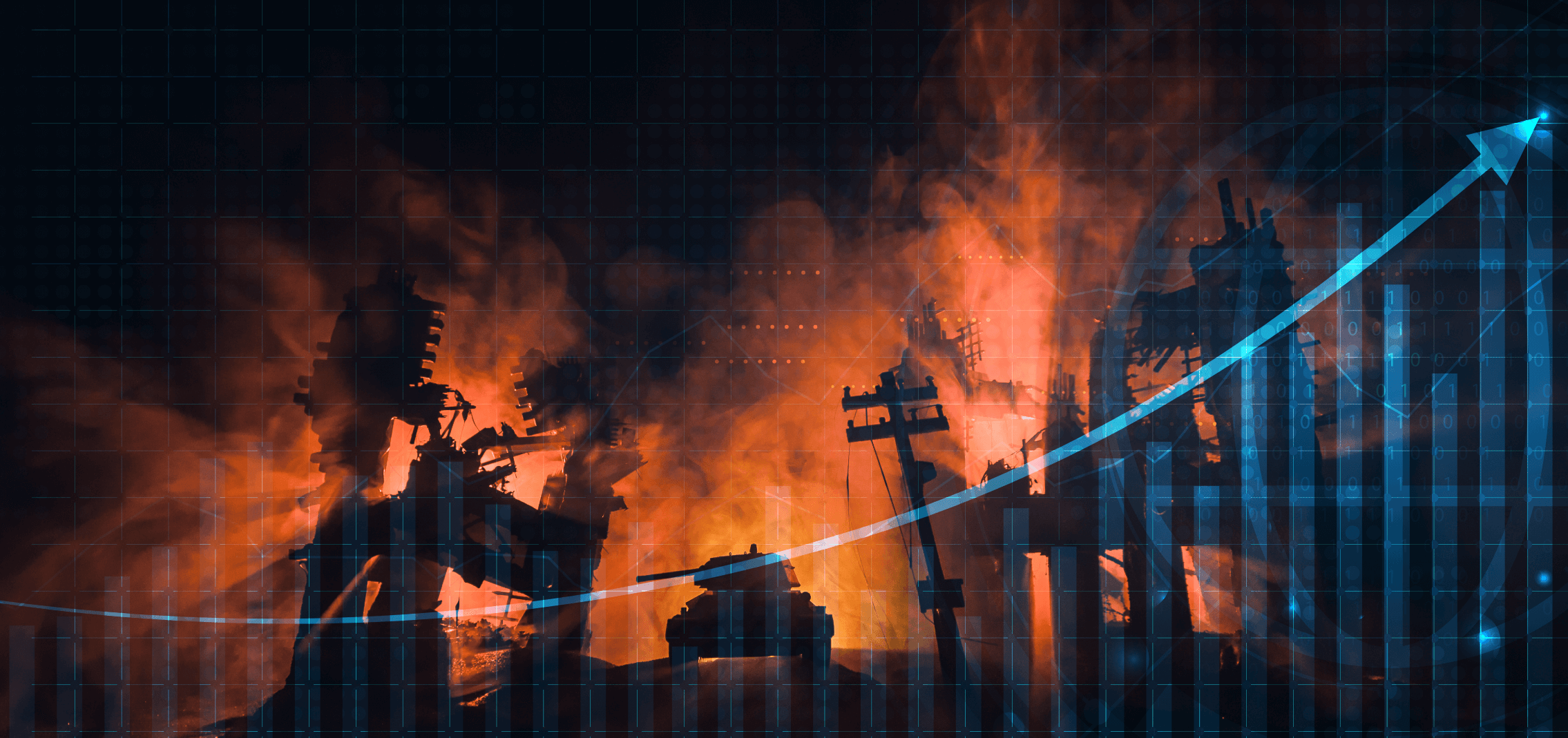

Stock markets. Two words that most people think rule the world. Well, when it comes to looking for assets that can give great returns, then the stock markets are where you should head. We are going to give you a couple of picks with companies that you would have heard of and one that you will more than likely not have heard about. Yep, only three stocks. We are not going to give away all our secrets now, are we?

Blue chip hot picks.

Apple: Not the fruit but the company! Apple is one of those companies that everyone has heard of, and most will own one of their products. “But why would I invest in a company that is almost at a market value of $3,02 trillion USD?” Apple’s share price in 2023 alone has increased by 47% and this is without factoring in the generous dividend that they also pay out!!

Microsoft: Now anyone who runs a P.C. desktop or laptop will be running a variation of Windows which even now still enjoys a 70% market share for operating systems. The great thing with pretty much all big tech companies out there is their ability to evolve. Did you know that Cloud computing / storage equates for over $110 BILLION USD in Microsoft’s annual revenue?

One that you will search the Internet yourself to see if we are being true with my figures!

Palantir Technologies. This company specialises in data analytics. Collection of data is nothing new but in this digital age data can provide companies with the ability to target ads, track movements and even via artificial intelligence, predict what we want before we even know it! Rightly or wrongly, data is the largest commodity we have that everyone wants on us. Since Palantir’s Initial Public Offering (floating on the stock market) three years ago, then this stock price is up almost 70%, but due market conditions during 2022, then so far this year we have seen a 145% increase in stock value.

So how can I invest in these stocks?

You must have the investment vehicle or platform to be able to access these and other stocks. One must also bear in mind that it is imperative that any stocks in a portfolio are closely monitored so that you can sell and buy in a straightforward manner very easily as stock prices are driven by information and investor sentiment. Also, due to the highly volatile nature of stock prices, direct stock equity must also fall with your individual risk tolerance profiling.

Austen Morris Associates specialises in helping individuals reach their personal financial wealth targets, and there is no one investment that fits everyone. If you would like an introduction to Austen Morris Associates and how we can help with a stock portfolio, then please do contact us, at https://austenmorris.com/contact-us/

FROM THE DESK OF: KIRK MCARDLE, AUSTEN MORRIS ASSOCIATES ASSOCIATE PARTNER