Stocks rise as recession fears ease

Stock markets rose last week as signs of economic growth and easing inflationary pressures boosted investor sentiment.

The FTSE 100 ended its holiday-shortened trading week up 1.7% after figures showed the UK economy rose above its pre-pandemic levels in February. The pan-European Stoxx 600 also rose 1.7% following increases in eurozone industrial output and investor morale.

In the US, the S&P 500 and the Dow advanced 0.8% and 1.2%, respectively, as the annual rate of inflation slowed to its slowest pace since May 2021.

In Japan, the Nikkei 225 surged 3.5% after Warren Buffett said he intended to add to his investments in Japanese stocks. China’s Shanghai Composite edged up 0.3% as investors weighed a surprise 14.8% year-on-year increase in exports against softer-than-expected inflation.

Last week’s market update*

• FTSE 1001: +1.68%

• S&P 500: +0.79%

• Dow: +1.20%

• Nasdaq: +0.29%

• Dax1: +1.34%

• Hang Seng1: +0.53%

• Shanghai Composite: +0.32%

• Nikkei 225: +3.54%

• Stoxx 6001: +1.74%

• MSCI EM ex Asia: +3.10%

* Data from close of business Friday 7 April to close of business Friday 14 April

1Closed on Monday 11 April

Investors await slew of quarterly earnings

Stock markets had a quiet trading day on Monday (17 April) as investors braced themselves for this week’s raft of US quarterly earnings reports. Bank of America, Morgan Stanley, Netflix and Tesla are all due to release their results this week.

In economic news, a report from the Federal Reserve Bank of New York showed factory sector activity in the region significantly improved in April. The NY Empire State manufacturing index rose from -24.6 in March to +10.8 in April, smashing forecasts of -18 and marking the first increase in five months.

UK economy rises above pre-Covid levels

Figures released by the Office for National Statistics (ONS) last week showed the UK economy has finally risen above its pre-Covid levels. Although gross domestic product (GDP) was unchanged between January and February, revisions to data from previous months meant the economy ended the month 0.3% bigger than in February 2020.

February’s reading was held back by strike action in the services sector and was below the 0.1% expansion forecast in a Reuters poll. However, an upwardly revised 0.4% expansion in January led several commentators to speculate that the economy is unlikely to have contracted in the first quarter. Only a month ago, the Office for Budget Responsibility said GDP would shrink by 0.4% in the first quarter.

US inflation falls to 5.0%

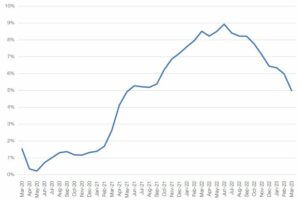

Over in the US, investors were encouraged by figures that showed consumer inflation eased in March to its slowest pace since May 2021. The consumer price index (CPI) rose by 5.0% year-on-year, down from 6.0% in February, according to the Bureau of Labor Statistics.

US CPI – annual % change

Source: Refinitiv Datastream

Energy prices decreased 6.4% year-on-year, with gasoline and fuel oil falling 17.4% and 14.2%, respectively. In contrast, electricity rose 10.2% over the year, while natural gas grew by 5.5%. Food at home prices rose 8.4%, whereas food away from home prices rose by 8.8%.

Core inflation (excluding food and energy) rose by an annualised 5.6% in March. The largest driver was shelter, which grew 8.2% over the year and accounted for over 60.0% of the total increase. Other indexes that saw notable increases included motor vehicle insurance (15.0%), household furnishings and operations (5.6%), recreation (4.8%) and new vehicles (6.1%).

On a monthly basis, headline inflation rose by a lower-than-expected 0.1% in March, down from 0.4% in February, while core inflation grew 0.4% in March, down from 0.5% in February.

Producer prices unexpectedly fall

Further evidence of easing inflationary pressures came from the US producer price index (PPI) report. This showed prices paid by businesses unexpectedly fell by 0.5% in March, bringing the year-on-year increase to 2.7%, the smallest annual rise since January 2021.

Two thirds of the decline was attributed to falling goods prices, particularly energy, which decreased 6.4%. In contrast, when excluding food and energy, goods prices grew 0.3%.

Services also saw a decline of 0.3% in March, the largest decline since April 2020. This was primarily driven by a 0.9% drop in trade services margins.

Core PPI – which excludes food, energy and trade services – gained 0.1% in March, down from 0.2% in February. On an annualised basis, the index grew by 3.6%.

Eurozone industrial production rises

In the eurozone, figures from Eurostat showed industrial production grew by more than expected in February, thanks to easing supply chain issues and low energy prices. Industrial production rose by 1.5% month-on-month, bringing the year-on-year increase to 2.0%.

Further encouraging data came from the Sentix index of investor morale, which rose in April after dipping in March. The assessment of current conditions rose to the highest level in more than a year.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][zuperla_single_image image=”23486″ inherit_align=”left”][/vc_column][/vc_row]