Stocks mixed as eurozone falls into recession

Stocks were mixed last week after revised data showed the eurozone slipped into a mild recession in the first quarter of the year.

The pan-European Stoxx 600 fell 0.5% and Germany’s Dax declined 0.6% following a slew of weak economic data for Europe. The UK’s FTSE 100 lost 0.6% ahead of this week’s interest rate decisions by the US Federal Reserve and European Central Bank (ECB).

In contrast, US indices ended the week in the green, with technology stocks boosted by the unveiling of Apple’s virtual reality headset. The S&P 500 entered bull market territory – up more than 20% from its October lows – and finished the week up 0.4%.

Japan’s Nikkei 225 also enjoyed solid gains, rising 2.4% to hit a 33-year high. This came after the

Cabinet Office said Japan’s economy grew by more than initially estimated over the first quarter of the year. China’s Shanghai Composite ended the week flat as inflation figures for May raised concerns about the risk of deflation.

Last week’s market update*

• FTSE 100: -0.59%

• S&P 500: +0.39%

• Dow: +0.34%

• Nasdaq: +0.14%

• Dax: -0.63%

• Hang Seng: +2.32%

• Shanghai Composite: +0.04%

• Nikkei 225: +2.35%

• Stoxx 600: -0.46%

• MSCI EM ex Asia: +3.99%

*Data from close of business Friday 2 June to close of business

Friday 9 June

Investors await US CPI report

Stocks started this week on a positive note as investors awaited the release of Tuesday’s US consumer price index (CPI) report. The S&P 500 and the Nasdaq rose 0.9% and 1.5%, respectively, on Monday (12 June) to reach their highest closes since April 2022. Economists expect the CPI for May to show a meaningful easing of inflation to 4.1% year-on-year, according to a poll by Reuters. This would add to the case for a pause in US interest rate hikes this week.

Elsewhere, a report from the Confederation of British Industry (CBI) gave a more encouraging outlook for the UK economy. The CBI expects the economy to grow 0.4% this year and 1.8% in 2024, much better than its initial forecast of a 0.4% contraction in 2023 and 1.6% growth in 2024. It also expects food inflation to fall from 15.5% in 2023 to 4.4% next year.

Eurozone GDP shrinks by 0.1% in Q1

Figures released by Eurostat last week demonstrated the impact that the rising cost of living is having on consumer spending in the eurozone. The revised gross domestic product (GDP) data showed the eurozone’s economy contracted by 0.1% in the first quarter of 2023 and in the final quarter of 2022. This means the eurozone slipped into a technical recession, which is defined as two consecutive quarters of declining GDP.

Retail sales figures for the eurozone were also disappointing. The seasonally adjusted volume of retail trade was flat in April, missing expectations for a 0.2% increase. This followed a decline of 0.4% in March. Among individual countries, Germany saw a 0.8% increase in sales, whereas France saw a 1.3% decline.

Meanwhile, factory orders in Germany unexpectedly fell by 0.4% in April from the previous month, according to figures from Destatis. This followed a 10.9% slump in March. On an annual basis, orders were down 9.9%, following an 11.2% fall the month before.

UK house prices fall sharply

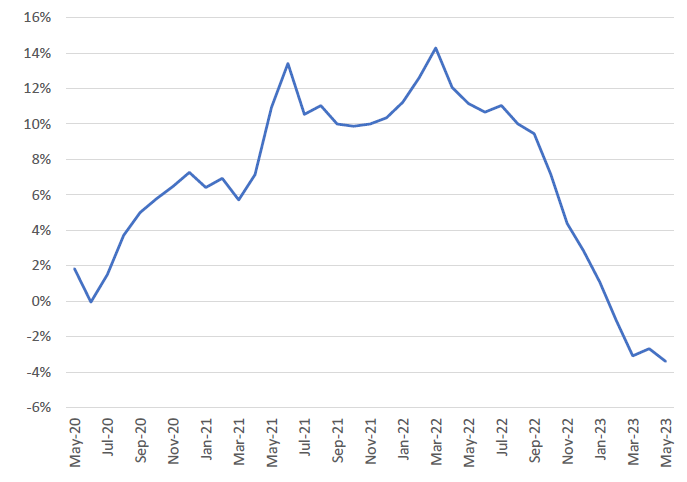

Here in the UK, data from mortgage lenders Halifax and Nationwide showed the first annual drop in house prices for over a decade. Halifax reported a 1.0% year-on-year decline in May, the first drop since 2012. Nationwide reported a bigger 3.4% annual decrease in May, the steepest decline for 14 years.

Nationwide house price index (YoY % change)

Source: Refinitiv Datastream

Robert Gardner, Nationwide’s chief economist, said the drop largely reflected base effects, with prices broadly flat over the month after taking account of seasonal effects. “Recent Bank of England data had shown some signs of recovery in housing market activity, although the number of mortgages approved for house purchase in March was still around 20% below pre-pandemic levels,” he said.

Gardner added that headwinds to the housing market look set to strengthen in the near term. “While consumer price inflation did slow in April, it was a much smaller decline than most analysts had expected. As a result, investors’ expectations for the future path of the Bank Rate increased noticeably in late May, suggesting it could peak at around 5.5%, well above the 4.5% peak that was priced in around late March.”

US jobless claims hit 18-month high

In the US, the number of Americans filing new claims for unemployment benefits surged to the highest level since October 2021. Initial claims jumped by 28,000 to a seasonally adjusted 261,000 for the week ending 3 June, well above the 235,000 claims forecast by economists in a Reuters poll.

Volatility in week-to-week data means it is too early to say whether layoffs have increased. The four-week moving average of claims, which is considered a better measure of labour market trends, rose by just 7,500 to 237,250. Continuing claims (the number of people who received unemployment benefits for two or more weeks) unexpectedly fell to their lowest level in nearly four months.

China’s factory gate deflation deepens

Over in China, factory gate prices fell at the fastest pace in seven years in May as demand faded. The producer price index fell by 4.6%, marking the eighth consecutive month of declines, according to the National Bureau of Statistics. This was the steepest fall since February 2016. The data added to concerns that China is facing the risk of deflation – where prices decrease in a sign of a weakening economy. Consumer prices rose by just 0.2% year-on-year in May, and real estate and factory activity have slowed sharply.