Stocks fall as US headline inflation soars

US and European indices fell last week as US headline inflation soared and the European Central Bank (ECB) signalled it could increase interest rates at a faster rate than anticipated.

After a positive start to the week, the S&P 500, Dow and Nasdaq slid 5.1%, 4.6% and 5.6%, respectively. The consumer price index (CPI) for May, released on Friday, showed headline inflation rose by 8.6% from a year earlier – higher than consensus estimates.

In Europe, the STOXX 600 dropped 4.0% and Germany’s Dax sank 4.8% after the ECB lowered its outlook for economic growth. The UK’s FTSE 100 fell 2.9%.

Stocks in Asia had a more encouraging week, with the Nikkei 225 edging up 0.2% after figures showed the Japanese economy shrank by less than expected in the first quarter. China’s Shanghai Composite rose 2.8% on news Beijing appeared to be easing its crackdown on the technology sector.

Last week’s market performance *

• FTSE 100: -2.86%

• S&P 500: -5.05%

• Dow: -4.58%

• Nasdaq: -5.60%

• Dax: -4.83%

• Hang Seng: +3.43%

• Shanghai Composite: +2.80%

• Nikkei: +0.23%

*Data from close on Friday 3 June to close of business on Friday 10 June.

UK GDP unexpectedly shrinks in April

The FTSE 100 slumped 1.5% on Monday (13 June) after data from the Office for National Statistics (ONS) showed UK gross domestic product (GDP) contracted by 0.3% in April after declining by 0.1% in March. Economists had been expecting a slight increase of 0.1%. The ONS said the scaling back of the Covid-19 vaccination programme and pandemic test-and-trace was the biggest contributor to the monthly fall in GDP. Manufacturing also suffered with some companies affected by rising fuel and energy prices.

Stocks in the US and Europe also slid on Monday following speculation the Federal Reserve might decide to raise interest rates by 75 basis points at its next policy meeting on 14-15 June. The S&P 500 and the Nasdaq lost 3.9% and 4.7%, respectively, while the STOXX 600 fell 2.4%. Concerns over a resurgence of Covid-19 cases in China weighed on markets in Asia, with the Shanghai Composite, Hang Seng and Nikkei down 0.9%, 3.4% and 3.0%, respectively.

The FTSE 100 opened in the green on Tuesday as investors mulled the latest UK labour market data. Unemployment edged slightly higher to 3.8% in the three months to April from 3.7% in the three months to March. This was the first increase since the last three months of 2020. The number of job vacancies hit a new record high of 1.3 million, while real wages (adjusted for inflation) fell by 2.2% year-on-year.

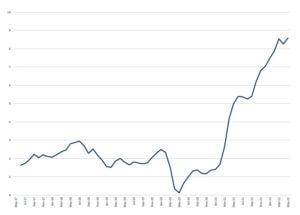

US inflation hits new 40-year high

Inflation in the US accelerated to a new four-decade high in May as the cost of petrol, food and other necessities surged. The headline CPI rose to 8.6% from a year ago, faster than April’s year-on-year increase of 8.3% and the highest level since December 1981.

US consumer price index – YoY % change

Source: Refinitiv Datastream

The increase was driven by a surge in prices for gasoline, food and shelter. Energy costs rose by 34.6% from a year earlier, while groceries jumped by 11.9%. On a month-on-month basis, prices rose by 1.0%, significantly higher than the 0.3% increase in April and above economists’ expectations of a 0.7% rise. Once food and energy prices were stripped out, core inflation rose by 0.6% month-on-month and by 6.0% from a year ago, according to the Department of Labor.

ECB unveils interest rate plans

Inflation and interest rates also dominated the headlines in Europe last week. The ECB signalled it was likely to raise rates by half a percentage point in September, in addition to a planned quarter-point rise in July. ECB president Christine Lagarde and chief economist Philip Lane had previously said rate rises of 0.25% were the benchmark for its meetings in July and September. On Thursday, however, Lagarde said risks to the inflation outlook were “primarily on the upside”, according to a report in the Financial Times.

The comments came as the ECB raised its inflation projections to an average of 6.8% for this year, well above the 5.1% predicted in March. Inflation is expected to ease to 3.5% in 2023 and 2.1% in 2024. The ECB also cut its outlook for GDP growth to 2.8% for 2022 and 2.1% for 2023, down from 3.7% and 2.8% previously.

“Russia’s war against Ukraine has severely hit confidence, caused energy and food prices to soar further and, together with pandemic-related disruptions in China, compounded existing supply chain pressures,” the ECB said. “These factors pose strong headwinds for the economic recovery in the euro area and come at the same time as a relaxation of pandemic-related restrictions, which is providing a strong boost to the services sector.”

Japan GDP better than expected

The latest economic growth figures for Japan proved to be better than expected. According to the Cabinet Office, GDP declined by an annualised 0.5% in the first quarter of the year, less than the initial estimate of a 1.0% contraction. On a quarter-on-quarter basis, GDP shrank by 0.1%, beating expectations for a 0.3% decline. Private consumption, which makes up more than half of Japan’s GDP, rose by 0.1% from the previous quarter, while inventories also increased. This helped to offset a 0.7% quarterly fall in capital spending.[zuperla_single_image image=”22728″]