Stocks weak as UK narrowly avoids recession

Most major indices ended the week in the red following concerns that aggressive central bank policy might prolong the economic downturn.

The FTSE 100 fell by 0.2% as worries of higher interest rates overshadowed news that the UK narrowly avoided a recession in the final quarter of last year. Declines were limited by a rise in energy shares.

Over in the US, the Dow lost 0.2%, the S&P 500 fell by 1.1% and the Nasdaq dropped 2.4%. This followed Federal Reserve chairman Jerome Powell’s announcement that disinflation will take time and further policy rate increases may be necessary. US energy stocks rose to their highest level in three years following Russia’s announcement that it will cut about 5.0% of its monthly oil output.

Sentiment across markets was also affected by investors looking ahead to the US consumer price index (CPI) report, after economists warned of a slower decline in inflation over the next few months.

Asian stocks saw a marginal fall following weaker-than-expected Chinese consumer inflation in January, and concerns that growing geopolitical tensions between China and the US would lead to sanctions against Chinese tech companies. Hong Kong’s Hang Seng fell by 2.2% while China’s Shanghai Composite saw a fractional drop.

Last week’s market performance*

• FTSE 100: -0.24%

• S&P 500: -1.11%

• Dow: -0.17%

• Nasdaq: -2.41%

• Dax: -1.09%

• Hang Seng: -2.17%

• Shanghai Composite: -0.08%

• Nikkei: +0.59%

* Data from close of business on Friday 3 February to close of business on Friday 10 February.

Stocks rise despite mounting US-China tensions

US stocks closed higher on Monday (13 February) despite worsening geopolitical tensions between the US and China. The Chinese government accused the US of flying spy balloons into its airspace more than ten times since 2022, while the US air force shot down a fourth airborne object in under a week. The Dow Jones added 1.1%, the S&P 500 grew 1.1% and the Nasdaq gained 1.5%.

The FTSE 100 gained 0.4% on Tuesday morning (14 February) following new UK employment data. The unemployment rate remained stable at 3.7% in December, while annual wage growth increased from 6.5% to 6.7% in the final quarter of last year. This marks the fastest growth rate outside of the pandemic and exceeded expectations for it to remain flat.

UK narrowly avoids recession

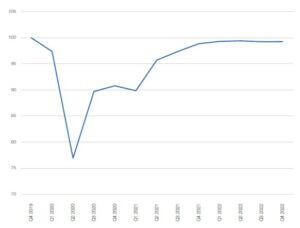

Figures released by the Office for National Statistics last week showed the UK narrowly avoided a recession at the end of last year as a decline in gross domestic product (GDP) of 0.5% in December was offset by increases in the previous two months. This left the economy at roughly the same level as in the third quarter. Negative growth in Q4 would have signalled a recession as Q3 saw the UK economy shrink by 0.2%. December’s result was affected by a 0.8% decline in the services industry, which recorded falls in health, education, transport and storage, arts and entertainment.

UK GDP

Source: Refinitiv Datastream

The Bank of England forecast last week that the UK will enter a shallow recession in the first quarter of this year, which will last for five quarters.

Yield curve inversion at lowest level in decades US government bond investors pushed two-year yields above ten-year yields by the widest margin since the 1980s on Thursday. The yield on the shorter-dated bond exceeded that of the longer-dated by as much as 86 basis points. The move came after stronger-thanexpected US employment data indicated that further Federal Reserve policy rate increases may be needed to stifle inflation. Curve inversions occur where shorterterm yields exceed longer-term ones. In the US, curve inversions have preceded every recession for the past 50 years, typically by 12 to 18 months.

The US yield curve works as a barometer of investors’ assessment of where the economy is headed. Shorterterm yields tend to represent what investors believe will happen to policy rates in the near future, while longerterm maturities represent predictions for where inflation, growth and interest rates are headed in the medium to long term.

US consumer confidence grows

US consumer confidence rose to its highest level in 13 months in February, according to the University of Michigan’s consumer sentiment index. Consumer sentiment came in at 66.4, up from 64.9 the prior month, and exceeding economists’ predictions of 65.0. Sentiment has improved in part by cooling inflation and a strong labour market.

However, the consumer expectations index, which measures sentiment about where the economy will be in a year’s time and five years’ time, fell to 62.3 from 62.7. Five-year inflation expectations were flat at 2.9% for the third consecutive month.

Ueda expected to be nominated as BoJ governor

Japanese prime minister Fumio Kishida is expected to nominate Kazuo Ueda as governor of the Bank of Japan when Haruhiko Kuroda retires in April. The announcement came as a surprise following reports the job would go to Masayoshi Amamiya, who is believed to have declined the position. Amamiya was the continuity candidate and was seen as the most likely to continue with the ultra-dovish stance of Kuroda. In contrast, Ueda is believed to be a hawkish candidate, as it is understood he has been critical of negative interest rates.

Economists expect Ueda to make a gradual shift towards tightening monetary policy. This would involve removing commitments to keep yields on ten-year government bonds at historically low levels, and raising the interest rate, which is currently -0.1%.[zuperla_single_image image=”23486″]