Stocks mixed on hawkish central bank comments

Stocks gave a mixed performance last week following hawkish comments from central bank policymakers.

After enjoying its longest winning streak in two years, the S&P 500 slumped on Thursday after Federal Reserve chair Jerome Powell said the central bank was not confident it had done enough to rein in inflation. A tech-driven rally on Friday helped the S&P 500 end the week up 1.1%.

Powell’s comments weighed on indices in Europe, with the Stoxx 600 slipping 0.1%. European Central Bank (ECB) president Christine Lagarde added to concerns about rates staying higher for longer, saying it would take more than the next couple of quarters for the ECB to start cutting rates. The FTSE 100 declined 0.8% after Bank of England governor Andrew Bailey said it was “really too early” to talk about cutting rates.

In Asia, China’s Shanghai Composite declined 0.6% after consumer prices fell in October, adding to concerns about the country’s economic outlook.

Last week’s market update*

• FTSE 100: -0.77%

• S&P 500: +1.13%

• Dow: +0.55%

• Nasdaq: +2.07%

• Dax: +0.65%

• Hang Seng: -4.25%

• Shanghai Composite: -0.64%

• Nikkei 225: -0.43%

• Stoxx 600: -0.05%

• MSCI EM ex Asia: -1.21%

*Data from close of business Friday 3 November to close of business

Friday 10w November.

Investors await US inflation data

Stocks were mixed on Monday (13 November) as investors awaited the release of US inflation data on Tuesday. The Stoxx 600 rose 0.8%, the FTSE 100 added 0.9% and the S&P 500 edged down 0.1%. In economic news, figures from Rightmove showed new seller asking prices in the UK fell 1.7% this month, the largest November drop for five years. Nevertheless, Rightmove’s director of property science Tim Bannister said the year so far had been better than many expected, with new seller asking prices just 3% behind May’s peak.

The FTSE 100 was flat at the start of trading on Tuesday as figures from the Office for National Statistics (ONS)

showed wage growth cooled slightly in the three months to September. Earnings excluding bonuses were 7.7% higher than in Q3 2022. This was a slight slowdown from 7.8% in the previous period, which was the highest since comparable records began in 2001.

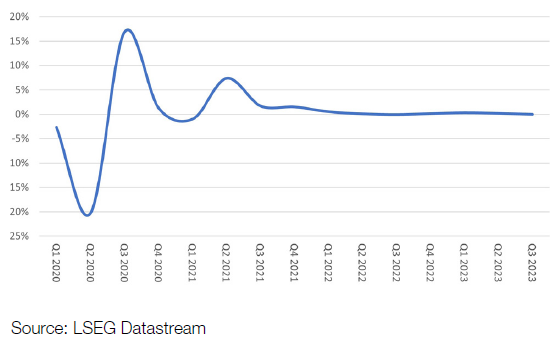

UK economy stagnates in third quarter

As well as interest rate commentary, last week saw the release of some important pieces of economic data, including the latest UK gross domestic product (GDP) figures. The data from the ONS showed GDP was flat in the third quarter compared with the previous three months, following a 0.2% expansion in the second quarter. There was a 0.1% decline in services sector output, which offset a 0.1% increase in contraction sector output and broadly flat production sector output.

UK GDP – quarterly % change

The 0% figure was in line with the Bank of England’s expectations and better than the 0.2% contraction forecast by economists. Flat growth means the UK has managed to avoid a recession this year, which is defined as two consecutive quarters of declining GDP.

Eurozone retail sales fall for third straight month

In the eurozone, the latest retail sales data continued to point to a weak European economy. Retail sales fell for the third consecutive month in September, declining by 0.3% from the previous month, according to Eurostat. An increase in sales of food, drinks and tobacco was offset by falls in non-food products and automotive fuel. The decline was worse than the 0.2% drop expected by analysts, although sales for August were revised up from -1.2% to -0.7%.

On an annual basis, sales were 2.9% lower than in September 2022. This was worse than the 1.8% yearon- year decline in August, but better than the 3.2% contraction forecast by economists.

US consumer sentiment drops to six-month low

In the US, consumer sentiment fell for the fourthconsecutive month in November, according to the University of Michigan’s preliminary consumer sentiment index. The headline index fell from 63.8 in October to 60.4 in November, the lowest level since May. The preliminary gauge of current conditions fell from 70.6 to 65.7, and the expectations index declined from 59.3 to 56.9. Joanne Hsu, the University of Michigan’s surveys of consumer director, said the decline was in part due to growing concerns about the negative effects of high interest rates, as well as geopolitical concerns.

The report also showed that year-ahead inflation expectations rose from 4.2% to 4.4%, the highest since April 2023, while long-run inflation expectations rose from 3.0% to 3.2%, the highest since 2011.

China’s consumer prices fall in October

Over in China, consumer prices fell in October, according to the National Bureau of Statistics. The consumer price index fell 0.2% year-on-year after being unexpectedly flat in September, underscoring the country’s fragile economic recovery since the pandemic. Food prices were the main culprit, with overall food prices down 4.0% from a year ago. Pork prices were 30.1% lower than in October 2022.

Meanwhile, producer prices declined 2.6% year-on-year, compared with a fall of 2.5% in September. The producer price index has now been in negative territory for 13 consecutive months.