to June, according to the ONS. Producer output prices also declined by an annualised 0.8% in July, down from a rise of 0.3% in the 12 months to June. It is the first time that output PPI has been negative since December 2020, and the twelfth consecutive month that the annual inflation rate has slowed.

On a monthly basis, input prices fell by 0.4% while output prices rose by 0.1% in July.

UK labour market cools

The UK job market has shown signs of cooling as employment rates fell and unemployment rates increased in the three months to June compared to the previous quarter, according to the ONS.

The employment rate was estimated at 75.7%, a 0.1 percentage point decline on the first quarter of the year and 0.8 percentage points below pre-pandemic levels. The decrease was largely driven by a decline in full-time employees and self-employed workers.

The unemployment rate was estimated at 4.2%, up 0.3 percentage points than the previous quarter and 0.2 percentage points above pre-pandemic levels. This was primarily driven by those unemployed for up to six months.

Meanwhile, annual growth for regular pay (which excludes bonuses) was 7.8% in the three months to June, the highest level since records began in 2001. Average weekly earnings for regular pay were £613 in June, up from £610 in May.

China’s economic recovery weakens

China’s retail sales rose by 2.5% in July, falling short of an expected 4.5% increase. Industrial production also fell short of expectations, rising by 3.7% in July. Economists had predicted an increase of 4.4%.

Real estate investment fell by 8.5% year-on-year in July, with investment in residential buildings seeing a decline of 7.6%. Meanwhile, turmoil in China’s property sector continued as new home sales declined 19% year-on-year in July, while overall house prices fell by 0.2% month-on-month.