Stocks fall on US credit rating downgrade

Most major stock markets fell last week after rating agency Fitch downgraded the US government’s credit rating.

This marked the second time in history that a leading credit agency has downgraded US debt. Fitch cut its rating from AAA to AA+, citing concerns about the state of the country’s finances and its debt burden. The announcement weighed on stocks, with the S&P 500, Dow and Nasdaq finishing the week down 2.4%, 1.4% and 3.0%, respectively.

The UK’s FTSE 100 lost 1.8% after the Bank of England (BoE) indicated that interest rates were likely to stay higher for longer. The pan-European Stoxx 600 and Germany’s Dax fell 2.6% and 3.0%, respectively, following disappointing European corporate earnings reports.

In China, the Shanghai Composite was flat as investors weighed measures that aim to boost consumption and support the real estate market against a 33.1% year-onyear slump in new home sales in July.

Last week’s market update*

• FTSE 100: -1.75%

• S&P 500: -2.42%

• Dow: -1.39%

• Nasdaq: -3.04%

• Dax: -3.01%

• Hang Seng: -2.69%

• Shanghai Composite: -0.09%

• Nikkei 225: -2.95%

• Stoxx 600: -2.56%

• MSCI EM ex Asia: -3.33%

* Data from close of business Friday 28 July to close of business

Investors await US inflation report

US indices rose on Monday (7 August) ahead of the release of US inflation numbers later in the week. The Dow rallied 1.2% and the S&P 500 gained 0.9%. Investors will be scrutinising the report for any clues as to the Federal Reserve’s next interest rate decision in September.

UK and European indices were mixed on Monday and then fell at the start of trading on Tuesday, after data showed exports from China fell by 14.5% year-on-year in July, the biggest drop since the start of the pandemic. Closer to home, the value of UK retail sales grew by just 1.5% year-on-year in July, much lower than the 12-month average of 3.9%, according to the British Retail Consortium and KPMG. The slowdown was partly due to easing inflation (the figures are not adjusted for inflation) as well as wet weather.

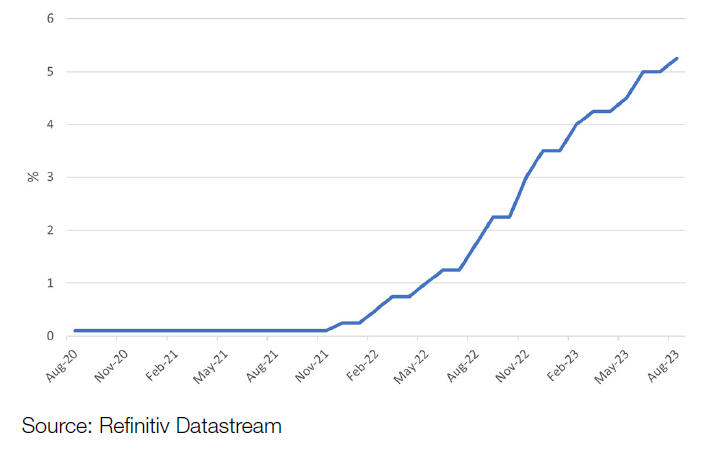

BoE raises base rate to 5.25%

Last week saw the Bank of England lift the UK’s base interest rate by a quarter of a percentage point to 5.25%, a new 15-year high. In its statement, the BoE said that some key indicators, notably wage growth, “suggest that some of the risks from more persistent inflationary pressures may have begun to crystallise”.

UK base interest rate

The BoE hinted that interest rates were likely to stay high for some time, saying it would “ensure the bank rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target”. The bank expects inflation to fall to 4.9% by the end of the year. Although the BoE does not forecast a recession in the coming years, gross domestic product (GDP) is expected to remain below pre-pandemic levels as a result of high interest rates.

UK house prices plummet

UK house prices fell in July at their fastest annual rate since 2009, according to Nationwide. House prices fell by 0.2% from the previous month and by 3.8% from a year ago, worse than the 3.5% annual decline seen in June. The price of a typical home is now 4.5% below the August 2022 peak.

Robert Gardner, Nationwide’s chief economist, said housing affordability remains stretched for those looking to buy a home with a mortgage. For example, a first-time buyer with a 20% deposit who earns the average wage would see monthly mortgage payments account for 43% of their take-home pay (assuming a 6% mortgage rate). This is up from 32% a year ago and well above the longrun average of 29%.

Separate data from the BoE showed the value of net mortgage lending fell in the second quarter compared to the first quarter, marking the first quarterly contraction since records began in 1987.

US labour market cools

Over in the US, Friday’s closely watched nonfarm payrolls report showed the labour market cooled slightly in July. The economy added 187,000 new jobs, slightly below expectations of 200,000. The figure for June was revised lower to 185,000 from 209,000, while May’s number was reduced by 25,000 to 281,000. The report from the Labor Department also showed the unemployment rate fell back down to 3.5% from 3.6% the previous month, showing continued tightness in the labour market. Average hourly earnings rose by 0.4% month-on-month, which is above what is considered consistent with the Federal Reserve hitting its inflation target.

Japan’s services sector softens

Japan’s services sector activity grew at a slower pace in July as new business growth eased and cost pressures remained high. The final au Jibun Bank purchasing managers’ index (PMI) showed the headline services index fell slightly to 53.8 in July from 54.0 in June. This was the slowest pace of growth since January. Average cost burdens faced by service providers accelerated for the first time since April amid reports of higher electricity, fuel, raw material and labour costs. Business confidence remained strong in July, but the degree of optimism slipped to a five-month low.

Meanwhile, the manufacturing PMI slipped further into contraction territory to 49.6 in July from 49.8 in June. Firms attributed the decline to weak customer demand for manufactured goods in both domestic and international markets. More positively, input price inflation eased to the softest level since February 2021, and business confidence was the second highest in 18 months.