Markets boosted by cooling US inflation

All major indices finished in the green in a week that saw inflation and producer prices falling in the US.

The UK’s FTSE 100 and pan-European Stoxx 600 rose by 2.2% and 2.8% respectively on the back of the positive data, while over in the US, the S&P 500 grew 2.2%, the Dow rose by 1.7% and the Nasdaq added 3.1%.

In Asia, the Shanghai Composite added 1.0% as China extended policies to help bolster its struggling property market. The measures encourage financial institutions to extend loans and adjust repayment arrangements for real estate companies in order to promote completion and delivery of pre-sold housing projects.

Hong Kong’s Hang Seng added 5.1% while Japan’s Nikkei 225 added a more modest 0.6% amid speculation the Bank of Japan may raise its ten-year yield ceiling to 1% later this month.

Last week’s market update*

• FTSE 100: +2.21%

• S&P 500: +2.17%

• Dow: +1.66%

• Nasdaq: +3.13%

• Dax: +2.76%

• Hang Seng: +5.05%

• Shanghai Composite: +1.06%

• Nikkei 225: +0.63%

• Stoxx 600: +2.75%

• MSCI EM ex Asia: +3.15%

*Data from close of business Friday 7 July to close of business

Friday 14 July

Markets dampened by Chinese data

Markets in the UK and China ended in the red on Monday (17 July) following disappointing economic data, including lower-than-expected second quarter GDP growth. China’s GDP grew to 6.3% year-on-year in Q2, compared to a forecasted 7.3%. The FTSE 100 lost 0.4% while the Shanghai Composite dropped 0.9%. Japan’s Nikkei 225 was closed Monday due to a public holiday, and Hong Kong’s Hang Seng was closed due to a typhoon.

Over in the US, indices closed in the green, as the anticipation of US earnings reports and retail sales data this week boosted investor sentiment. The Dow Jones added 0.2% for its sixth consecutive day, while the S&P 500 grew 0.4% and tech-heavy Nasdaq increased 0.9%.

The average UK property price has fallen by an average 0.2% (£905) this month to £371,907, Rightmove’s House Price Index shows. The decline is attributed to rising mortgage costs and buyer affordability constraints. The average interest rate on Rightmove’s mortgage tracker is now 5.69% for an 85% loan-to-value five-year-fixed mortgage. However, demand is still resilient and 3% higher than in 2019, despite the number of properties for sale being 12% lower than four years ago.

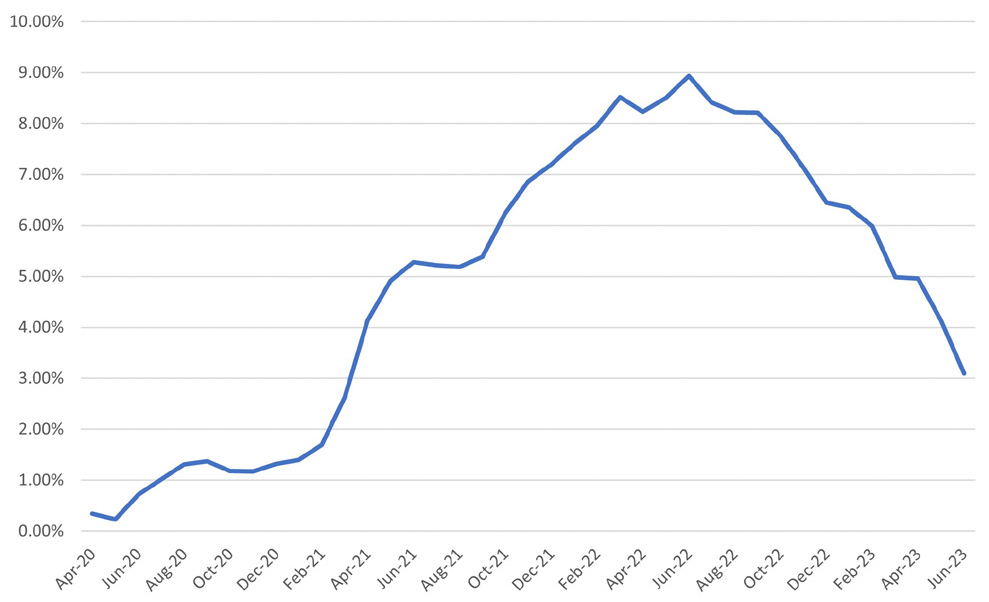

US inflation cools

US inflation rose by an annualised 3% in June, the smallest 12-month increase in over two years, according to figures from the US Bureau of Labor Statistics. This is an improvement from the 4% measured in May, and slightly below the market’s expected 3.1%.

On a monthly basis, the US headline Consumer Price Index (CPI) rose by 0.2% in June, up from 0.1% in May. The rise was driven primarily by the index for shelter, which contributed over 70% of the increase.

Core CPI, which includes all items except food and energy, rose 0.2% in June, the smallest monthly increase since August 2021. On an annualised basis, core CPI rose by 4.8%, driven largely by the shelter index, which accounted for two thirds of the total increase.

US headline CPI – annualised % rate

Source: Refinitiv Datastream

In another sign of cooling inflation, the US Producer Price Index (PPI) for final demand rose by a betterthan- expected 0.1% in June, according to the Labor Department. Economists had predicted a 0.2% increase. The increase was primarily driven by a 0.2% rise in the final demand services index, while prices for final demand goods were unchanged. On an annualised basis, the index advanced 0.1%.

Core PPI – excluding food, energy, and trade services – rose by 0.1% in June after remaining flat in May. On an annualised basis, prices rose 2.6%.

Although inflation has eased, many economists still expect the Federal Reserve to raise interest rates by 25 basis points on 26 July. The Fed held rates last month, but policymakers have indicated there may be a further rise of up to 0.5 percentage points before the end of the year.

UK economy shrinks

UK gross domestic product (GDP) is estimated to have fallen by 0.1% in May, after growth of 0.2% in April, according to the Office of National Statistics.

Production output and the construction sector fell by 0.6% and 0.2% respectively in May, while services output remained flat.

The additional bank holiday in early May for the coronation of King Charles III was cited as a reason for reduced output in manufacturing and construction. The bank holiday benefitted industries in the arts, entertainment and recreation, while sentiment in accommodation and the food services sector was mixed, with reports of both increased and reduced output.

Strikes in healthcare, the rail network, education and the civil service were also reported to have had an impact on results.

The market is expecting the Bank of England to raise interest rates again next month in an effort to stifle inflation.

The pound reached a new 15-month high following last week’s GDP report, rising to $1.30 against the dollar for the first time since April 2022. The pound has gained almost 8% on the dollar so far this year.

Germany reduces dependence on China

Germany announced it will reduce its dependence on China for supply chains and export markets. Sectors impacted include medicine, lithium batteries used in electric cars, and elements used in chipmaking. China continues to be Germany’s main trading partner, with goods worth almost €300 billion exchanged between the countries in 2022.