US stocks snap seven-week losing streak

Signs that inflationary pressures could be peaking helped to boost most major stock markets last week.

Wall Street indices snapped their seven-week losing streak, with the Dow, S&P 500 and Nasdaq surging 6.2%, 6.6% and 6.8%, respectively. Economic data was mixed as the latest US purchasing managers’ indices (PMIs) showed signs of slowing growth whereas consumer spending remained solid.

UK and European indices also recorded solid gains last week. The FTSE 100 added 2.7% despite business activity falling to a 15-month low in May. The STOXX 600 and Germany’s Dax rose 3.0% and 3.4%, respectively, as the European Central Bank (ECB) gave clarity over the likely path of interest rate hikes.

In Asia, Japan’s Nikkei 225 edged up 0.2% as weak manufacturing data held back gains. China’s Shanghai Composite lost 0.5% amid growing concerns about the impact of lockdown restrictions on economic growth.

Last week’s market performance *

• FTSE 100: +2.65%

• S&P 500: +6.58%

• Dow: +6.24%

• Nasdaq: +6.84%

• Dax: +3.44%

• Hang Seng: -0.10%

• Shanghai Composite: -0.52%

• Nikkei: +0.16%

*Data from close on Friday 20 May to close of business on Friday 27 May.

China starts lifting Covid restrictions

Stocks rose on Monday (30 May) as authorities in Shanghai announced that some Covid-19 restrictions imposed on businesses would be lifted from Wednesday. The city has been under a strict lockdown for nearly two months. The Shanghai Composite rose 0.6%, Hong Kong’s Hang Seng gained 2.1% and the Nikkei 225 added 2.2%. The positive sentiment continued in Europe, where the Dax rose 0.8% and the FTSE 100 gained 0.2%. US indices were closed on Monday for Memorial Day. The FTSE 100 was up 0.4% at the start of trading on Tuesday ahead of data on net lending, consumer credit and mortgage approvals.

UK business activity falls to 15-month low

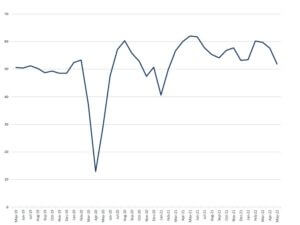

Growth in the UK’s private sector in May slumped to its lowest level since the winter 2021 lockdown as the cost-of-living crisis hit customer demand. The S&P Global / CIPS flash UK composite output index fell to 51.8 in May from 58.2 in April, marking the fourth-largest month-on-month decline on record. The index remained above the 50.0 mark that separates growth from contraction.

S&P Global / CIPS flash UK composite output index

Source: Refinitiv Datastream

The services sub-index fell to a 15-month low of 51.8, with survey respondents noting that economic and geopolitical uncertainty had contributed to a slowdown in client demand. The manufacturing output sub-index also slipped to 51.8 from 54.3. Producers said supply chain disruptions, the war in Ukraine and rising inflation were all acting as growth headwinds.

Business expectations eased to the lowest for two years amid worries about the global economic outlook and downbeat projections for consumer spending. The drop in business optimism was most acute in the service sector, with the month-on-month loss of momentum the greatest since March 2020.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said: “There are some signs that the rate of inflation could soon peak, with companies reporting price resistance from customers, and it is likely that the slowing in demand will help pull prices down in coming months. However, the latest data indicate a heightened risk of the economy falling into recession as the Bank of England fights to control inflation.”

US economic growth slows

The latest PMIs for the US also showed signs of slowing economic growth. The services sector PMI fell to 53.5 in May, below economists’ projections for a reading of 55.2 and down from 55.6 in April. Meanwhile, new order growth was the slowest since August 2020 as selling prices rose and the boost from the reopening of the economy faded. Input prices increased at the quickest rate since October 2009, driven by supplier-driven price hikes, higher interest rates and wage rises.

“Despite all of the headwinds facing businesses, the survey data remain indicative of the economy growing at an annualised rate of 2%, which is also supporting stronger payroll growth,” said Williamson. “However, cost pressures have risen to a new survey high which, alongside the encouraging output and employment numbers, will fuel further speculation about the need for further imminent aggressive rate hikes.”

Consumer spending remains solid

Elsewhere, the US core personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose at an annual rate of 4.9% in April, in line with estimates and a deceleration from the 5.2% increase seen in March. Including food and energy, the headline PCE rose by 6.3%, down from 6.6% in March. On a monthly basis, the headline PCE fell to 0.2% in April from 0.9% in March.

Consumer spending remained solid, rising by a better-than-expected 0.9% in April, albeit lower than the 1.4% increase seen in March. Goods spending rose by 0.8% and services spending increased by 0.9%. Strong wage gains fuelled some of the increase in spending, but consumers also tapped into the savings they had built up during the pandemic.

ECB signals July and September rate hikes

European Central Bank (ECB) president Christine Lagarde said last week that interest rates would likely rise in July and September, resulting in the eurozone exiting negative interest rates by the end of the third quarter. She also said net purchases under the ECB’s bond buying programme would finish very early in the third quarter, thereby confirming the end of the ECB’s quantitative easing programme.

“If we see inflation stabilising at 2% over the medium term, a progressive further normalisation of interest rates towards the neutral rate will be appropriate. But the pace and overall scale of the adjustment cannot be determined ex ante,” Lagarde wrote in a blog.

Interest rates are currently at -0.5%, which means moving into positive territory by the end of the third quarter would require two 25 basis point hikes between now and then.[zuperla_single_image image=”22816″]