Stocks rise after Fed skips rate hike in June

Most major stock markets rose last week after the US Federal Reserve refrained from raising interest rates in June.

In the US, the S&P 500 enjoyed its longest stretch of daily gains since November 2021 and finished the week up 2.6%. The Nasdaq and the Dow added 3.3% and 1.3%, respectively, after a notable easing of US inflation also helped to boost investor sentiment.

Stock markets in Europe also rallied, with the Stoxx 600 and Germany’s Dax up 1.5% and 2.6%, respectively. The FTSE 100 gained 1.1% following a rebound in UK gross domestic product (GDP) in April.

In Asia, the Nikkei 225 surged 4.5% to its highest level in over three decades after the Bank of Japan chose to leave its ultra-loose monetary policy unchanged. The Shanghai Composite and the Hang Seng rallied 1.3% and 3.4%, respectively, after the People’s Bank of China cut a key policy rate for the first time in ten months.

Last week’s market update*

• FTSE 100: +1.06%

• S&P 500: +2.58%

• Dow: +1.25%

• Nasdaq: +3.25%

• Dax: +2.56%

• Hang Seng: +3.35%

• Shanghai Composite: +1.30%

• Nikkei 225: +4.47%

• Stoxx 600: +1.48%

• MSCI EM ex Asia: +1.05%

*Data from close of business Friday 9 June to close of business

Friday 16 June

UK house prices cool

Stock markets finished in the red on Monday (19 June) as investors took profits following last week’s rally. The FTSE 100 fell 0.7% and the Stoxx 600 lost 1.0% in a quiet day for trading. US indices were closed on Monday to mark the Juneteenth national holiday.

In economic news, Rightmove’s house price index showed average new seller asking prices slipped by £82 in June from the previous month. While this was a very small decrease (house prices were flat in percentage terms), it was notable in that it was the first monthly decline so far this year, and the first for this time of year since 2017. Rightmove said the recent significant increases in mortgage rates hadn’t affected buyer demand yet, but were creating “renewed disruption and uncertainty among movers trying to calculate how much they can afford to borrow and repay”. In the last four weeks, the average mortgage rate for a five-year fixed 85% loan-to-value mortgage has jumped from 4.56% to 5.20%.

Fed leaves interest rates unchanged

Last week saw the US Federal Reserve vote unanimously to skip an interest rate increase in June and instead hold the federal funds rate at the target range of between 5.00% and 5.25%. This was the first time the Fed had kept rates unchanged since March 2022. Fed chair Jerome Powell said it was a prudent move given “how far and how fast we’ve moved”.

However, Powell also signalled that further rate hikes are on the cards this year. He said the meeting next month would be a “live” one, which has been interpreted as meaning the Fed is likely to raise rates by 0.25 percentage points on 26 July.

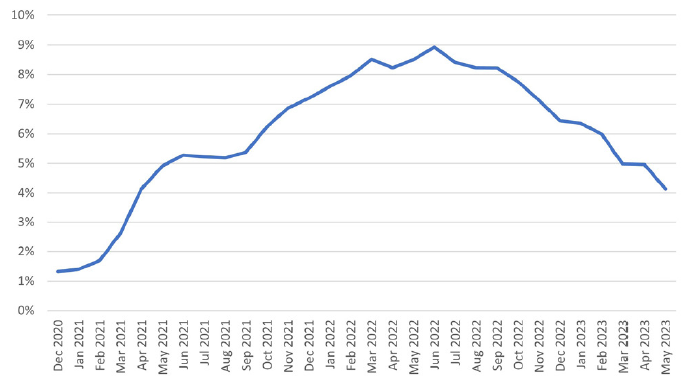

The Fed’s decision came a day after the Labor Department issued its latest consumer price index (CPI) report. Headline inflation eased to 4.0% year-on-year in May, down from 4.9% in April and the slowest annual pace since March 2021.

US headline CPI – YoY % change

Source: Refinitiv Datastream

On a monthly basis, prices rose by just 0.1% after increasing by 0.4% in April. However, core CPI – which excludes food and energy – rose by 0.4% for the third consecutive month.

ECB increases rates to highest level in 22 years

The European Central Bank (ECB) also met last week and decided to increase its key deposit rate by a quarter of a percentage point to 3.5%, the highest in 22 years. ECB president Christine Lagarde said another rate hike in July was “very likely” and that the ECB was “not thinking about pausing”. In a statement, the ECB said that while inflation was coming down, it is projected to remain “too high for too long”.

Despite seeing an easing in inflation, the ECB increased its forecast for core inflation for 2023 to 5.1%, up from 4.6% previously. This was mainly due to wage increases – average wages grew by 5.2% in the first quarter compared with a year ago. Meanwhile, the eurozone economy is expected to grow by 0.9% this year and 1.5% in 2024, down from the ECB’s previous estimates of 1.0% and 1.6%, respectively.

Bank of Japan sticks to ultra-low rates

The week ended with another major central bank meeting – this time at the Bank of Japan (BoJ). Although inflation in Japan has proved stronger than expected, the BoJ chose to maintain its -0.1% short-term interest rate target and a 0% cap on the ten-year bond yield set under its yield curve control policy. The bank reiterated its view that inflation will slow later this year.

“The bank will patiently continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions,” it said. “By doing so, it will aim to achieve the price stability target of 2% in a sustainable and stable manner, accompanied by wage increases.”

UK economy returns to growth in April

The UK economy returned to growth in April, with GDP expanding by 0.2% month-on-month after contracting by 0.3% in March, according to the Office for National Statistics. This was driven by an increase in car sales and customer spending in pubs and bars. The rise in activity was partly offset by junior doctors’ strikes, which held back health sector output.

The return to growth has added to expectations that the Bank of England will raise interest rates for the 13th time in a row when it meets on Thursday. It has also raised hopes that the UK will avoid a recession this year. Earlier this month, the OECD upgraded its economic growth forecasts for the UK. It expects GDP to grow by 0.3% this year and 1.0% in 2024, much better than its previous forecasts of a 0.2% decline in 2023 and a 0.9% rise in 2024. Nevertheless, all the other economies in the G7 apart from Germany are expected to grow at faster rates this year.