Stocks fall as Russia halts gas supplies

Stocks fell last week on rising concerns that Russia will shut off gas supplies to Europe this winter.

On Wednesday, Gazprom halted the flow of gas through the Nord Stream 1 pipeline to Germany. Flows were due to resume on Saturday, but the state-owned oil and gas firm said on Friday evening that supplies would remain halted indefinitely after a leak was detected. The pan-European STOXX 600 finished the week down 2.4%, with fears of more aggressive interest rate hikes also weighing on investor sentiment.

The FTSE 100 ended its holiday-shortened trading week almost two percentage points lower, as the Conservative Party’s leadership race led to heightened political and economic uncertainty.

In the US, the S&P 500 and the Nasdaq shed 3.3% and 4.2%, respectively, as Federal Reserve officials reinforced the view that further rate hikes are needed to rein in inflation. The hawkish outlook dampened investor sentiment in Japan, where the Nikkei tumbled 3.5%.

China’s Shanghai Composite slipped 1.5% as outbreaks of Covid-19 in several major cities led to renewed lockdowns.

Last week’s market performance*

• FTSE 1001: -1.97%

• S&P 500: -3.29%

• Dow: -2.99%

• Nasdaq: -4.21%

• Dax: +0.61%

• Hang Seng: -3.56%

• Shanghai Composite: -1.54%

• Nikkei: -3.46%

*Data from close on Friday 26 August to close of business on

Friday 2 September.

1Closed on Monday 29 August.

Truss confirmed as new UK prime minister

The FTSE 100 finished up 0.1% on Monday (5 September) as oil and gas prices rose following Russia’s decision to suspend gas flows to Europe. The day also saw Liz Truss win the Conservative party leadership contest to become the next UK prime minister. Truss promised to cut taxes and grow the economy.

The worsening energy crisis saw stocks in Europe close in the red on Monday, with the STOXX 600 and Germany’s Dax down 0.6% and 2.2%, respectively. Data from S&P Global showed eurozone business activity contracted again in August, with the composite purchasing managers’ index (PMI) falling to 48.9 from 49.9 in July. The services PMI declined to 49.8, below the 50.0 mark that separates growth from contraction. US indices were closed on Monday for Labor Day.

The FTSE 100 rose at the start of trading on Tuesday on news Truss is expected to unveil an emergency package to tackle the cost-of-living crisis.

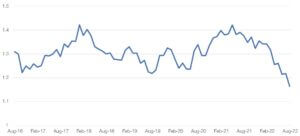

Pound slumps against the dollar

Last week saw further falls in the value of the pound as concerns about slowing UK economic growth and rising inflation gathered pace. In August, the pound suffered its biggest monthly fall against the US dollar since the aftermath of the Brexit vote in 2016, tumbling by 4.6%.

GBP to USD exchange rate

Source: Refinitiv Datastream

The GBP/USD exchange rate fell as the likelihood of Truss winning the Conservative party leadership race increased and the energy crisis worsened, although it also reflected the soaring US dollar, which strengthened amid better-than-expected US economic data. On Monday (5 September) the pound fell to a new post-pandemic low of $1.14 ahead of Truss being named the UK’s next prime minister, before bouncing back to $1.16 on Tuesday morning.

US jobs market still strong

Over in the US, the Bureau of Labor Statistics’ closely watched nonfarm payrolls report showed the economy added 315,000 jobs in August. While this was far lower than the 526,000 positions added in July, the data was seen as solid in light of fears about slowing economic growth.

The unemployment rate edged up to 3.7% from 3.5% in July. This was largely because of a gain in the labour force participation rate – in other words, there was an increase in the number of people looking for jobs as opposed to a rise in the number of existing workers losing their jobs.

Eurozone inflation hits 9.1%

In the eurozone, inflation rose to a record 9.1% in the 12 months to August, according to Eurostat’s flash estimate. This was higher than the 8.9% annual inflation recorded in July and the 9% figure expected by economists in a Reuters poll. Energy prices were up by 38.3% from a year ago, while food, alcohol and tobacco rose by 10.6%.

There are growing expectations that the European Central Bank (ECB) will increase interest rates by 0.75 percentage points for the first time in its history on Thursday. According to the Financial Times, Germany’s central bank president Joachim Nagel said high inflation was becoming an enormous burden for people, adding: “We need a strong interest rate hike in September. And further interest rate hikes can be expected in the coming months.” However, ECB chief economist Philip Lane said at an event in Barcelona that interest rates should be increased at a “steady pace” to avoid adverse effects.

Covid outbreaks are in 41 Chinese cities

China reimposed curbs in major cities such as Guangzhou and Shenzhen last week in an effort to tackle flare-ups of Covid-19. Capital Economics estimated that 41 cities, responsible for 32% of China’s gross domestic product, are currently in the midst of outbreaks – the highest number since April.

The lockdowns came as data showed China’s zero-Covid strategy continues to hold back the economy. The official manufacturing PMI came in at 49.4 in August, up from July’s 49.0 but still in contraction territory. The non-manufacturing PMI declined to 52.8 from 53.8 in July.[zuperla_single_image image=”22728″]