Guy Foster, Chief Strategist, discusses end-of-month market performance and recent central bank policy announcements, while Janet Mui, Head of Market Analysis, looks at the latest US economic data.

We are one fifth of the way through the US Q4 earnings season and the headline statistics are in line with historical norms; 79% of companies posted earnings that exceeded expectations, and so would meet the criteria of an earnings surprise – except that the same thing happens each quarter. Similarly, sales surprises were a more modest, equally repetitive 52%.

Perhaps more importantly, stocks generally performed better on the back of these earnings announcements, which you might expect. In doing so, they overcame very modest expectations. In fact, on balance, profits of the companies that have reported so far shrank slightly in the fourth quarter. This was mainly due to the decline in commodity prices, with underwhelming performances from the financial, real estate and telecommunications industries. Consumer discretionary and utilities firms saw the strongest growth. The technology sector has seen modest positive growth so far, with all fourteen companies having beaten estimates, but this week will see the behemoths announcing. This will attest to the market’s strong positive momentum.

China in the spotlight

The best performing market last week was Hong Kong, and specifically the 60% of that market that comprise so-called ‘H shares’. These are Chinese companies that have listed their shares in Hong Kong to take advantage of the deeper international capital markets.

Chinese-related shares have been woeful performers in recent years. As we have discussed before, they have typically failed to keep pace with Chinese gross domestic product (GDP). There is no explicit reason why a country’s stocks should exactly reflect its GDP; the companies may earn profits from outside their home economy, they may take a share from the private sector, or the balance of revenues earned by shareholders as profits, relative to those paid to other stakeholders (employees, creditors, government, management) could change. However, for a colossal, relatively restrictive economy like China, you might expect the link to be close.

Chinese companies’ historic failure to keep pace with GDP is likely to reflect a lack of shareholder orientation amongst companies. It is also possible that the official measure of GDP is not accurate. After a long period of weakness, Chinese markets enjoyed a bounce last week, reflecting the hopes that stimulus would support the economy (and indirectly the market), or just the market more directly. China has been known to encourage various state-influenced entities to support the market in keeping with the government’s agenda.

Recovery in sight?

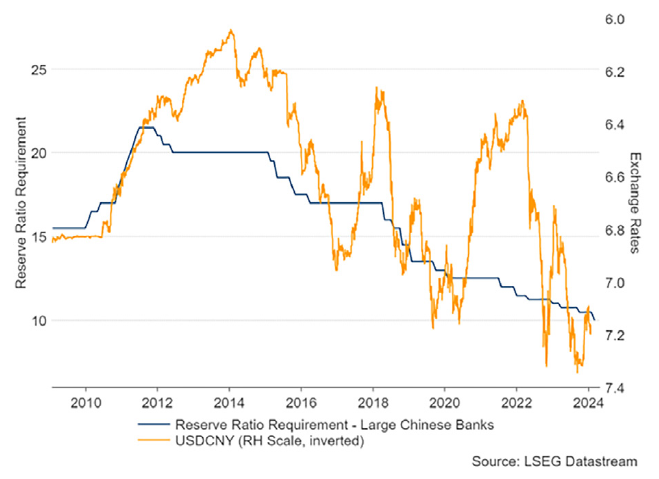

Last week saw a surprise stimulus announced in the form of a cut to the reserve ration requirement (RRR), which determines how much lending banks can provide against their deposit bases. This ratio has been gradually declining over the last decade, reflecting an easing of monetary policy, and, commensurate with that, the Chinese yuan has depreciated, bracketing occasional rallies when the RRR was held unchanged. The expectation is that China will need to employ RRR cuts and interest rate cuts over the course of this year.

The use of RRR is one of the distinctions between Western and Chinese policymaking. Chinese policymakers have also started surprising the market by revealing measures, and even economic statistics, ahead of official announcements.

Perhaps the most marked difference in approaches taken towards the stock market is the Chinese state’s use of it as a vehicle of policy. At the moment, speculation is building that it would like it to rise again. With that in mind, the formation of a state-backed stabilisation fund has been being discussed. The package has been estimated at two trillion yuan ($278bn), which should be enough to provide short-term support, but it seems unlikely to prompt a long-term change in market performance, which ought to reflect a stable economic and regulatory background. After a huge amount of policy and

regulatory flip-flopping in recent years, creating that level of business confidence seems challenging. An example of this was the removal of draft video game rules from the regulator’s website last week. These draft rules were announced in December and caused havoc amongst some large, exposed stocks (such as Tencent). Since then, a key official associated with the rules has been removed, and now the rules themselves have been removed from the website, although so far without explanation.

So, after a decent bounce in Chinese shares, which had been heavily sold previously, the outlook remains clouded. There seems to be limited scope for stimulus to drive a lasting improvement in company prospects without some sense of predictability and stability in the regulatory environment.

Central banks

The relative laggard last week was the Japanese stock market. Earlier in the week, at an uneventful Bank of Japan policy meeting, governor Kazuo Ueda reiterated his confidence in Japan meeting its inflation target. However, he also stressed the need to keep policy accommodating until that target has been reached. Japanese inflation has actually been above target since April 2022, and was expected to spend two and half years above target before dipping below later in 2024. However, in data released on Friday, it seemed price growth may be slowing significantly faster than expected. Stocks fell on the news.

Following Japan’s uneventful policy meeting was the European Central Bank (ECB)’s on Thursday. The bank maintains it is data dependent. This well-worn phrase means that its forecasts are sufficiently vague for it to expect to respond to new economic data, even though monetary policy is assumed to act with long and variable lags. This means that data dependency raises the prospect of inflationary over or under-shoots.

The ECB is widely expected to begin cutting interest rates in April because inflation has been declining fast, inflation expectations have declined significantly, and the region will flirt with recession over the coming quarters. However, the ECB’s data dependency may encourage it to think about the recent positive inflationary surprises, the elevated level of wage growth, the tight labour market, indicators of rising prices from purchasing managers indices, and an expected increase in loan growth. So, the market’s confidence in forthcoming rate cuts seems a little too over-zealous.

The week ahead

This week will continue the trend of central bank policy meetings. It will also continue the trend of inaction, with the Federal Reserve and the Bank of England both expected to leave policy unchanged. Important for central bankers everywhere will be the early estimates of January’s inflation from Germany, France, and Italy on Wednesday. At the start of November, these set a disinflationary tone, which seemed to bolster the market rally by triggering a retrenchment for bonds at the beginning of this year.

It will also be a big week for company earnings reports with Apple, Microsoft, Amazon, and Meta all due to report.