Stocks mixed as FTSE 100 passes 8,000

Stock markets were mixed last week as US and UK retail sales beat expectations while consumer price inflation eased.

The FTSE 100 added 1.6% in a week that saw the blue-chip index close above 8,000 for the first time. Investor sentiment was boosted by UK retail sales rising 0.5% month-on-month, exceeding economists’ expectations for a 0.3% fall.

In the US, the S&P 500 was down 0.3% and the Dow lost 0.1% as economic data raised fears of further interest rate hikes. A strong performance among technology stocks helped the Nasdaq grow by 0.6%.

In Asia, China’s Shanghai Composite dropped 1.1% and Hong Kong’s Hang Seng lost 2.2% on concerns of escalating geopolitical tensions between China and the US. Japan’s Nikkei dropped 0.6% following lower-than-expected gross domestic product (GDP) growth in the final quarter of 2022.

Last week’s market performance*

• FTSE 100: +1.55%

• S&P 500: -0.28%

• Dow: -0.13%

• Nasdaq: +0.59%

• Dax: +1.14%

• Hang Seng: -2.22%

• Shanghai Composite: -1.12%

• Nikkei: -0.57%

* Data from close of business on Friday 10 February to close of business on Friday 17 February.

House prices rise by just £14

UK and European indices made marginal gains on Monday (20 February), with the FTSE 100 and STOXX 600 both up 0.1%. In economic news, figures from Rightmove showed UK house prices rose by just £14 in February, the smallest January-to-February increase on record. On an annual basis, house prices grew by 3.9% following a 6.3% rise the previous month.

US markets were closed on Monday for President’s Day.

The FTSE 100 opened in the red on Tuesday (21 February), despite data showing the government unexpectedly recorded a budget surplus of £5.4bn in January as self-assessment income tax receipts hit a record high.

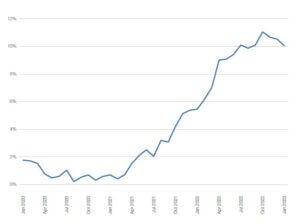

UK inflation slows

Figures released by the Office for National Statistics (ONS) last week showed UK inflation, as measured by the consumer price index (CPI), eased to 10.1% year-on-year in January from 10.5% in December, exceeding economists’ predictions of 10.3%. On a monthly basis, the CPI fell by 0.6% in January. Prices for transport, restaurants and hotels fell month-on-month, whereas tobacco and alcohol rose 2.7%.

UK CPI (% YoY)

Source: Refinitiv Datastream

Encouragingly, core inflation – excluding energy, food, alcohol and tobacco – fell to 5.3% in the 12 months to January from 5.8% in December, much lower than the 6.2% forecast by economists. Nevertheless, economists are still anticipating a further interest rate hike of 0.25 percentage points in March.

Separate figures showed UK retail sales unexpectedly grew by 0.5% in January, whereas economists had been predicting a 0.3% fall. Consumer confidence was boosted by seasonal discounts and falling fuel prices. On an annual basis, sales volumes declined by 5.1% compared to January 2022.

US economic data sparks rate hike fears

Over in the US, figures showed that while consumer inflation eased in January, it remained higher than anticipated. Markets were volatile following the release of the data, which showed prices rose by 6.4% yearon- year in January, a modest decline from 6.5% in December and higher than the predicted rate of 6.2%. Core CPI measured 5.6% year-on-year in January, a drop from 5.7% in December but higher than the anticipated 5.5%. On a monthly basis, CPI grew by 0.5%, with about half of the increase driven by rising shelter costs.

Meanwhile, the producer price index (PPI), which measures the change in prices that producers receive for their goods and services, rose at an annual rate of 6.0% in January, down from 6.5% in December. Month-on-month, prices rose by 0.7%, the largest increase since June, surpassing economists’ predictions of 0.4% growth. Core PPI rose by 0.5%, the highest rate since May last year.

US retail sales were also higher than expected, growing by 3.0% in January. This was the largest increase in nearly two years and almost double forecasts of 1.8%. On a year-to-year basis, retail sales rose by 6.4%, largely driven by motor vehicle purchases.

The combination of resilient consumer spending and high inflation has raised expectations that a further interest rate increase of 0.5 percentage points may be necessary to stifle inflation.

Japan GDP grows less than expected

Japan’s economy grew by an annualised 0.6% in the final quarter of last year, falling significantly short of the market’s forecasted 2.0%. Although the Japanese economy avoided a technical recession, it rebounded less than expected after GDP contracted by 1.0% in Q3 2022. For the full year, the world’s third-largest economy expanded by 1.1% compared with a 2.1% increase in 2021.[zuperla_single_image image=”23486″]