Markets mixed as investors mull spike in US inflation

Stock markets were mixed last week as investors weighed a rise in US inflation against the EU’s more optimistic economic growth forecasts.

The S&P 500, Dow and Nasdaq fell 0.3%, 0.6% and 0.7%, respectively, after the headline consumer price index (CPI) increased at its fastest annual pace since 1990. This overshadowed news that weekly jobless claims had reached a new pandemic-era low.

In contrast, the pan-European STOXX 600 added 0.7% as the EU raised its economic growth forecast for the eurozone and industrial production fell less than expected. The UK’s FTSE 100 gained 0.6% as investors digested the latest gross domestic product (GDP) data. Over in Asia, the Shanghai Composite added 1.4% following reports that Beijing is considering easing rules to let struggling property developers sell off assets to avoid defaults.

Last week’s market performance*

• FTSE 100: +0.60%

• S&P 500: -0.31%

• Dow: -0.63%

• Nasdaq: -0.69%

• Dax: +0.25%

• Hang Seng: +1.84%

• Shanghai Composite: +1.36%

• Nikkei: -0.01%

* Data from close on Friday 5 November to close of business on Friday 12 November.

European stocks hit new all-time highs

European indices rose on Monday (15 November) following encouraging economic data from China. The STOXX 600, Dax and CAC 40 all closed at fresh record highs after China’s industrial output rose 3.5% in October from a year ago, beating expectations of a 3.0% increase. Chinese retail sales rose 4.9% year-on-year, significantly higher than forecasts of 3.5% growth.

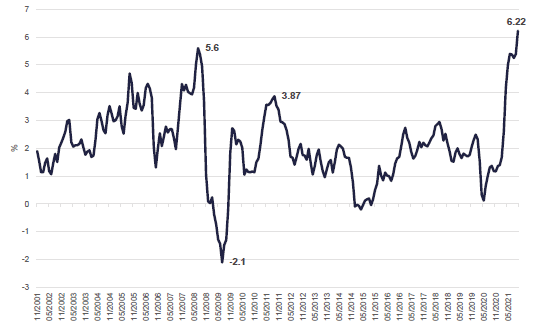

The FTSE 100 was little changed after Bank of England governor Andrew Bailey said he was ‘very uneasy’ about rising inflation and had come to close to voting for an increase in interest rates when policymakers met earlier this month. US stocks were also flat ahead of this week’s retail sales, construction starts and building permits reports. At the start of trading on Tuesday, the FTSE 100 was 0.2% weaker as investors considered the latest employment data from the Office for National Statistics (ONS). The number of payrolled employees rose by 160,000 to 29.3m between September and October despite the ending of the furlough scheme. The unemployment rate fell by a bigger-than expected 0.5 percentage points to 4.3%. The figures are likely to fuel speculation that the Bank of England will increase the base interest rate when it meets in December. US inflation highest in three decades. Last week’s economic headlines were dominated by the latest inflation figures from the US, which revealed the headline CPI rose to 6.2% in October from a year ago, the fastest pace for three decades, largely because of faster-than-expected rises in the cost of fuel and food.

US CPI – annual inflation rate

Source: Refinitiv Datastream

Compared with a month ago, prices surged by 0.9%, well above the 0.6% rise forecast by economists. Core inflation, which excludes energy and food, also rose more than expected by 0.6% from the previous month.

The data came a week after Federal Reserve chair Jerome Powell admitted that high inflation was lasting longer than anticipated and it was difficult to predict the persistence of supply constraints.

Concerns about rising prices saw US consumer sentiment decline to its lowest level in a decade. The University of Michigan’s consumer sentiment index fell to 66.8 in November, down from 71.7 in October and well below the expected 72.4. Richard Curtin, chief economist of the university’s consumer surveys, said the decline was driven by “an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation.”

Supply issues hit UK GDP growth

Here in the UK, data from the ONS showed the impact that supply chain problems are having on UK economic growth. GDP grew by an estimated 1.3% in the third quarter (July to September), a marked slowdown from the 5.5% growth seen in the second quarter when there was an easing in many coronavirus restrictions. The growth rate was below the 1.5% forecast by the Bank of England, with shortages of goods, labour and components weighing on activity.

The monthly figures showed GDP grew by 0.6% in September but remained 0.6% below the pre-pandemic level. Services output grew by 0.7% as the number of face-to-face appointments at GP surgeries grew, whereas production output declined by 0.4% following two consecutive months of growth.

EU hikes growth forecast

More encouragingly, the European Commission increased its 2021 GDP growth forecast for the eurozone to 5.0% from 4.8%. The commission’s vice president Valdis Dombrovskis said measures to cushion the blow of the pandemic and ramp up vaccinations had “clearly contributed to this success”. GDP growth is forecast to be 4.3% in 2022 and 2.4% in 2023.

The commission also said inflation would reach 2.4% this year, before slowing to 2.2% next year and 1.4% in 2023. The eurozone’s budget deficit is expected to decline to 7.1% of GDP this year from 7.2% in 2020, and then fall to 3.9% and 2.4% in 2022 and 2023.

Elsewhere, data from Eurostat showed supply chain constraints held back manufacturing in September, with industrial production declining by 0.2% from the previous month. However, this was better than the 0.7% decrease predicted by economists in a Wall Street Journal poll.

Brewin Dolphin Ltd, a member of the London Stock Exchange, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Smithfield Street London EC1A 9BD. Registered in England and Wales no 2135876.

[zuperla_single_image image=”22816″]