Stocks fall after hawkish Fed minutes

Stock markets fell last week as the release of the Federal Reserve’s June policy meeting minutes raised concerns that interest rates would remain higher for longer.

In the US, the S&P 500 and the Nasdaq ended their holiday-shortened trading week down 1.3% and 1.1%, respectively. Weaker-than-expected US jobs growth also weighed on investor sentiment.

In Europe, the Stoxx 600 and the FTSE 100 lost 2.9% and 3.6%, respectively, on fears of tighter monetary policy and weak economic data. Interest rate woes also dampened sentiment in Japan, where the Nikkei 225 shed 4.0%.

China’s Shanghai Composite eased 1.5% and Hong Kong’s Hang Seng tumbled 4.9% after data showed manufacturing and services sector activity in China softened in May, adding to concerns about the country’s post-pandemic recovery.

Last week’s market update*

• FTSE 100: -3.59%

• S&P 5001: -1.27%

• Dow1: -1.99%

• Nasdaq1: -1.13%

• Dax: -2.97%

• Hang Seng: -4.87%

• Shanghai Composite: -1.46%

• Nikkei 225: -4.04%

• Stoxx 600: -2.89%

• MSCI EM ex Asia: -1.15%

*Data from close of business Friday 30 June to close of business

Friday 7 July

1Closed on Tuesday 4 July

Investors get ready for Q2 earnings

Indices in the US, UK and Europe all rose on Monday (10 July) as investors looked ahead to the start of second quarter earnings season in the US. Some of the largest financial institutions are due to publish their quarterly results later this week. Wednesday will also see the release of the all-important US consumer price index (CPI) report, which is expected to show a slowdown in inflationary pressures.

Stock markets in Asia were mixed on Monday, after data showed producer prices in China slumped by 5.4% yearon- year in June, the biggest drop since December 2015. Consumer inflation slowed to 0.0% year-on-year, the lowest reading since February 2021. The data will add to fears of deflation and weakening demand in the world’s second-largest economy.

Fed minutes signal further rate hikes

The minutes from the US Federal Reserve’s most recent monetary policy meeting, which were published last Wednesday, signalled the central bank’s intention to start raising interest rates again in the coming months. While the Fed opted to pause its streak of interest rate hikes in June, the minutes said that with inflation well above the 2% target and the labour market remaining tight, “maintaining a restrictive stance for monetary policy would be appropriate”. The minutes added: “Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate.”

The following day, Dallas Fed president Lorie Logan called on the central bank to immediately resume raising rates, saying she was very concerned about “whether inflation will return to target in a sustainable and timely way”. She added that two-thirds of Federal Open Market Committee participants had projected at least two more rate hikes this year. Markets have priced in a quarter point interest rate hike at the Fed’s next meeting on 26 July.

Payrolls rise by smallest amount since 2020

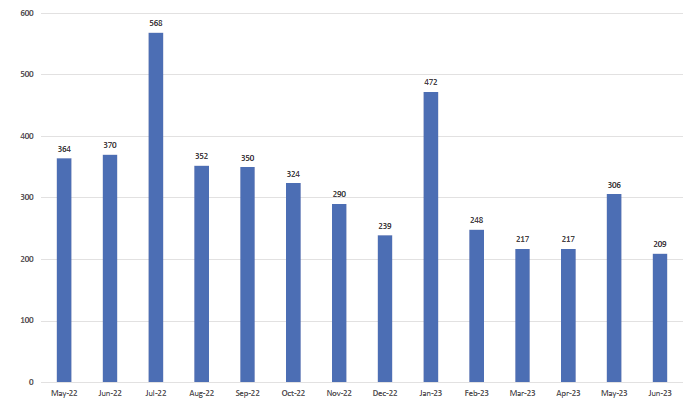

The US nonfarm payrolls report, released on Friday, did nothing to change expectations of further monetary tightening. The report showed the US added 209,000 jobs in June. This was the smallest increase since December 2020, but was still well above the estimated 100,000 jobs that need to be created to absorb new entrants into the workforce. Employment growth based on data from the household survey rebounded strongly from the previous month, and the unemployment rate ticked back down to 3.6%.

US nonfarm payrolls – monthly change (thousands)

Source: Refinitiv Datastream

UK house prices fall sharply

Here in the UK, data from Halifax showed UK house prices fell in June at the fastest annual rate since 2011. House prices fell by 2.6% year-on-year and were down 0.1% month-on-month, the third consecutive monthly decline. The typical UK property now costs £285,932 versus a peak of £293,992 last August. Kim Kinnaird, director at Halifax Mortgages, said the steep annual decline reflected the impact of historically high house prices last summer, which were supported by the temporary stamp duty cut.

“How deep or persistent the downturn in house prices will be remains hard to predict,” Kinnaird added. “Consumer price inflation is likely to come down in the near term as energy and food prices look set to reverse their steep rises, but core inflation is clearly proving stickier than originally expected. With markets now forecasting a peak in the Bank Rate of over 6%, the likelihood is that mortgage rates will remain higher for longer, and the squeeze on household finances will continue to put downward pressure on house prices over the coming year.”

German industrial production declines

A surprise fall in industrial production in Germany thwarted hopes of a swift economic recovery in Europe’s biggest economy. Output fell by 0.2% in May compared with the previous month, whereas analysts had expected output to stagnate. The data was released a day after figures showed manufacturing orders surged 6.4% in May, driven by an increase in orders for cars and other vehicles. This was much stronger than the 1.2% increase forecast by economists in a Reuters poll. Nevertheless, on a three-month basis orders were down by 6.1% compared

with the previous period, while monthly orders were 4.3% below the levels of May 2022.