Markets mixed after surprise US jobs data

Stock markets were mixed last week following the release of a forecast-busting US nonfarm payrolls report on Friday.

US indices started Friday’s trading session sharply lower, but staged a quick recovery as investors concluded that the jobs report was less worrying than initially thought. In particular, a slowdown in wage growth helped to calm fears about a rebound in inflation. The S&P 500 and the Nasdaq ended the week up 0.5% and 0.9%, respectively, whereas the Dow slipped 0.1%.

In Europe, a sharp fall in eurozone retail sales weighed on the Stoxx 600 and Germany’s Dax, which edged down 0.2% and 0.1%, respectively. The FTSE 100 fell 0.2% amid another decline in UK house prices.

In Asia, Japan’s Nikkei 225 slid 2.4% as US bond yields surged and domestic data showed real wages and consumer spending continued to fall in August. Financial markets in China were closed for the Mid-Autumn Festival and National Day holiday.

Last week’s market update*

• FTSE 100: -0.21%

• S&P 500: +0.47%

• Dow: -0.08%

• Nasdaq: +0.93%

• Dax: -0.11%

• Hang Seng1: -1.82%

• Shanghai Composite2: 0.00%

• Nikkei 225: -2.41%

• Stoxx 600: -0.15%

• MSCI EM ex Asia: -2.47%

*Data from close of business Friday 29 September to close of business

Friday 6 October

1Closed on Monday 2 October

2Closed from Friday 29 September to Friday 6 October

Israel-Hamas conflict shocks financial markets

UK and European stock markets fell on Monday (9 October) after Hamas terrorists launched a violent attack on Israel over the weekend. The Stoxx 600 and Germany’s Dax declined 0.3% and 0.7%, respectively. The FTSE 100 closed only marginally lower, as the assault led to a sharp rise in energy prices, limiting losses in the commodity-heavy index. US indices saw some gains as concerns about the conflict were offset by hopes of a pause in interest rate hikes. Two members of the Federal Reserve suggested that higher bond yields could act as a substitute for additional rate hikes.

The FTSE 100 was up 0.9% at the start of trading on Tuesday following the positive session on Wall Street. In economic news, figures from the British Retail Consortium (BRC) and KPMG showed retail sales rose by 2.7% yearon- year in September, down from 4.1% in August. Helen Dickinson, chief executive of the BRC, said the high cost of living was continuing to bear down on households.

US nonfarm payrolls smash forecasts

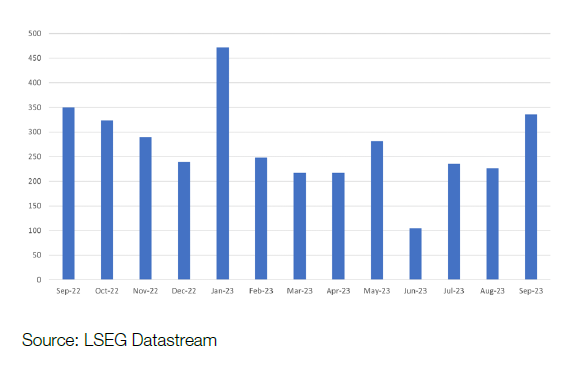

Last week’s economic headlines focused on the release of the highly anticipated US nonfarm payrolls report. Investors were hoping the report would show a decline in hiring, which would support the case for another pause in interest rate hikes. Instead, the number of job gains exceeded even the most bullish estimate. According to the Department of Labor, payrolls surged by 336,000 in September, resulting in the biggest positive surprise since January.

New US jobs per month

While the data initially exacerbated concerns about interest rates staying higher for longer, the report wasn’t quite as inflationary as feared. Average hourly earnings rose by only 0.2% month-on-month, taking the year-on-year rate down to 4.2%, the lowest since June 2021. Meanwhile, the workforce participation rate (the number of people working as a percentage of the total working-age population) remained steady at 62.8%.

Eurozone retail sales fall more than expected

In the eurozone, retail sales fell far more sharply than expected in August. According to Eurostat, retail sales volumes fell by 1.2% month-on-month and by 2.1% year-on-year. Economists in a Reuters poll had forecast declines of 0.3% and 1.2%, respectively. The monthly fall was driven by a sharp drop in mail orders and online shopping, as well as a drop in petrol sales.

The data added to an already bleak picture of the eurozone economy in the third quarter. Earlier in the week, S&P Global’s purchasing managers’ index for the eurozone came in at 47.2 for September, marking a fourth consecutive monthly contraction (a reading below 50.0 indicates a decline in business output).

Japan household spending drops 2.5%

Over in Japan, household spending fell by 2.5% yearon- year in real terms in August. This marked a sixthconsecutive month of declines, although it was better than the 4.3% drop expected by markets. Rising prices saw spending on food fall for the 11th month in a row, this time by 2.5% year-on-year.

Separate data showed real wages fell for the 17th month in a row in August, as rising prices continued to outpace salaries. Average earnings fell by 2.5% from a year earlier, according to the Ministry of Health, Labour and Welfare.

The data came a week after Japan’s prime minister Fumio Kishida said he would release a new economic stimulus package to help boost wages and ease the pain of rising prices.