FTSE 100 suffers steepest loss since 2020

European indices suffered heavy losses last week as troubles at Credit Suisse weighed on the banking sector.

The FTSE 100 lost 5.3%, its biggest weekly decline since June 2020, while the pan-European Stoxx 600 and Germany’s Dax slid 3.8% and 4.3%, respectively. Credit Suisse, whose reputation for competence had been undermined by a series of controversies and poor lending decisions, saw its share price tumble after shareholder Saudi National Bank said it would not invest further capital in the company. This came hot on the heels of the collapse of Silicon Valley Bank (SVB) and Signature Bank in the US the previous week, adding to concerns about weaknesses in the banking sector.

In the US, investors speculated whether First Republic Bank could be the third regional bank to collapse. Such fears were partially alleviated when 11 banks committed to adding deposits worth $30bn, although First Republic’s shares remained under pressure. The S&P 500 managed to end the week up 1.4% and the Nasdaq climbed 4.4% as tech shares recorded strong gains. The week’s developments led to speculation that central banks could adopt a less aggressive approach to interest rates.

Stocks in Asia also experienced a volatile week, with Japan’s Nikkei 225 falling 2.9%. The Shanghai Composite edged up 0.6% after China cut the reserve requirement ratio for banks in an effort to boost liquidity in the banking system.

Last week’s market update*

• FTSE 100: -5.33%

• S&P 500: +1.43%

• Dow: -0.15%

• Nasdaq: +4.41%

• Dax: -4.28%

• Hang Seng: +1.03%

• Shanghai Composite: +0.63%

• Nikkei 225: -2.88%

• Stoxx 600: -3.85%

• MSCI EM ex Asia: -5.25%

* Data from close of business Friday 10 March to close of business Friday 17 March

UBS agrees to buy Credit Suisse

Stocks clawed back earlier losses to finish in the green on Monday (20 March) following news that UBS had agreed to buy Credit Suisse in a Swiss government-backed deal. The FTSE 100 rose 0.9% and the Stoxx 600 added 1.0% as central banks sought to reassure investors about the security of the global financial system. The Bank of England said the UK banking system “remains safe and sound” and that the takeover served as an “important backstop to ease strains in global funding markets”. US indices also rose, with the Dow gaining 1.2% and reversing losses from its previous trading session.

Traders bet on Federal Reserve rate cuts

Last Wednesday saw a turbulent day of trading for futures markets, as investors rapidly increased bets that the Federal Reserve would cut interest rates later this year following the banking sector turmoil. This marked a significant shift from a week earlier, when investors were concerned about the central bank reaccelerating the pace of rate hikes. Expectations of a half percentage point increase at the Fed’s meeting on 21-22 March have been reduced to a quarter percentage point, and the federal funds target rate is expected to end the year lower than its current range of 4.50% to 4.75%.

There was some speculation that the European Central Bank (ECB) would ease the pace of rate hikes, but the central bank chose to go ahead with a half percentage point increase to its key rates on Thursday. The bank’s main rate now stands at 3.5%. Christine Lagarde, president of the ECB, said the central bank would treat heightened tensions in financial markets separately from its strategy for bringing down inflation.

“We don’t see a trade-off between price stability and financial stability and handle them separately. We are not waning on our commitment to fight inflation and we are determined to return inflation back to 2% target in the medium term,” she stated.

US inflation eases

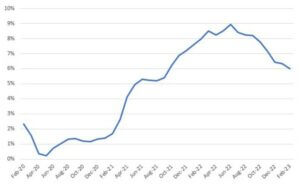

Last week also saw the release of the all-important US consumer price index (CPI) report. This showed headline inflation moderated in February to 6.0% year-on-year, the slowest pace since September 2021.

US headline CPI

Source: Refinitiv Datastream

On a monthly basis, the CPI rose by 0.4%, mainly driven by a 0.8% increase in shelter prices. Core inflation (excluding food and energy) rose by 0.5%, taking the year-on-year rise to 5.5%, down from 5.6% year-on-year in January.

Separate data showed US producer prices unexpectedly fell in February by 0.1% month-on-month, following a downwardly revised 0.3% increase in January. On an annual basis, prices rose by 4.6%, slowing from January’s downwardly revised 5.7% gain.

UK economy to contract by 0.2% in 2023

Here in the UK, chancellor Jeremy Hunt delivered his spring budget in which he announced the abolition of the pension lifetime allowance, an expansion of free childcare, a tax break on business investment, and the confirmation of a rise in the rate of corporation tax.

The budget was accompanied by the Office for Budget Responsibility’s (OBR) economic and fiscal outlook, which stated that the UK is no longer expected to enter a technical recession this year – defined as two consecutive quarters of declining gross domestic product (GDP). The economy is forecast to contract by 0.2% this year, a big upgrade from the 1.4% contraction forecast in November. Inflation is expected to fall sharply from 10.7% in the final quarter of 2022 to 2.9% by the end of 2023.

However, the OBR warned that the economy still faces “significant structural challenges”. Real household disposable income per person – a measure of real living standards – is expected to fall by a cumulative 5.7% over 2022/23 and 2023/24. While this is 1.4 percentage points less than forecast in November, it would still be the largest two-year fall since records began in 1956/57. Looking further ahead, the OBR has trimmed its GDP growth forecasts from 2.7% to 2.1% for 2026 and from 2.2% to 1.9% for 2027.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][zuperla_single_image image=”23486″ inherit_align=”left”][/vc_column][/vc_row]