Stock markets rise as inflation eases

Stock markets rose last week as data showed signs of easing inflation in several major economies.

Inflation data for both the US and the UK came in lower than expected and raised hopes that interest rates could be cut next year. The S&P 500 rallied 2.3% while the FTSE 100 gained 1.1%. The pan-European Stoxx 600 climbed 2.1% as data confirmed eurozone inflation fell to 2.9% year-on-year in October, the lowest level for more than two years.

The positive sentiment spread to Asia, where Japan’s Nikkei 225 surged 3.1% despite weak third quarter gross domestic product (GDP) figures. China’s Shanghai Composite added 0.3% as investors weighed encouraging industrial production and retail sales figures against weaker-than-expected fixed asset investment growth.

Last week’s market update*

• FTSE 100: +1.06%

• S&P 500: +2.32%

• Dow: +1.77%

• Nasdaq: +2.60%

• Dax: +3.74%

• Hang Seng: +0.16%

• Shanghai Composite: +0.26%

• Nikkei 225: +3.07%

• Stoxx 600: +2.06%

• MSCI EM ex Asia: +3.97%

*Data from close of business Friday 10 November to close of business

Friday 17 November.

Nasdaq hits 16-week high

Wall Street stocks extended their gains on Monday (20 November), with the Nasdaq rising 1.1% to close at its highest level in 16 weeks. The tech-heavy index had to digest a complicated reorganisation of OpenAI, which saw the departure of staff, including chief executive Sam Altman, who were then hired by Microsoft, an anchor investor in OpenAI. Negotiations continue over how the firm will be organised going forward. The S&P 500 added 0.7% to reach its highest closing level since the first week of August.

The FTSE 100 started Tuesday’s trading session in the red after figures showed the UK government borrowed a higher-than-expected £14.9bn in October. Investors will closely watch Wednesday’s autumn statement, in which chancellor Jeremy Hunt is under pressure to announce measures that aim to drive long-term economic growth.

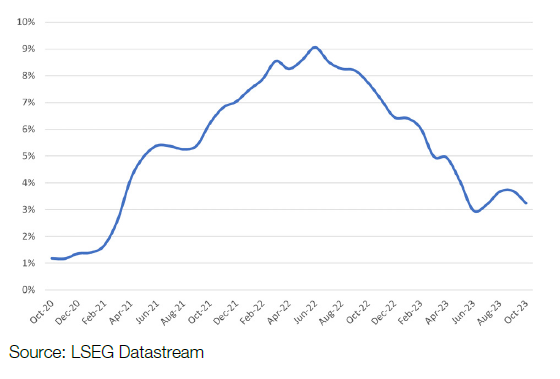

US inflation eases in October

Last week’s economic headlines focused on the latest US consumer price index (CPI) report and how it could influence the Federal Reserve’s monetary policy. Headline inflation eased to 3.2% year-on-year in October, down from 3.7% year-on-year in September and lower than the 3.3% rate forecast by economists in a Dow Jones poll. On a monthly basis, the CPI remained unchanged, largely due to a sharp drop in energy costs. Core inflation (excluding food and energy) measured 4.0% year-on-year, down from 4.1% in September and the lowest level in two years.

US headline CPI – YoY % change

Separate data showed an unexpected decline in US producer prices in October. Producer prices fell by 0.5% month-on-month, the largest decrease since April 2020, according to the Bureau of Labor Statistics. Economists polled by Reuters had forecast prices edging up by 0.1%. On an annual basis, producer prices rose by 1.3% in October, down from 2.2% in September.

Cooling inflation, together with slowing job and wage growth, has added to expectations that the Federal Reserve has reached the end of its interest rate hiking cycle. Markets are currently anticipating an interest rate cut next May, according to the CME FedWatch Tool.

Further encouraging news came from the latest US retail sales figures. Although sales fell by 0.1% in October – the first monthly decline since March – the decrease was less than the 0.3% decline forecast by economists. The data from the Commerce Department suggested consumer spending remains resilient despite interest rate hikes, and reinforced hopes of a ‘soft landing’ for the US economy.

UK inflation lower than expected

Here in the UK, figures from the Office for National Statistics showed inflation slowed more than expected in October. The annual headline inflation rate fell sharply to a two-year low of 4.6% in October from 6.7% in September. This partly reflected the fact that last year’s significant increase in energy bills finally dropped out of the yearon- year inflation numbers. Core CPI (excluding food and energy) dropped by more than expected to 5.7% year-onyear, but was still well above the Bank of England’s 2% target. Food price inflation eased to its lowest rate since 2021 but remained in double-digit figures at 10.1% yearon- year.

The decrease in the headline inflation rate helped to calm fears that the Bank of England will raise interest rates again this year. Markets currently expect interest rates to be cut next June, despite Bank of England governor Andrew Bailey recently stating that it was “much too early” to be thinking about rate cuts.

China economic data remains mixed

Over in China, official data for October added to a mixed picture of the country’s economic recovery. Encouragingly, retail sales grew by 7.6% year-on-year in October, up from 5.5% in September and above the 7.0% growth expected by economists in a Reuters poll. Industrial production was also slightly better than expected, expanding by 4.6% year-on-year. However, fixed-asset investment rose by just 2.9% year-on-year, following a dip in infrastructure growth and real estate investment. Property sales by floor area fell 7.8% year-on-year in January to October, while property investment declined by 9.3% over the same period, according to the National Bureau of Statistics.