Positive economic data weigh on stock markets

Positive data from the world’s largest economy proved to be bad news for stock markets last week, as investors fretted about further interest rate hikes.

The S&P 500, Dow and Nasdaq slipped 1.3%, 0.8% and 1.9%, respectively, after the US services sector unexpectedly picked up steam in August. Indices were also dragged lower by a slump in Apple shares and an uptick in oil prices.

In Europe, the Stoxx 600 fell 0.7% after gross domestic product (GDP) in the eurozone grew by just 0.1% in the second quarter, down from initial estimates of a 0.3% expansion. Germany’s Dax declined 0.5% as industrial production fell for a third consecutive month.

In China, the Shanghai Composite fell 1.9% after a slowdown in services sector activity added to concerns about the country’s economic outlook. Hong Kong’s Hang Seng finished its four-day trading week 3.4% lower, with markets closed on Friday due to extreme rain.

Last week’s market update*

• FTSE 100: +0.34%

• S&P 5001: -1.29%

• Dow1: -0.75%

• Nasdaq1: -1.93%

• Dax: -0.53%

• Hang Seng2: -3.41%

• Shanghai Composite: -1.90%

• Nikkei 225: -1.01%

• Stoxx 600: -0.72%

• MSCI EM ex Asia: -2.14%

*Data from close of business Friday 1 September to close of business Friday 8 September

1 Closed on Monday 4 September

2 Closed on Friday 8 September

Germany’s economy to contract this year

Stocks started this week in the green as investors looked ahead to the release of the US consumer price index (CPI) inflation report and the European Central Bank’s interest rate decision later this week. The pan-European Stoxx 600 managed a 0.3% gain on Monday (11 September), despite the European Commission forecasting a 0.4% decline in Germany’s economic activity this year, compared with its previous forecast of 0.2% growth. The commission also cut its growth expectations for Germany in 2024 from 1.4% to 1.1%, and warned of a general slowdown across the EU as a whole.

The FTSE 100 was up 0.6% at the start of trading on Tuesday as investors digested the latest UK jobs data. The unemployment rate rose to 4.3% in the May to July quarter, up from 3.8% the previous quarter. Regular pay (excluding bonuses) grew by 7.8% year-on-year, the same rate as the previous quarter and the highest since comparable records began in 2001.

US services activity hits six-month high

Last week’s economic data indicated that parts of the US economy are performing better than expected and that inflationary pressures are persisting. Concerns that interest rates may need to stay higher for longer weighed on stock and bond prices last week.

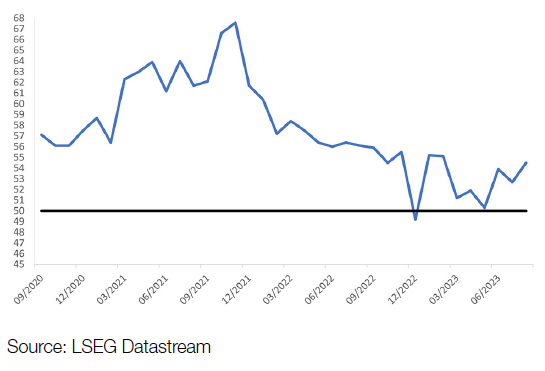

Figures from the Institute for Supply Management (ISM) showed US services sector activity unexpectedly rose to a six-month high in August. ISM’s non-manufacturing purchasing managers’ index (PMI) measured 54.5, up from 52.7 in July and well above the 50.0 mark that separates growth from contraction. A gauge of prices paid by services businesses jumped sharply to 58.9 from 56.8, indicating ongoing inflationary pressures.

ISM US non-manufacturing PMI

Elsewhere, weekly jobless claims were lower than expected, suggesting the US labour market remains tight despite previous data showing an increase in the unemployment rate. Initial jobless claims fell to 216,000 in the week ending 2 September, the lowest since February and the fourth consecutive weekly decline.

Eurozone GDP growth revised lower

Figures from Eurostat showed eurozone GDP grew by only 0.1% in the second quarter compared with the previous three months. This was worse than the initial estimate of a 0.3% expansion. Exports fell by 0.7% due to a slowdown in trade with China and a sharp decline in the German car making industry. German industrial production fell by 0.8% in July, driven by a 9% decline in auto manufacturing.

Separate data showed retail sales volumes in the eurozone dropped 0.2% in July, worse than the 0.1% decline forecast by analysts. In Germany, the eurozone’s biggest economy, sales were down 0.8% month-on-month.

UK interest rates ‘nearing peak’

Here in the UK, Bank of England (BoE) governor Andrew Bailey told MPs last week that interest rates were “much nearer now to the top of the cycle”. He said that while there had previously been a period when “it was clear that rates needed to rise”, the Bank was “not in that place anymore”. Bailey also reiterated his prediction that inflation will fall significantly this winter. The Bank is expected to raise interest rates to 5.5% when it meets again on 21 September.

The BoE’s latest survey of businesses indicated that underlying price pressures might be easing. Companies polled in the three months through August expect output prices to increase by 4.9% over the next 12 months, down from 5.2% in the three months to July. CPI inflation expectations for the year ahead also eased to 4.8% from 5.4% in July.