Guy Foster, Chief Strategist, discusses the risks of escalating tensions in the Red Sea, while Janet Mui, Head of Market Analysis, analyses the latest US inflation figures.

As the second week of the year drew to a close, the contrast with 2023 remained tangible. The market seems to continue to see the glass half full, and even when confronted by some challenging technical and seasonal trends, the January blues are looking quite short-lived.

After losses in the first week, markets generally rallied in the second, and there was little in the way of news flow to point to as the drivers. At the end of the first week, US jobs growth was strong but with stronger wage growth than had been expected. So, the main theme of economic data at the beginning of 2024 was that recession risks were low, but with hints that inflationary pressures remain.

And that message continued into the second week. Again, it was a relatively quiet one from a news perspective, but the data continue to support the idea of an economy that is doing well with some lingering inflationary pressure.

Inflation persists

What were these data? The main news of last week was the US consumer price index (CPI) report and, jumping to the punchline, even though the report was stronger than expected, the markets showed little evidence of anxiety over the inflationary or interest rate outlook.

The headline rate of inflation was higher than expected but headline inflation tends to be dominated by food and energy prices. Energy prices have been weak but because they are volatile, it can be difficult to determine the extent to which movements in headline commodity prices translate into higher consumer prices from one month to the next. Furthermore, a rising oil price does not necessarily reflect robust domestic economic demand, and therefore would not necessarily prompt a response from the central bank (such as an increase in interest rates). So, attention naturally shifts to the core CPI measure, which strips food and energy prices out.

Core CPI was in line with expectations with prices rising 0.3% over the month. The bad news is that continued monthly increases at that pace would be exceeding the Federal Reserve’s inflation target, whereas increases of 0.2% would be consistent with that target. Fortunately, we can also assume that core CPI will come down in the future. Shelter is a large part of the index and rental inflation has been slowing. This strongly suggests that in the future, the rent of the shelter category will slow too.

This time it’s personal

In a sense it doesn’t matter, because the Fed does not base its policy decisions upon the CPI rate of inflation. Instead, it prefers the Personal Consumption Expenditure (PCE) Price Index. This number gets far less coverage than CPI, mainly because it comes out much later in the month, but what it lacks in timeliness it makes up for in relevance. With a lower weighting to rent and without the distortions of energy prices, and with a lower weighting to used vehicles, which were another temporary anomaly from the current month’s report, the core PCE is considered more accurate. Both are suggesting very similar annual rates of inflation at the moment, but the six-month annualised rate of core PCE price increases will likely drop to the Fed’s target of 2% when the data is eventually reported at the end of the month.

Were that to happen, the economy would enjoy the fabled Goldilocks scenario, which would be in play for the short term at least, as growth still seems ok. The weekly jobless claims data stubbornly refuse to rise, and the CPI data that we have just discussed gives an opportunity to estimate current consumer spending, which is the biggest driver of economic growth.

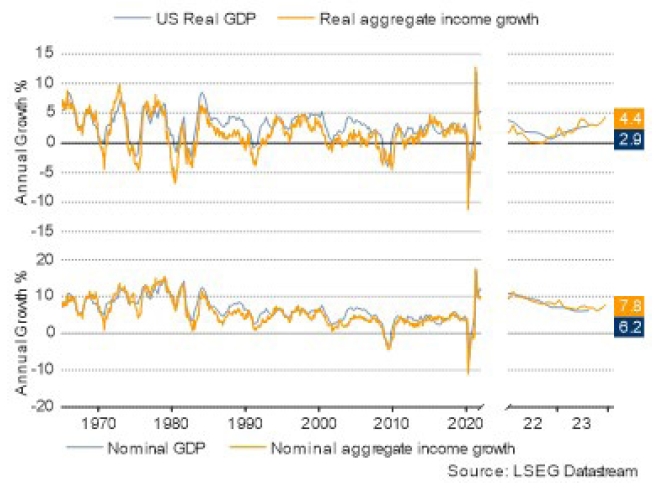

With the increase in employment, the increase in wages and notwithstanding the decline in hours worked, aggregate US consumer incomes increased by 7.8% over the last year – that is the fastest since January last year. This makes four months of consecutive improvement. Adjusting for inflation, real aggregate income growth has been 4.4%, so if employment remains robust and aggregate income expands faster than inflation, that should support economic growth and company earnings.

Earnings season

We’ll find out over the coming days how companies faired during the last quarter as the US Q4 results season began in earnest on Friday. There will be plenty of headlines and statistics about the earnings season but in reality, it is difficult to draw many conclusions from the numbers posted in company results. Instead, it is what they say about the future that has more value. For instance, it seems likely that around 80% of companies will beat estimates, which sounds impressive until you realise this happens almost every earnings seasons. Typically, sell-side analysts at banks will forecast earnings and be overly optimistic. Over the course of a year, they will gradually reduce their estimates such that by the time the company reports, it beats reduced estimates.

Over most years, the aggregate market will see earnings undershoot estimates by around 6%. But that doesn’t necessarily matter as there have been plenty of years in which earnings have been poor in absolute terms, and disappointing relative to estimates (a year ahead). Investors have rightly been more focused on the future flow of potential profits from the company than any single year.

Banks got earnings season up and running on Friday. JP Morgan seems to have impressed while Citigroup and Bank of America underwhelmed.

Takeaways from management were encouraging. The Bank of America CFO said the bank thinks the soft landing is playing out. Jamie Dimon at JP Morgan was a little more circumspect, acknowledging that the economy continues to be resilient, and that consumers are still spending. He noted that markets are expecting a soft landing. But he highlights the size of the fiscal deficit and the pent-up impact of previous stimulus as reasons not to be too confident over current economic performance.

Rather than a Goldilocks scenario, Dimon emphasised that supply chains, the green transition, and healthcare would require higher levels of spending in the future, which could lead to higher inflation and interest rates. On the growth side, he warns of some of the uncertainties we noted in our annual preview; the economy is primed for recession with limited spare capacity but could easily avoid it with a fair wind. The problem would come if the economy was subject to economic shocks such as a spike in oil prices or disrupted supply chains.

On the Red Sea

On that note, of course, the other main news of last week saw an expansion of hostilities in the Red Sea. On Thursday, the US and UK intervened, with non-operational support from other Western nations, in military actions against Houthi rebels in Yemen. This is intended to prevent them from haranguing shipping en route to the Suez Canal. In advance of the attacks, the rebels warned there would be a response to them.

Since the attacks, they have continued targeting Israeli vessels. Iran has meanwhile condemned the attacks by the US and UK, and Saudi Arabia (which has been in conflict with the Houthis for almost a decade) expressed concern and pleaded for restraint. Oil and gold rose sharply on news of the intervention by the US and UK, although oil was sinking later in the session.

Traffic is still flowing through the Red Sea but at hugely inflated rates, reflecting the added risk to shippers. Meanwhile, many larger shippers have diverted around Southern Africa, which adds a further ten days and the requisite costs to the journey. These additional costs will be reflected in consumer prices at some stage, albeit goods prices are not the most influential category.