Stocks mixed as BoE hikes base rate to 4.5%

Concerns about the outlook for interest rates and inflation continued to weigh on stock markets last week.

The UK’s FTSE 100 fell 0.6% after the Bank of England (BoE) increased the base interest rate to its highest level since 2008 and raised its inflation forecast. Comments from European Central Bank (ECB) president Christine Lagarde that further rate hikes could be on the cards weighed on indices in Europe. The Dax slipped 0.3% while the Stoxx 600 ended the week flat.

In the US, the technology-heavy Nasdaq gained 0.8% after shares in Google parent Alphabet surged following the unveiling of its new artificial intelligence-based search platform. The release of better-than-expected inflation data boosted the S&P 500 on Wednesday. However, the index ended the week down 0.1% following a jump in consumers’ inflation expectations and concerns about the debt ceiling.

In China, the Shanghai Composite slid 1.9% after inflation data missed forecasts, raising concerns about the strength of the country’s post-pandemic recovery.

Last week’s market update*

•FTSE 1001: -0.61%

•S&P 500: -0.14%

•Dow: -1.08%

•Nasdaq: +0.76%

•Dax: -0.30%

•Hang Seng: -2.11%

•Shanghai Composite: -1.86%

•Nikkei 225: +0.79%

•Stoxx 600: +0.04%

•MSCI EM ex Asia: +0.61%

*Data from close of business Friday 5 May to close of business Friday 12 May

1 Closed on Monday 8 May.

Hopes build for debt ceiling resolution

Stocks ended Monday’s (15 May) trading session in the green as investors grew hopeful for a resolution to federal debt ceiling discussions. The S&P 500 and the FTSE 100 both gained 0.3%, following reports that talks between the White House and congressional leaders had been “constructive”. A second round of talks is due to be held later today (16 May).

The Stoxx 600 managed a 0.3% gain on Monday, despite mixed economic data. Figures from Eurostat showed industrial production in the eurozone fell by 4.1% in March, the sharpest decline since October 2021. Meanwhile, the European Commission increased its gross domestic product (GDP) growth forecasts for the eurozone to 1.1% in 2023 and 1.6% in 2024, up from 0.9% and 1.5%, respectively. However, it also raised its inflation forecasts to 5.8% in 2023 and 2.8% in 2024 because of persistent core inflation pressures.

BoE increases base rate by 0.25%

Last Thursday, the BoE hiked the UK base interest rate by a quarter of a percentage point to 4.5%, the highest level since 2008. The bank’s monetary policy committee voted 7-2 in favour of increasing interest rates for the 12th time in a row, after inflation rose by 10.1% year-on-year in March, driven by high food and energy bills.

The bank said it had underestimated the strength and persistence of food price rises, and would not hit its 2% inflation target until the start of 2025. Previously, it had forecast inflation falling below 2% within a year. Inflation is expected to fall to 5.1% by the end of 2023, instead of the bank’s previous forecast of 3.9%.

More positively, the bank said it no longer expects the UK to enter a recession this year. GDP is expected to be flat in the first half of the year, before growing by 0.9% by the middle of 2024 and by 0.7% by mid-2025. The bank’s comments came a day before the Office for National Statistics’ official GDP figures showed the economy grew by 0.1% in the first quarter despite an unexpected 0.3% contraction in March.

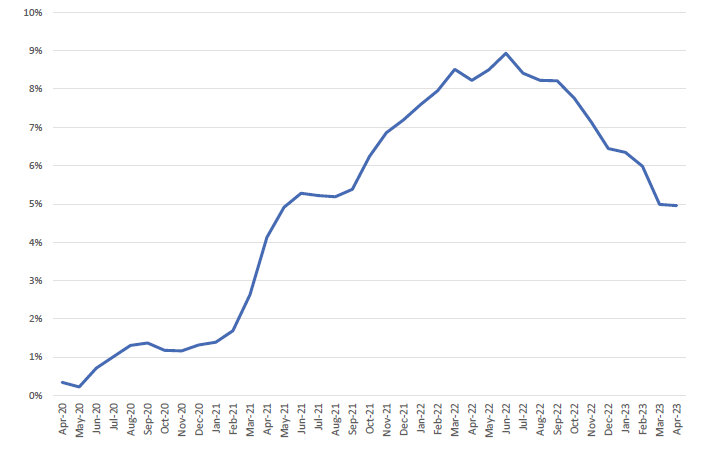

US inflation eases to 4.9%

Over in the US, the headline consumer price index (CPI) eased to 4.9% year-on-year in April, slightly below expectations and the slowest pace in two years.

US headline CPI – YoY % change

Source: Refinitiv Datastream

Core inflation (excluding food and energy) rose by 5.5% in line with expectations. ‘Supercore’ inflation – which covers services excluding energy and housing costs, and is thought to be the Federal Reserve’s preferred gauge – rose by just 0.1% month-on-month, the smallest increase since July 2022.

Despite the data, New York Fed president John Williams said that he did not expect an interest rate cut later this year because price pressures remain “too high”. Meanwhile, a survey by the University of Michigan showed consumers’ outlook for inflation in five years’ time rose to 3.2%, the highest reading since 2011. The survey also showed that consumer sentiment slumped to a six-month low in May. Joanne Hsu, director of the Surveys of Consumers, said this reflected “the proliferation of negative news about the economy, including the debt crisis standoff”.

ECB hints at further rate hikes

In Europe, comments from Lagarde that further rate hikes may be needed to tame inflation weighed on investor sentiment. In an interview with Japan’s Nikkei newspaper, Lagarde said the ECB had moved in a “very deliberate and decisive way” to fight inflation, but that there was still “more ground to cover”. She added that there were “significant upside risks” to the inflation outlook and that the ECB needed to be particularly attentive to wage pressures. Headline inflation in the eurozone rose for the first time in six months in April to 7.0% year-on-year, up from 6.9% in March.

China inflation cools to a two-year low

In China, consumer prices increased at their slowest pace in two years in April while borrowing slumped, adding to concerns about the country’s post-pandemic recovery. According to the National Bureau of Statistics, China’s CPI rose by just 0.1% year-on-year, well below the government’s 2023 target of around 3.0%. The producer price index declined by 3.6%, the biggest contraction in three years and the seventh-consecutive decline. Meanwhile, new bank loans tumbled to RMB719bn from RMB3.89trn in March, according to data from the People’s Bank of China.