Stocks tumble on inflation and growth fears

Most major stock markets fell last week as US inflation proved to be higher than expected and UK retail sales slumped.

In the US, the S&P 500 slid 4.8%, its largest weekly drop since mid-June, following news that consumer prices rose by 8.3% in the 12 months to August. The Nasdaq plunged 5.5% and the Dow lost 4.1%.

The UK’s FTSE 100 declined 1.6% as retail sales volumes in August fell by more than anticipated and fears of an imminent recession grew. Germany’s Dax tumbled 2.7% as business confidence slumped to its lowest level since October 2008.

The negative investor sentiment spread to Asia, where Japan’s Nikkei 225 dropped 2.3% despite exports rising by 22.1% year-on-year in August, up from 19.0% in July. China’s Shanghai Composite slumped 4.2% as the yuan slid against the dollar and new housing starts in August tumbled by 46% year-on-year.

Last week’s market performance*

• FTSE 100: -1.56%

• S&P 500: -4.77%

• Dow: -4.13%

• Nasdaq: -5.48%

• Dax: -2.65%

• Hang Seng: -3.10%

• Shanghai Composite: -4.16%

• Nikkei: -2.29%

*Data from close on Friday 9 September to close of business on Friday 16 September.

Sweden hikes rates by a full percentage point

The FTSE 100, which was closed on Monday to mark Queen Elizabeth II’s funeral, slipped 0.6% on Tuesday (20 September) and the STOXX 600 declined 1.1% after Sweden’s central bank announced its biggest interest rate hike in nearly three decades. The Riksbank surprised investors with a 100-basis-point increase, taking the headline rate up to 1.75%.

The rate hike has heightened expectations of large interest rate increases by the US Federal Reserve and the Bank of England this week. The S&P 500, Dow and Nasdaq all lost around one percentage point on Tuesday ahead of the Fed’s two-day policy meeting on Wednesday.

US inflation figures spark Wall Street sell off

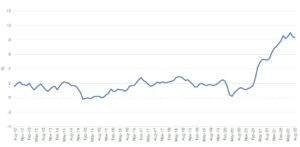

The release of the latest US consumer price index (CPI) last Tuesday triggered a sharp sell off on Wall Street. Annual and monthly price rises were both higher than forecast, weighing on hopes that the Federal Reserve will be able to rein in inflation without sparking a recession.

According to the Bureau of Labor Statistics, headline CPI measured 8.3% year-on-year in August, a slight easing from 8.5% in July but above forecasts of 8.1%. Increases in shelter, food and medical care were the largest contributors to inflation. Food prices were up 10.9% year-on-year and 0.8% month-on-month.

US CPI (YoY)

Source: Refinitiv Datastream

Of particular concern was the 6.3% year-on-year rise in core inflation, which strips out volatile items like food and energy. This was higher than the 5.9% annual increase in July, and cemented expectations for a third consecutive 0.75 percentage point interest rate hike. More encouragingly, US consumers’ near-term inflation expectations fell in September to the lowest level since a year ago. The University of Michigan’s reading of oneyear inflation expectations dropped to 4.6% from 4.8% in August. The five-year inflation outlook also slipped to 2.8%, below the 2.9-3.1% range for the first time since July 2021.

UK inflation dips as petrol prices decline

Last week also saw the release of the UK CPI, which revealed price rises eased in August as petrol prices declined. Annual CPI measured 9.9% in August, down from 10.1% in July and lower than expectations. Motor fuel inflation eased to 31.1% from 43.7% in July, which more than offset the 13.1% annual increase in food prices, according to the Office for National Statistics (ONS).

Further increases in the annual inflation rate are expected in the coming months as domestic energy bills rise, although the capping of the average annual bill at £2,500 means inflation is now expected to peak at about 11%.

Separate figures from the ONS showed higher prices appear to be discouraging spending. UK retail sales volumes fell by 1.6% month-on-month in August, worse than the 0.5% decline expected by analysts. This marked the largest monthly drop since December 2021 and triggered a sharp fall in the pound, which hit a 37-year low against the dollar last Friday.

Economic sentiment in Germany slumps

Over in Germany, economic sentiment declined by more than expected in September amid concerns about the country’s energy supply. ZEW’s economic sentiment index, which surveys 167 analysts, dropped to -61.9 points from -55.3 points in August. “The prospect of energy bottlenecks in winter makes the expectations for large parts of German industry even more negative,” said ZEW president Achim Wambach. It comes after an economy ministry report warned Germany’s economy could stagnate or contract in the second half of the year.

Elsewhere, industrial production in the eurozone fell by 2.3% in July from the previous month, according to Eurostat. This exceeded the 1.0% drop forecast by analysts and was the biggest monthly fall for more than two years. The biggest drop was in the production of capital goods, such as buildings, machinery and vehicles.[zuperla_single_image image=”22728″]