Stocks mixed as Fed and ECB hike rates

Stock markets were mixed last week as the US Federal Reserve and European Central Bank (ECB) hiked interest rates.

The S&P 500 rallied on Friday after the US nonfarm payrolls report beat forecasts. Despite this, the index ended the week down 0.8%, following comments from Fed chair Jerome Powell that interest rate cuts might not happen as soon as investors had hoped.

The pan-European Stoxx 600 declined 0.3% after ECB president Christine Lagarde said interest rates would rise to “sufficiently restrictive levels” until inflation eased to the bank’s 2% target. The UK’s FTSE 100 fell 1.2% ahead of the Bank of England’s (BoE) interest rate decision on 11 May.

Japan’s Nikkei 225 added 1.0% during the first two days of the week following a sell-off in the yen. The index was closed for the remainder of the week for national holidays. China’s Shanghai Composite ended its holidayshortened trading week up 0.3%, despite the official manufacturing purchasing managers’ index falling into contraction territory for the first time since December.

Last week’s market update*

• FTSE 1001: -1.17%

• S&P 500: -0.80%

• Dow: -1.24%

• Nasdaq: +0.07%

• Dax1: +0.24%

• Hang Seng1: +0.78%

• Shanghai Composite2: +0.34%

• Nikkei 2253: +1.04%

• Stoxx 600: -0.28%

• MSCI EM ex Asia: -0.32%

*Data from close of business Friday 28 April to close of business Friday 5 May

1 Closed on Monday 1 May.

2 Closed between Monday 1 May and Wednesday 3 May.

3 Closed between Wednesday 3 May and Friday 5 May.

Stocks slip ahead of US inflation data

Stock markets fell on Tuesday (9 May) as investors looked ahead to the release of US inflation numbers on Wednesday. The consumer price index will be closely monitored for any insights into the Federal Reserve’s next monetary policy decision.

The BoE is expected to hike interest rates for the 12th time in a row on Thursday, with economists and markets anticipating a quarter of a percentage point increase to 4.5%. It comes after official data showed the rate of inflation stood at 10.1% in March, far higher than expected.

US nonfarm payrolls beat forecasts

Last Friday saw the release of the closely watched US nonfarm payrolls report, which showed surprisingly strong jobs growth in April. Some 253,000 new jobs were added during the month, higher than the 180,000 forecast by economists and the 165,000 job gains recorded in March.

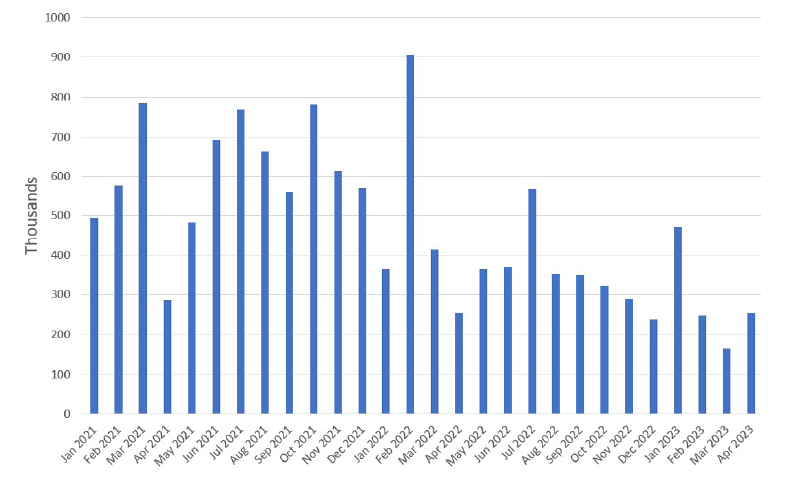

New US jobs per month

Source: Refinitiv Datastream

The report from the Department of Labor also showed average hourly earnings increased by 0.5% month-onmonth, the highest rate since the middle of last year. Meanwhile, the unemployment rate fell back to a 53-year low of 3.4% from 3.5% the previous month.

Separate data showed the number of job openings shrank for a third consecutive month in March. However, there are still 1.6 job openings for every unemployed person, which suggests the labour market remains tight.

Fed hikes rates as expected

Earlier in the week, the Federal Reserve hiked interest rates by a quarter of a percentage point, taking the benchmark fed funds rate to between 5.0% and 5.25%. The statement from the Federal Open Market Committee omitted language saying that further policy firming may be appropriate. Instead, it said officials would take into account how the impact of monetary policy was accumulating in the economy.

At a press conference later in the day, however, Powell indicated that it was too soon to say with certainty that the rate-hiking cycle is over. Powell said the Fed was “closer, or maybe even there”, but that it was “prepared to do more” and future policy decisions would be made on a meeting-by-meeting basis. Powell also indicated that a pivot to cutting rates would not occur this year.

ECB scales back rate increases

The ECB also increased interest rates by a quarter of apercentage point last week, scaling back from its three previous half-percentage point increases. The move takes the main policy rate to 3.25%.

However, Lagarde indicated that the fight against inflation is far from over. “We have more ground to cover and we are not pausing, that is extremely clear,” she said. Lagarde added that some of the ECB’s rate-setters had called for a bigger increase and that the “inflation outlook continues to be too high for too long”. Headline inflation in the eurozone rose for the first time in six months in April to 7.0% year-on-year, up from 6.9% in March.

Housing market shows signs of stabilising

Here in the UK, data from the Bank of England suggested the housing market could finally be stabilising after the turmoil caused by last autumn’s mini-budget. Net mortgage approvals rose for a second consecutive month to 52,000 in March, up from 44,100 in February and much higher than expected. This came after data from Nationwide showed UK house prices unexpectedly rose by 0.5% in April, following seven consecutive months of declines. The cost of an average home increased to £260,441, which was still 2.7% lower than a year ago.