Stocks rise on hopes of US ‘soft landing’

Most major stock markets rose last week as encouraging economic data raised hopes of a ‘soft landing’ for the US economy.

In the US, the Dow enjoyed its 13th consecutive daily gain on Wednesday – its longest winning streak since 1987 – before falling into negative territory on Thursday. For the week as a whole, the Dow gained 0.1%, while the S&P 500 and the Nasdaq added 0.6% and 1.8%, respectively. Investor sentiment was boosted by signs of easing inflation and forecast-beating gross domestic product (GDP) growth.

In Europe, the Stoxx 600 rose 1.1% and Germany’s Dax hit a fresh all-time high after the European Central Bank raised the possibility of a pause in interest rate hikes. The FTSE 100 edged up 0.2% in a week that saw a slew of corporate earnings reports.

In Asia, the Nikkei 225 advanced 0.2%, with gains held back by the Bank of Japan’s unexpected decision to loosen its yield curve control policy. The Shanghai Composite and Hang Seng surged 3.5% and 6.7%, respectively, after Beijing pledged more support for China’s economy.

Last week’s market update*

• FTSE 100: +0.20%

• S&P 500: +0.61%

• Dow: +0.14%

• Nasdaq: +1.83%

• Dax: +1.72%

• Hang Seng: +6.69%

• Shanghai Composite: +3.53%

• Nikkei 225: +0.18%

• Stoxx 600: +1.09%

• MSCI EM ex Asia: +1.38%

*Data from close of business Friday 21 July to close of business

Friday 28 July

Wall Street records fifth consecutive month of gains

Wall Street’s main indices rose on Monday (31 July) to cap off a fifth consecutive month of gains. Earnings have been a key focus for investors. We are now halfway through second quarter earnings season, and 80% of companies have outperformed analysts’ forecasts. This week will see tech giants Apple and Amazon release their results.

The FTSE 100 edged up 0.1% on Monday as investors weighed a contraction in manufacturing activity in China against measures that aim to bolster domestic consumption. The pan-European Stoxx 600 also added 0.1% on news that eurozone GDP expanded by 0.3% quarter-on-quarter in the three months to June, beating expectations for 0.2% growth. The preliminary data also showed eurozone inflation eased to 5.3% in July, down from 5.5% in June and the lowest level since January 2022. However, core inflation – which excludes food and energy prices – remained unchanged at 5.5%.

Fed and ECB hikes rates by 0.25 percentage points

Last week saw both the Federal Reserve and the European Central Bank (ECB) vote to increase interest rates by 0.25 percentage points.

The US central bank increased the federal funds rate to between 5.25% and 5.5%, the highest in more than 20 years. Fed chair Jerome Powell acknowledged in a press conference that inflation had eased in June, but pointed out that it was “just one report, one month of data”. He said there was still a “long way to go” to lower inflation to the 2% target and that the labour market continues to be strong. However, the press conference did contain some ‘dovish’ statements. Powell said that monetary policy is now restrictive and that if the US sees inflation reducing sustainably, it won’t need to be restrictive anymore.

In the eurozone, the ECB’s rate hike took its deposit rate to 3.75%. The ECB said that while inflation continues to decline, it is still expected to remain too high for too long. However, its guidance appeared to switch from implying that further interest rates lie ahead to a stance of data dependency. When asked about the next policy decision in September, Christine Lagarde, president of the ECB, said interest rates would not be cut but there could be “a hike or a pause”. She added: “Do we have more ground to cover? At this point in time I wouldn’t say so.”

US economic data largely positive

Investor sentiment was also boosted by a batch of better-than-expected US economic data. The core personal consumption expenditures price index – the Fed’s preferred inflation gauge – rose by 0.2% in June, down from 0.3% in May. This brought the year-on-year rate to 4.1%, the lowest since September 2021.

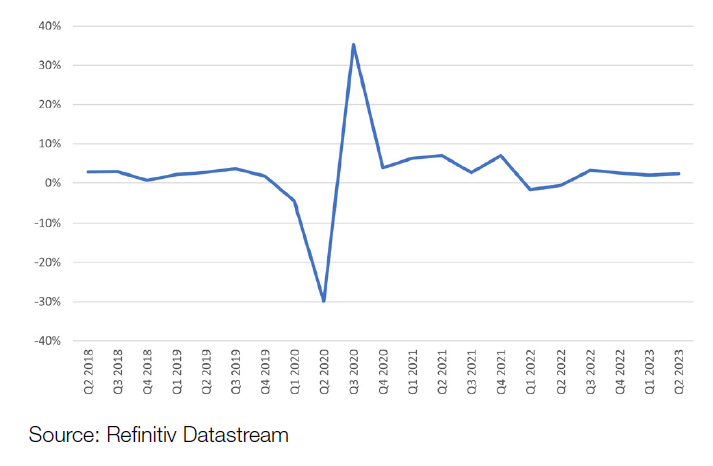

Meanwhile, US GDP grew by 2.4% year-on-year in the second quarter, well above expectations of around 1.8%, according to preliminary figures from the Commerce Department. This suggests the economy has been resilient despite rate hikes. A slowdown in consumer spending growth was more than offset by strong business investment in inventories and fixed assets.

US GDP – annual growth rate

The data has raised hopes that the US will achieve a ‘soft landing’ – where it brings inflation under control without sparking a recession.

BoJ loosens yield curve control policy

The Bank of Japan (BoJ) surprised markets last week by loosening its yield curve control policy. The BoJ said it would continue to allow ten-year Japanese government bond yields to fluctuate in the range of -0.50% to +0.50% from its 0% target level. However, the bank also said it would only rigidly enforce yield curve control if yields were to reach 1%. In effect, this expands its tolerance by a further 0.5 percentage points. BoJ governor Kazuo Ueda said at a press conference that the move was not intended as a step toward policy normalisation; rather, it was “a step aimed at enhancing the sustainability of yield curve control”, according to a translation provided by Reuters. The announcement triggered a sell-off in tenyear Japanese government bonds, pushing yields to their highest level since September 2014.