Stocks rise on hopes of slower rate hikes

Most major stock markets rose last week amid signs that central banks could slow the pace of interest rate hikes.

The FTSE 100 rose 1.8% after the Bank of England (BoE) raised the base rate to 4.0% but said inflation has likely peaked. The Dax added 2.2% despite the European Central Bank (ECB) taking a more hawkish stance after raising its deposit rate to 2.5%, the highest rate since 2008.

Most US indices also ended the week higher, aided by encouraging financial data and fourth quarter earnings reports, and a smaller 0.25 percentage point rate hike by the Federal Reserve. The Nasdaq grew by 3.3%, aided by a 25.0% jump in Meta shares. However, disappointing results and outlooks from Apple, Google’s parent company Alphabet, and Amazon dampened investor enthusiasm on Friday.

Over in Asia, Japan’s Nikkei grew by 0.5% as consumer confidence improved in January and annualised retail sales for December beat expectations. China’s Shanghai Composite eased slightly after the private Caixin/S&P Global survey of manufacturing activity recorded a contraction for the sixth consecutive month, as staff absences due to Covid-19 offset improving confidence. This came a day after China’s official purchasing managers’ index showed a mild recovery in activity due to an uptick in demand for manufactured goods.

Last week’s market performance*

• FTSE 100: +1.76%

• S&P 500: +1.62%

• Dow: -0.15%

• Nasdaq: +3.31%

• Dax: +2.15%

• Hang Seng: -4.53%

• Shanghai Composite: -0.04%

• Nikkei: +0.46%

* Data from close of business on Friday 27 January to close of

business on Friday 3 February

US payrolls weigh on investor sentiment

Stocks were mostly in the red on Monday (6 February) after payroll data from the US led to renewed interest rate fears. The S&P 500 slipped 0.6%, the Nasdaq fell by 1.0% and the FTSE 100 lost 0.9%. The Hang Seng also fell 2.0% and the Shanghai Composite retreated 0.8% after the US shot down a suspected Chinese ‘spy’ balloon over the weekend, fuelling concerns about tensions between the two countries.

The FTSE 100 started Tuesday’s trading session in the green after soaring gas prices helped BP more than double its annual profits in 2022.

BoE and ECB lift interest rates

Last week’s economic headlines focused on interest rate hikes by three of the world’s major central banks.

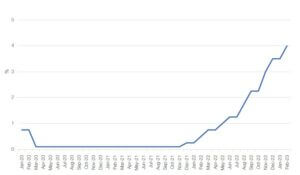

Here in the UK, the BoE raised its base rate by a half percentage point to 4.0% on Thursday, its tenth consecutive rate rise. The increase takes the base rate to its highest level since 2008. Encouragingly, the BoE said further rate hikes would only be needed if there were new signs that inflation was going to stay too high for too long. This was interpreted to mean that interest rates might peak at the current rate of 4.0%, with no further rate hikes this cycle (markets had been pricing in a peak of 4.5%).

Bank of England base rate

Source: Refinitiv Datastream

The BoE’s comments reflect the fact that consumer price inflation has begun to ease on the back of falling wholesale gas prices and easing global supply chain disruption. The BoE predicts that inflation will continue to fall sharply over the year, reaching 3.0% in the first quarter of 2024. However, the labour market remains tight and wage price gains have been stronger than expected, which indicates resilience in underlying inflation.

Further, the BoE expects the UK economy to shrink by 0.1% in the first quarter and for the country to enter into a recession, albeit a much shallower one than anticipated in November.

Last week also saw the ECB raise its deposit rate by half a percentage point to 2.5%, its highest level in 15 years. An additional rate increase is expected in March in an attempt to stifle inflation. Headline inflation cooled from an annual rate of 9.2% in December to 8.5% in January. However, core inflation – excluding changes in food and energy prices – remained at an all-time high of 5.2%.

Fed raises policy rate amid US job boom

Over in the US, the Fed raised its policy rate by 0.25 percentage points on Wednesday to a range of 4.5% to 4.75%. Fed chair Jerome Powell’s post meeting press conference contained a mix of hawkish and dovish statements. He acknowledged there were some encouraging signs that price pressures were easing, but also said it was “very premature to declare victory” and that policymakers would need “substantially more evidence to be confident that inflation is on a sustained downward path”.

Economists are expecting at least two further rate increases after the Department of Labor’s nonfarm payrolls report revealed 517,000 new jobs were added in January. This was nearly double December’s total and more than triple the forecasted 185,000. Meanwhile, the country’s unemployment rate fell to 3.4% in January from 3.5% in December, the lowest in 53 years.[zuperla_single_image image=”23486″]