Stocks fall as bank CEOs warn of recession

US and European stock markets fell last week as several bank CEOs gave a bleak outlook for the global economy.

Goldman Sachs CEO David Solomon warned of pay and job cuts and “some bumpy times ahead”. Bank of America CEO Brian Moynihan said the company is slowing hiring ahead of a downturn, and JPMorgan Chase CEO Jamie Dimon said a “mild to hard recession” may hit next year. Stronger-than-expected producer price inflation also weighed on investor sentiment. The S&P 500 fell 3.4%, its worst return for five weeks, the Dow lost 2.8% and the Nasdaq slid 4.0%.

The FTSE 100 dipped 1.1% as the UK services sector contracted for the second month running and house prices dropped at the fastest pace since 2008. The pan-European STOXX 600 slipped 0.9% and Germany’s Dax lost 1.1% as eurozone retail sales slumped and German industrial production declined.

In Asia, the Nikkei 225 added 0.4% after data showed Japan’s economy contracted by less than expected. The Shanghai Composite gained 1.6% and the Hang Seng soared 6.6% as China announced a ten-point guideline to its new Covid prevention and control measures, marking a rapid shift from its zero-Covid policy.

Last week’s market performance*

• FTSE 100: -1.05%

• S&P 500: -3.37%

• Dow: -2.77%

• Nasdaq: -3.99%

• Dax: -1.09%

• Hang Seng: +6.56%

• Shanghai Composite: +1.61%

• Nikkei: +0.44%

* Data from close on Friday 2 December to close of business on Friday 9 December.

UK chancellor warns of tough road ahead

The FTSE 100 slipped 0.4% on Monday (12 December) as UK chancellor Jeremy Hunt warned of a “tough road ahead”. Hunt was responding to the latest UK gross domestic product (GDP) figures, which showed that while the economy grew by 0.5% between September and October, it shrank by 0.3% in the three months to October, marking the biggest decline since the first quarter of 2021.

US indices were in the green on Monday as investors looked ahead to this week’s consumer price index (CPI) report and the Federal Reserve’s two-day policy meeting. The Dow added 1.6% and the S&P 500 gained 1.4%.

The FTSE 100 was up 0.1% at the start of trading on Tuesday following the release of the latest UK jobs data. According to the Office for National Statistics, the unemployment rate rose by 0.1 percentage points in the three months to October to 3.7%, while pay fell by 2.7% year-on-year in real terms.

US producer prices higher than expected

Figures released on Friday showed US producer prices increased by more than expected in November, which sent stocks sharply lower at the end of last week. The producer price index (PPI) increased by 7.4% year-on-year, lower than the 8.1% increase in October but above economists’ forecasts of 7.2%. While the report showed inflation is coming down, it also suggested it is stickier than many people assume.

Elsewhere, the University of Michigan’s preliminary survey of consumer sentiment for December showed long-term inflation expectations were unchanged at 3%, whereas one-year inflation expectations fell to 4.6%, the lowest reading in 15 months. The overall index of consumer sentiment measured 59.1, up from 56.8 the previous month.

UK house prices slump

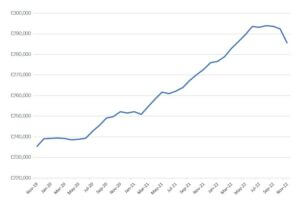

Here in the UK, figures from Halifax showed house prices dropped for a third consecutive month in November and at the fastest pace since the financial crash of 2008. The average house price fell 2.3% month-on-month, with the annual rate of growth dropping to 4.7% from 8.2% in October. It means the typical UK property now costs £285,579.

Halifax house price index – average house price

Source: Refinitiv Datastream

Kim Kinnaird, director at Halifax Mortgages, said some potential home moves have been paused as homebuyers feel increased pressure on affordability, and industry data continues to suggest that many buyers and sellers are taking stock while the market continues to stabilise.

“The market may now be going through a process of normalisation,” she added. “While some important factors like the limited supply of properties for sale will remain, the trajectory of mortgage rates, the robustness of household finances in the face of the rising cost of living, and how the economy – and more specifically the labour market – performs will be key in determining house prices changes in 2023.”

GDP estimates revised upwards

Eurozone GDP grew by more than initially estimated in the third quarter, according to data from Eurostat. GDP was 0.3% higher than the previous quarter and 2.3% higher than Q3 2022. These were above Eurostat’s flash estimates of 0.2% and 2.1%, respectively. Household spending added 0.4 percentage points to growth, while gross fixed capital formation added 0.8 points.

Over in Japan, GDP also shrank by less than expected in the third quarter, falling by an annualised 0.8% as opposed to the 1.2% contraction indicated by initial estimates. Domestic demand grew by 0.42%, slightly up from initial estimates of 0.36%. Exports were up 2.1%, faster than the 1.9% previously reported.[zuperla_single_image image=”23486″]