Stocks slide as US economy contracts in Q1

Global stock markets tumbled last week as economic data from both sides of the Atlantic fell short of expectations.

Wall Street indices suffered their fourth consecutive week of declines after data showed US gross domestic product (GDP) contracted in the first quarter. Disappointing earnings results from Amazon also weighed on investor sentiment. The S&P 500 fell to its lowest close year-to-date and finished the week down 3.3%. The Nasdaq slumped 3.9%, moving further into bear market territory.

Slowing economic growth in Europe weighed on the pan-European STOXX 600, which declined 0.6%. Germany’s Dax lost 0.3% whereas the UK’s FTSE 100 added 0.3%, boosted by a raft of strong corporate earnings reports.

Over in Asia, the Shanghai Composite slid 1.3% amid ongoing concerns about the cost of China’s zero-Covid policy.

Last week’s market performance *

• FTSE 100: +0.30%

• S&P 500: -3.27%

• Dow: -2.47%

• Nasdaq: -3.93%

• Dax: -0.31%

• Hang Seng: +2.18%

• Shanghai Composite: -1.29%

• Nikkei: -0.95%

*Data from close on Friday 22 April to close of business on Friday 29 April.

Investors await key interest rate decisions

Trading was suspended in several European markets on Monday (2 May) after indices recorded sudden steep declines. Sweden’s OMX 30 fell by nearly 8.0% but managed to recoup losses to end the day 1.9% lower. The STOXX 600 sank 3.0% before closing down 1.5%. According to the Guardian, the ‘flash crash’ was caused by a Citigroup trader making an error when inputting a transaction, which was subsequently corrected.

The FTSE 100 returned from the May bank holiday weekend to close up 0.2% on Tuesday. The S&P Global/CIPS UK manufacturing purchasing managers’ index rose to 55.8 in April from 55.2 in March, above the consensus estimate of 55.3. However, confidence among manufacturers fell to a 16-month low because of rising selling prices, longer delivery times and higher shopping costs after Brexit.

UK and European indices started Wednesday’s trading session in the red, as investors prepared themselves for the Federal Reserve’s monetary policy meeting later in the day. The Fed is expected to announce a 50-basis-point increase in interest rates.

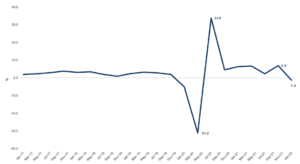

US GDP unexpectedly shrinks by 1.4%

Disappointing US GDP figures from the Commerce Department came as a big surprise to investors last week. GDP dropped by an annualised 1.4% in the first three months of the year, according to the advance estimates. This marked the first contraction since mid-2020 and was a significant drop from the 6.9% rise recorded in the fourth quarter of 2021. Economists were expecting an expansion of around 1.0%.

US real GDP – quarterly % change

Source: Federal Reserve of St Louis

The decline was mostly driven by a wider trade deficit, which hit a record high in March as import volumes surged and exports fell, as well as a slowdown in inventory investment. These offset strong growth in consumer spending, which accounts for more than two-thirds of US economic activity. Consumer spending rose by 2.7%, up from 2.5% the previous quarter, despite the hit from Omicron. US President Joe Biden blamed the contraction on “technical factors” and said the American economy “continues to be resilient in the face of historic challenges”.

The report showed price pressures are continuing, with the core personal consumption expenditures index, which strips out volatile components like food and energy, rising by 5.2% compared with 5.0% in the previous quarter. The employment cost index rose by 1.4%, reflecting the tight labour market.

Eurozone economic growth slows

Last week also saw lower-than-expected economic growth figures for the eurozone. GDP expanded by 0.2% sequentially in the first quarter, lower than the 0.3% forecast by the European Commission just before the Ukraine war started. Germany’s GDP grew by 0.2%, France’s stagnated, and Italy’s declined by 0.2%.

Meanwhile, inflation in the eurozone hit a record high for the sixth consecutive month, reaching 7.5% year-on-year in April, up from 7.4% in March. This was largely driven by a 38.0% annual increase in energy prices, although this was a slight slowdown from the 44.4% increase seen in March.

In Germany, inflation rose to 7.4% year-on-year in April, the highest in four decades. The last time prices rose at a faster pace was in autumn 1981 in West Germany, when the Iran-Iraq War caused oil prices to increase sharply.

Japan unveils measures to mitigate inflation

In Japan, the government announced a new package of measures that aim to help cushion the impact of surging prices and support the country’s recovery from the pandemic. According to Japan Today, the package includes cash handouts of 50,000 yen per child for low-income households, more subsidies for oil wholesalers to bring down retail gasoline prices, and support for struggling small and medium-sized companies, as well as livestock farmers.

The measures came as the Bank of Japan forecast inflation would rise by a median 1.9% in the 2022 fiscal year, up from the 1.1% increase it predicted in January. The Bank also revised down its forecasts for GDP growth in the 2022 fiscal year from 3.8% year-on-year to 2.9% because of the resurgence of coronavirus, rising commodity prices and a slowdown in overseas economies. Next year, GDP is forecast to expand by 1.9%, up from the previous forecast of 1.1%.[zuperla_single_image image=”22816″]