Stocks mixed as UK chancellor hikes taxes

Stock markets gave a mixed performance last week as investors digested a slew of tax hikes in the UK and signs of an economic slowdown in the US.

The FTSE 100 ended the week up 0.9% after data showed UK retail sales bounced back in October. Germany’s Dax gained 1.5% as a survey showed investors became less pessimistic for a second month in row in November.

In contrast, US stocks fell last week following mixed economic data. Whereas US retail sales were above forecasts, a gauge of manufacturing fell to its lowest level since May 2020. The S&P 500 lost 0.7% and the Nasdaq declined 1.6%.

In Asia, Japan’s Nikkei 225 slid 1.3% as core consumer price inflation rose to a 40-year high and gross domestic product (GDP) unexpectedly contracted in the third quarter. China’s Shanghai Composite added 0.3% after a meeting between Chinese president Xi Jinping and US president Joe Biden helped to boost sentiment despite a rise in Covid-19 cases.

Last week’s market performance*

• FTSE 100: +0.92%

• S&P 500: -0.69%

• Dow: -0.01%

• Nasdaq: -1.57%

• Dax: +1.46%

• Hang Seng: +3.85%

• Shanghai Composite: +0.32%

• Nikkei: -1.29%

* Data from close on Friday 11 November to close of business on Friday 18 November.

China reports first Covid deaths since April

Stocks started this week in the red on concerns China could implement further lockdowns after reporting its first Covid-related deaths since April. In Beijing, where cases have hit a fresh record high, business and schools in the most affected districts have been shut and there are tighter rules for entering the city. The FTSE 100 slipped 0.1% on Monday (21 November) while the S&P 500, Shanghai Composite and Dax all lost 0.4%. Oil prices also declined as analysts warned lockdowns could dampen demand.

The FTSE 100 was up 0.7% at the start of trading on Tuesday after Saudi Arabia denied reports that OPEC was considering an increase in oil production.

Hunt confirms tax increases

Last Thursday saw UK chancellor Jeremy Hunt deliver his autumn statement, in which he confirmed a range of tax increases and spending cuts to help narrow the gap between the government’s income and outgoings and demonstrate fiscal responsibility to the markets.

The raft of tax hikes included slashing the capital gains tax exemption, dividend allowance and additional-rate income tax threshold, and extending the freeze on the personal allowance, higher-rate income tax threshold and inheritance tax nil-rate band. Hunt also announced that public spending would rise by just 1% a year in real terms in the next parliament. The energy price cap will increase from April 2023, meaning the average household will see their bills rise from £2,500 to £3,000 a year.

The autumn statement was accompanied by the Office for Budget Responsibility’s economic and fiscal outlook, which warned that a squeeze on real incomes, rise in interest rates and fall in house prices would see the economy fall into a year-long recession from the third quarter of 2022. GDP is forecast to contract by 1.4% in 2023 before rising by 1.3% in 2024 as energy prices and inflation fall.

UK retail sales rise in October

More positively, data published on Friday showed UK retail sales bounced back in October, with volumes up 0.6% from the previous month, according to the Office for National Statistics (ONS). This was double the 0.3% increase forecast by economists in a Reuters poll. It followed a 1.5% decline in September, when sales were impacted by the bank holiday for the funeral of HM Queen Elizabeth II.

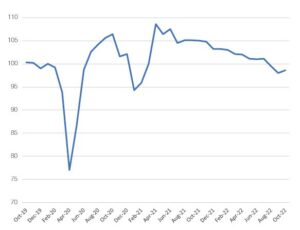

UK retail sales index (volume)

Source: ONS / Refinitiv Datastream

Sales in the three months to October were 2.4% lower than the previous quarter, suggesting the rising cost of living is resulting in consumers reining in their spending. Sales were also 0.6% below their pre-pandemic February 2020 level, yet shoppers spent 14.2% more as a result of high inflation.

Earlier in the week, the ONS’s consumer price index (CPI) report showed UK inflation rose to a 41-year high of 11.1% in October, up from 10.1% in September, mainly due to increases in energy bills and food prices.

US economic data mixed

US retail sales figures were also published last week and were well above consensus expectations. Sales rose by 1.3% in October from the previous month, the biggest gain since May. The increase was led by car sales and higher petrol prices (US retail sales are based on receipts as opposed to volume). Even when volatile car sales and petrol prices were excluded, sales were up 0.9% on the previous month.

Conversely, industrial production in the US decreased by 0.1% in October, as a slight gain in manufacturing output was offset by weaker mining and utilities production. A gauge of manufacturing in the mid-Atlantic region also worsened. The Federal Reserve Bank of Philadelphia’s current activity index dropped from -8.7 in October to -19.4 in November, the lowest reading since the early months of the pandemic.

Japan core inflation hits 40-year high

Over in Japan, core inflation (excluding fresh food prices) hit a 40-year high in October as a weak yen pushed up the cost of imported commodities. Prices rose at an annual rate of 3.6% in October, up from 3.0% in September. Unlike other central banks, the Bank of Japan (BoJ) is sticking with its policy of ultra-low interest rates. The BoJ’s governor, Haruhiko Kuroda, reiterated the bank’s pledge to maintaining monetary stimulus to achieve wage growth and sustainable and stable inflation.

Separate figures from the Cabinet Office showed Japan’s GDP fell by an annualised 1.2% in the three months to the end of September. Again, this was largely due to external factors. Imports grew by 5.2% from the previous quarter as higher energy costs and the weak yen drove up the prices of products coming to Japan, whereas exports grew by just 1.9%. The steep rise in imports meant net exports declined, which dragged GDP lower.[zuperla_single_image image=”23486″]