Stocks fall as central banks signal further rate hikes

Stocks fell last week as central banks in the US, UK and Europe stressed the need for further interest rate hikes despite easing inflation.

The S&P 500 slumped 2.1%, the Dow fell 1.7% and the Nasdaq declined 2.7% as forecasts from the Federal Reserve showed the bank’s key interest rate could rise above 5% a year from now. A bigger-than-expected decline in US retail sales in November also weighed on investor sentiment.

UK and European stocks fell after the Bank of England and European Central Bank (ECB) also warned of further interest rate increases to bring inflation back to the 2% target. The FTSE 100 lost 1.9% and Germany’s Dax slid 3.3%.

In Asia, the Shanghai Composite declined 1.2% following weak retail sales and industrial production figures.

Last week’s market performance*

• FTSE 100: -1.93%

• S&P 500: -2.08%

• Dow: -1.66%

• Nasdaq: -2.72%

• Dax: -3.32%

• Hang Seng: -2.26%

• Shanghai Composite: -1.22%

• Nikkei: -1.34%

* Data from close on Friday 9 December to close of business on Friday 16 December.

Rising oil prices boost energy stocks

UK and European indices rose on Monday (19 December) as higher oil prices boosted energy stocks. BP and Shell performed particularly strongly amid hopes of a recovery in demand from China after the country relaxed some of its Covid restrictions. The pan-European STOXX 600 gained 0.3% and the FTSE 100 added 0.4%. US stocks extended the previous week’s losses, with the S&P 500, Dow and Nasdaq all in the red on Monday.

Markets in Asia fell on Tuesday after the Bank of Japan surprised markets with a change to its yield curve control policy. The central bank said it would allow ten-year bond yields to fluctuate by 0.5%, instead of the previous 0.25%, a move that will allow long-term interest rates to rise more.

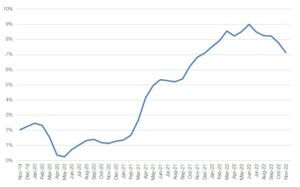

US CPI at lowest level since December 2021

Investors were cheered at the start of last week by data that showed US inflation eased more than expected in November to its lowest level since December 2021. The consumer price index (CPI) dropped to 7.1% year-on-year, lower than the 7.3% forecast by economists and down from 7.7% in October.

US headline CPI (YoY)

Source: Refinitiv Datastream

On a monthly basis, CPI rose by 0.1%, less than the 0.4% increase in October. Housing-related costs (‘shelter’) were the biggest driver of the monthly increase, rising by 0.6% from the previous month, reflecting the fact that rental costs lag changes in home prices. Prices for used cars and trucks fell 2.9% month-on-month while gasoline declined by 2.0%.

But further rate hikes needed

Despite the encouraging CPI report, the Federal Reserve warned that more interest rate hikes will be needed to rein in inflation. Speaking after the central bank hiked rates by 0.5 percentage points, Fed chair Jerome Powell said that while the bank was encouraged by signs that inflation was improving, it would need “substantially more evidence” to be confident it was on a sustained downward path. He pointed out that although the labour market showed signs of slowing down, it remained extremely tight.

Fed officials now expect rates to peak at 5.1% in 2023, above the 4.75% to 5.0% range expected by markets. The release of the statement and Powell’s comments sent stocks sharply lower on Wednesday afternoon.

UK interest rates reach 14-year high

The Bank of England (BoE) also met last week and voted to lift interest rates for the ninth time in a row, by 0.5 percentage points. The base rate now stands at 3.5%, the highest for 14 years. The BoE said further increases may be needed to rein in inflation, although BoE governor Andrew Bailey said in a letter to the chancellor that inflation may have peaked.

It came after figures from the Office for National Statistics showed UK CPI eased slightly to 10.7% in November from a 41-year high of 11.1% in October. This was better than the 10.9% forecast by economists. Core inflation, which excludes volatile items like energy, food, alcohol and tobacco, eased to 6.3% from 6.5%, a further positive sign that underlying price pressures are moderating.

Encouragingly, the BoE is now forecasting a 0.1% contraction in UK gross domestic product (GDP) in the final quarter of the year, less than its previous estimate of a 0.3% contraction.

ECB lifts rates to 2%

The ECB also chose to increase interest rates by 0.5 percentage points last week, lifting the deposit rate to 2.0%. The bank said interest rates would still have to rise “significantly at a steady pace” to ensure a timely return of inflation. “Keeping interest rates at restrictive levels will, over time, reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations,” it said. Inflation is expected to average 8.4% this year, before falling to 6.3% in 2023 and 3.4% in 2024.

The ECB announced plans to start shrinking the portfolio of bonds it acquired as part of its asset purchase programme. This will reduce by an average of €15bn per month from March 2023 through to the end of the second quarter.

Chinese retail sales disappoint

Over in China, weak retail sales figures showed the impact that the country’s strict Covid controls have had on economic growth. Retail sales declined by 5.9% in November from a year ago, according to the National Bureau of Statistics. This was worse than the 3.7% decline forecast by economists in a Reuters poll and much steeper than the 0.5% year-on-year decrease in October.

Industrial production also disappointed, growing by just 2.2% in November from a year ago, down from 5.0% in October and missing expectations for a 3.6% increase. Investors will no doubt be keeping a close eye on the next set of figures to see whether the recent relaxing of Covid restrictions is helping to boost economic activity.[zuperla_single_image image=”23486″]