Markets rally on US payroll figures

Markets ended the week with mixed results on the back of varied economic data.

In the US, the S&P 500, Dow and Nasdaq added 0.8%, 0.1% and 1.5%, respectively, as US nonfarm payroll employment increased more than expected and consumer confidence grew.

In Europe, US payrolls figures helped rally the FTSE 100 to add 0.6%, despite UK construction activity contracting and house prices falling by almost £7,000 month-onmonth. Germany’s DAX added 2.6% while pan-European Stoxx 600 added 1.4%.

In Asia, Hong Kong’s Hang Seng fell 1.9% and the Shanghai Composite dropped 1.8% as China’s consumer price index (CPI) saw its steepest annualised decline in three years and the country’s credit rating was reduced to ‘negative’ by ratings agency Moody’s. Japan’s Nikkei 225 fell 2.8% on the news that the economy contracted by more than expected in the third quarter.

Last week’s market performance*

• FTSE 100: +0.55%

• S&P 500: +0.76%

• Dow: +0.12%

• Nasdaq: +1.54%

• DAX: +2.61%

• Hang Seng: -1.87%

• Shanghai Composite: -1.76%

• Nikkei 225: -2.78%

• Stoxx 600: +1.39%

• MSCI EM ex Asia: -0.33%

* Data from close of business on Friday 1 December to close of

business on Friday 8 December

Monday update

US markets closed in the green Monday (11 Dec) as investors looked forward to the Federal Reserve’s final meeting of the year on 12-13 December, where it is expected to maintain interest rates at the current level of 5.25-5.50%. The Dow, S&P 500 and the Nasdaq advanced 0.4%, 0.4%, and 0.2%, respectively.

After a 0.1% dip on Monday, the FTSE 100 rallied Tuesday morning (12 December), as data from the Office for National Statistics showed the unemployment rate was unchanged in the three months to October at 4.2%. Wage growth cooled to 7.3% (excluding bonuses) while the number of vacancies fell to 949,000.

US adds 199,000 nonfarm jobs in November

US nonfarm payroll employment increased 199,000 jobs in November, according to the Bureau of Labor Statistics data. Although it was lower than the monthly average of 240,000 jobs, it was better than the 180,000 new jobs forecasted for the month by economists.

The greatest job gains were seen in healthcare (+77,000 jobs) and government (+49,000 jobs), while retail trade employment declined by 38,000.

The unemployment rate fell to 3.7% in November, down from 3.9% in October.

American consumer confidence grows

US consumer confidence grew to 69.4 in December from 61.3 in November, a month-on-month increase of 13.2%, according to preliminary data from the University of Michigan. On an annualised basis, consumer sentiment grew 16.1%.

Inflation expectations dropped drastically from 4.5% last month to 3.1% in December, the lowest since March 2021 and just above the 2.3-3.0% range seen in the two years before the pandemic. Long-running inflation expectations fell to 2.8% in December from 3.2% in November, which matched the lowest reading since July 2021.

UK construction output declines

UK construction activity contracted slightly to 45.5 in November from 45.6 in October, according to the S&P Global / CIPS purchasing managers’ index. A level of 50.0 indicates growth. November’s reading was the lowest since May 2020 and indicated reduced activity across the sector.

House building remained the weakest-performing segment indexed at 39.2, followed by civil engineering (43.5). Respondents attributed this to cutbacks to residential development projects and a general slowdown in activity due to unfavourable market conditions.

UK house prices fall £7,000 month-to-month

The average UK house price fell by 1.9% (-£6,966) to £355,177 this month, according to the Rightmove House Price Index. Although prices tend to fall in December due to seasonal variations, the drop is larger than the previous 20-year average of 1.5%. The drop is driven largely by new sellers looking to price below the competition as the market has swung in the buyer’s favour. On an annualised basis, house prices have fallen 1.1%.

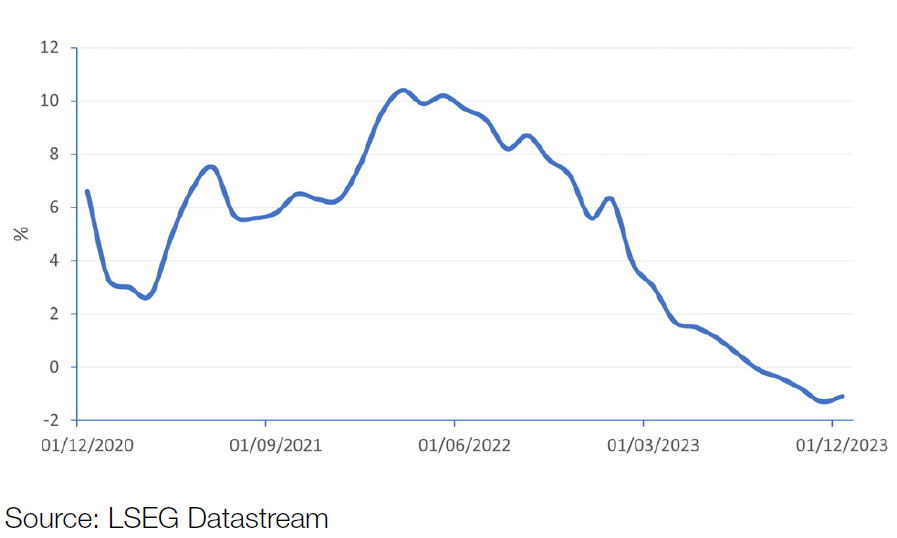

UK house prices – YoY % change

The average UK mortgage rate has fallen for the 19th consecutive week. The average five-year fixed rate mortgage rate is now 5.11%.

China’s CPI sees steepest annual decline in three years

China’s national consumer price index fell by 0.5% both month-on-month and year-on-year in November, the steepest annualised decline in three years. Economists had expected a drop of 0.1%, respectively. Core inflation, which excludes food and fuel prices, was 0.6% year-onyear in November, the same as October.

The producer price index fell by a worse-than-expected 3.0% in November, down from 2.6% in October. Economists had predicted a 2.8% fall. This was the 14th consecutive month and fastest rate of decline since August.

Last week, ratings agency Moody’s lowered the outlook on China’s A1 credit rating from ‘stable’ to ‘negative’. The downgrading effectively means that Moody’s considers Beijing’s risk of default to have increased over the past year. The ratings agency expects China’s annual GDP growth to slow to 4.0% in 2024 and 2025 and average 3.8% from 2026 to 2030, declining to 3.5% in 2030.

Meanwhile, China’s services sector activity grew to an above-forecast 51.5 in November from 50.4 in October, the fastest rate of growth in three months, the Caixin China General Business Activity index showed. The index remained above the 50.0 limit that indicates expansion for the 11th consecutive month.

Japanese economy contracts in Q3

Japan’s GDP shrank by a worse-than-expected 2.9% year-on-year in the third quarter, revised data from the Cabinet Office showed. The preliminary figure was -2.1%, while markets had anticipated a decline of 2.0%. Private consumption, which makes up half the economy, fell 0.2% in for the quarter, while household spending declined 2.5% in October compared to the year before, an eight consecutive decline.