Mixed inflation data weigh on stock markets

Stock markets gave a lacklustre performance last week following the release of mixed US inflation data.

In the US, the S&P 500 ended the week down 1.2%, while the Nasdaq slumped 2.5%. Although the consumer price index (CPI) report was largely encouraging, the annual rate of inflation rose for the first time in more than a year. Separate data showed producer prices also rose by more than expected in July.

Concerns about an economic slowdown in China weighed on indices in Europe and Asia. The Stoxx 600 and Germany’s Dax eased 0.1% and 0.7%, respectively, while China’s Shanghai Composite lost 2.4%. The FTSE 100 declined 0.4% despite UK gross domestic product (GDP) expanding in the second quarter.

Japan’s Nikkei 225 was the strongest performer among the major indices. The index finished its holiday-shortened trading week up 0.7% after China said it would allow tour groups to return to Japan.

Last week’s market update*

• FTSE 100: -0.40%

• S&P 500: -1.20%

• Dow: -0.54%

• Nasdaq: -2.50%

• Dax: -0.74%

• Hang Seng: -2.37%

• Shanghai Composite: -2.43%

• Nikkei 2251: +0.68%

• Stoxx 600: -0.11%

• MSCI EM ex Asia: -0.47%

* Data from close of business Friday 4 August to close of business

Friday 11 August

1 Closed on Friday 11 August

Concerns grow over China’s property sector

Markets were mixed on Monday (14 August) amid growing concerns about China’s troubled property sector. US indices managed modest gains, whereas Hong Kong’s Hang Seng lost more than two percentage points and the FTSE 100 slipped 0.2%.

Last week, Country Garden, one of China’s largest property developers, announced it had missed interest payments on two dollar-denominated bonds. The company also warned it could see a loss of up to RMB55bn (£6bn) for the first six months of the year. Yesterday, the developer suspended trading in at least ten of its mainland bonds, triggering a sell-off in property-linked stocks.

China’s property sector, which accounts for between a quarter and a third of the economy, has been in a downturn for several years. Dozens of property developers have defaulted since the failure of Evergrande in 2021.

Investors mull conflicting inflation data

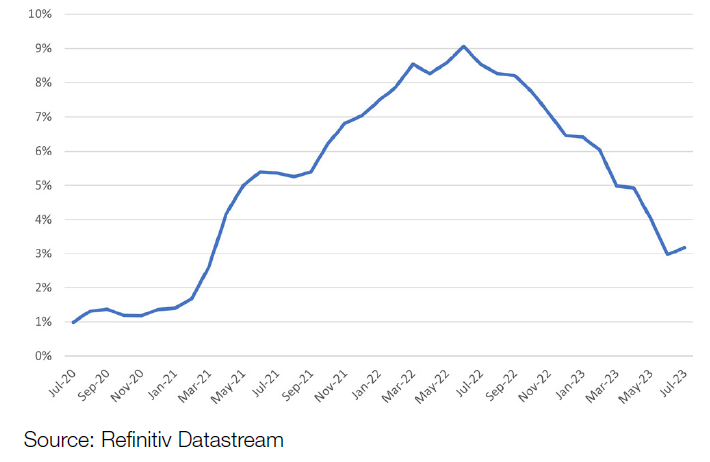

Last week saw the release of the closely watched US CPI report, which showed consumer prices rose by 3.2% year-on-year in July, according to the Bureau of Labor Statistics. This was slightly below forecasts of 3.3%, but was higher than June’s 3.0% rise. It marked the first increase in the annual rate of inflation for more than a year.

US headline CPI – YoY % change

On a monthly basis, consumer prices rose by 0.2%, in line with expectations. Core CPI, which excludes volatile food and energy prices, also rose by 0.2% from the previous month, bringing the year-on-year rate to 4.7%, the lowest since October 2021.

Markets reacted positively to the report, at least initially. However, investor sentiment dipped the following day after data showed US producer prices increased by more than expected in July. The producer price index (PPI) rose by 0.3% from the previous month. On an annual basis, the PPI was up 0.8% following a 0.2% rise in June. This was led by a 0.5% surge in the cost of wholesale services, the largest increase since August 2022.

UK economy grows by 0.2%

Here in the UK, figures from the Office for National Statistics showed GDP expanded by 0.2% in the second quarter, beating economists’ forecasts for zero growth. GDP grew by 0.5% in June alone; this followed a dip the previous month when an extra bank holiday was held for the King’s coronation.

The second quarter saw increases in all the main sectors, with services output rising by 0.1%, production by 0.7% and construction by 0.3%. There were particularly strong rises in manufacturing, as well as consumer and government spending.

However, the positive figures were somewhat marred by forecasts from the National Institute of Economic and Social Research. The institute said it doesn’t expect the UK economy to pass its pre-pandemic level until the third quarter of 2024, resulting in “five years of lost economic growth”. The institute has predicted a 60% chance of a recession at the end of next year.

China slips into deflation

Over in China, consumer prices fell for the first time in more than two years in July, adding to concerns about the country’s post-pandemic recovery. The CPI fell by 0.3% from a year earlier, according to the National Bureau of Statistics. The producer price index also fell by a worsethan- expected 4.4% from a year ago, albeit at a slower rate than June’s 5.4% decline.

The inflation figures added to a slew of disappointing economic data from the world’s second-largest economy. Exports slumped by 14.5% in July, the weakest reading since the start of the pandemic. Imports also fell by a worse-than-expected 12.4%, almost double the drop seen in the previous month.

On Thursday, US president Joe Biden said China’s growing economic issues made it a “ticking time bomb”.