Stocks mixed as US retail sales plummet

Stock markets were mixed last week as investors weighed signs of easing inflation against a slowdown in the US economy.

The S&P 500 and the Dow lost 0.7% and 2.7%, respectively, after US retail sales recorded a much steeper decline than expected. Concerns about a US recession also dented the mood in London, where the FTSE 100 declined by 0.9%.

Shares in Europe fell after the European Central Bank (ECB) said it would continue to raise interest rates for as long as it takes to bring inflation down to its 2% target.

In contrast, stock markets in Asia rose on hopes that China’s reopening would boost the global economy. Japan’s Nikkei added 1.7% and China’s Shanghai Composite rallied 2.2%.

Last week’s market performance*

• FTSE 100: -0.94%

• S&P 5001: -0.66%

• Dow1: -2.70%

• Nasdaq1: +0.55%

• Dax: -0.35%

• Hang Seng: +1.41%

• Shanghai Composite: +2.18%

• Nikkei: +1.66%

* Data from close of business on Friday 13 January to close of business on Friday 20 January

1Closed on Monday 16 January.

Investors prepare for a busy week of earnings

Stocks rose on Monday (23 January) as investors looked ahead to a busy week of US corporate earnings reports from the likes of Microsoft, IBM, Tesla, Visa and Mastercard. The S&P 500 added 1.2% and the Nasdaq rose 2.0%, despite The Conference Board’s gauge of future US economic activity falling for a tenth consecutive month in December. The strong performance on Wall Street followed the FTSE 100 finishing in the green on Monday, even though EY forecast a drop in UK gross domestic product of 0.7% in 2023, worse than the 0.3% contraction it predicted in October.

US retail sales fall 1.1% in December

The release of the latest US retail sales data last week provided further evidence of a slowing economy following the Federal Reserve’s aggressive interest rate hikes. Retail sales in December fell by 1.1% month-on-month, the biggest decline in a year and much worse than the 0.8% drop forecast by economists. Retail sales for November were revised down from a preliminary reading of -0.6% to -1.0%.

US retail sales are not adjusted for inflation, so some of the decline was likely due to the prices of goods falling during the month. Holiday shopping also occurred earlier in October as consumers took advantage of the discounts offered by retailers.

Nevertheless, the figures could encourage the Federal Reserve to further scale back the pace of its interest rate increases next month. Especially since US producer prices fell by 0.5% in December, the biggest drop since early in the pandemic and further evidence that inflation is receding.

UK inflation ‘likely to fall rapidly’

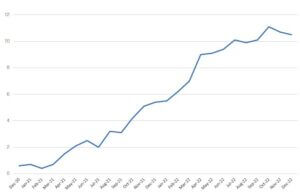

Here in the UK, Bank of England governor Andrew Bailey told Media Wales that inflation is likely to fall rapidly from late spring onwards as energy prices decline. His comments came after the consumer price index (CPI) report showed prices rose by 10.5% year-on-year in December, down from 10.7% in November and 11.1% in October. Bailey said this was “the beginning of a sign that a corner has been turned”.

UK CPI (annual % change)

Source: Refinitiv Datastream

Bailey also said that a recession was still on the cards: “People always talk about the rapid recovery from the worst of Covid. The economy went off a cliff and it came back up some of the cliff, but since then it has been a pretty grinding process. That goes along with the fact that we have had a very big real income shock to the country, which obviously affects the situation. And working our way through that shock, and the inflationary impacts of that shock, is important. That is why I am afraid, and I know we have been marked down as a pessimist by saying, as we did in November, we think there will be a recession.”

ECB warns of further rate hikes

Last week also saw widely reported comments from ECB president Christine Lagarde, who warned of further big interest rate increases. Lagarde said the ECB would “stay the course” until inflation returns to its 2% target. She added that financial markets should “revise their position” that the ECB would soon slow down its rate rises.

The ECB began raising interest rates later than the Federal Reserve and the Bank of England, and rates started from a much lower level. And although headline inflation has eased in the eurozone, core inflation (excluding food and energy) rose to 5.2% year-on-year in December, up from 5.0% the previous month.

BoJ leaves yield curve policy unchanged

Despite pressure to phase out its monetary stimulus and start raising interest rates, the Bank of Japan (BoJ) announced last week that it was leaving its yield curve control policy unchanged. In December, the BoJ said it would allow the yield on ten-year Japanese government bonds to move half a percent either side of its 0% target, wider than the previous 25 basis points band. Since then, yields have exceeded the upper ceiling several times and there has been widespread speculation that the BoJ would widen the range further or even scrap the cap. Instead, it made no further changes to the policy and kept overnight interest rates at -0.1%.

The announcement came two days before figures showed inflation in Japan jumped to a fresh 41-year high of 4.0% in December. This will likely put further pressure on the BoJ to abandon its yield curve control policy and increase interest rates.[zuperla_single_image image=”23486″]