Eurozone inflation slows for first time since 2021

Shares in Europe rose for the seventh consecutive week last week as a slight easing of inflation raised hopes of slower interest rate hikes.

The STOXX 600 ended the week up 0.6%, with signs of improving economic confidence also helping to boost investor sentiment. The FTSE 100 gained 0.9% despite a sharp slowdown in the UK housing market.

In the US, the S&P 500, Nasdaq and Dow rose 1.1%, 2.1% and 0.2%, respectively, after Federal Reserve chair Jerome Powell signalled smaller interest rate hikes.

In Asia, the Shanghai Composite added 1.8% and the Hang Seng surged 6.3% amid signs that China is moving away its zero-Covid policy. Japan’s Nikkei 225 underperformed, falling 1.8% as data showed a decline in industrial production and consumer confidence.

Last week’s market performance*

• FTSE 100: +0.93%

• S&P 500: +1.13%

• Dow: +0.24%

• Nasdaq: +2.09%

• Dax: -0.08%

• Hang Seng: +6.27%

• Shanghai Composite: +1.76%

• Nikkei: -1.79%

* Data from close on Friday 25 November to close of business on Friday 2 December.

Asia shares rally as China eases testing rules

Stock markets in Asia rose on Monday (5 December) after authorities in China relaxed some of their strict Covid testing rules over the weekend. It followed a wave of nationwide discontent the previous week. The Shanghai Composite added 1.8% and the Hang Seng soared 4.5%, with travel and technology stocks among the top performers.

The positive news was somewhat marred by the latest Caixin / S&P Global purchasing managers’ index (PMI), which showed service sector activity in China contracted at its fastest pace in six months in November. The index dropped to 46.7, well below the 50.0 mark that separates growth from contraction.

The easing of restrictions in China helped to boost the FTSE 100, which rose 0.2% on Monday, led by the mining sector. Gains were held back by a warning from the Confederation of British Industry that the UK faces a “lost decade of growth” if action isn’t taken to address falling business investment and worker shortages. In Europe, the Dax lost 0.6% and France’s CAC 40 fell 0.7% after S&P Global’s composite PMI for the eurozone showed economic activity contracted for the fifth month in a row in November, marking the longest downturn since the recession of 2011 to 2013.

Eurozone inflation eases to 10.0%

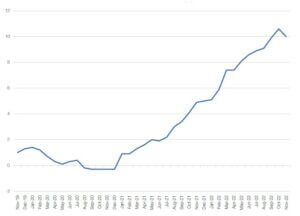

Last week, figures from the EU’s statistics agency showed inflation in the eurozone fell for the first time in 17 months, raising hopes the European Central Bank (ECB) will announce smaller interest rate rises this month. Consumer prices rose by 10.0% year-on-year in November, down from a record high of 10.6% in October and below the 10.4% forecast by economists in a Reuters poll.

Eurozone annual inflation (%)

Source: Refinitiv Datastream

Energy price inflation eased to 34.9% from 41.5% in October, which outweighed a slight rise in food, alcohol and tobacco inflation to 13.6% from 13.1%. Services inflation also slowed slightly to 4.2% from 4.3%.

Further positive news came from the European Commission’s economic sentiment survey, which registered its first increase since February. The index rose to 93.7 in November from 92.7 in October, driven by a rebound in consumer confidence. This more than outweighed a further deterioration in industry confidence. Consumers were more positive about their household’s financial situation, both over the past 12 months and especially for the next 12 months. Consumers’ expectations about the general economic situation were also more upbeat.

UK house price growth slows

Here in the UK, the latest research from Nationwide showed a sharp slowdown in annual house price growth to 4.4% in November from 7.2% in October, as the fallout from the mini-budget continued to impact the market. Prices fell by 1.4% month-on-month, the largest fall since June 2020.

Robert Gardner, Nationwide’s chief economist, said that while financial market conditions have now stabilised, interest rates for new mortgages remain elevated and the market has lost a significant degree of momentum. “Housing affordability for potential buyers and home movers has become much more stretched at a time when household finances are already under pressure from high inflation,” he said.

Separate figures from the Bank of England showed UK mortgage approvals dropped to 59,000 in October, down from 66,000 the previous month and the lowest level since the June 2020 lockdown. The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 25 basis points to 3.09% in October, the highest since 2014.

Fed signals smaller rate hikes

US Federal Reserve chair Jerome Powell said in a speech last week that the central bank could slow the pace of interest rate increases as soon as the mid-December policy meeting. Many commentators are now anticipating a 0.5 percentage point rate hike at the December meeting, as opposed to the four consecutive 0.75 percentage point rate hikes that preceded it. However, Powell also warned against relaxing monetary policy too soon and said the peak interest rate could be higher than previously forecast.

Powell said that in order to bring inflation back down, the labour market would need to soften. However, Friday’s nonfarm payrolls report showed the economy added 263,000 jobs in November, exceeding consensus estimates, while the unemployment rate stayed at 3.7%. Average hourly earnings were up by 0.6% month-on-month, pushing the annual rate of increase to 5.1% from 4.7% the previous month.

Japan industrial production declines

Over in Japan, industrial production declined by 2.6% month-on-month in October, worse than forecasts of a 1.5% fall, according to flash data from the Ministry of Economy, Trade and Industry (METI). It came as elevated raw material costs and slowing overseas demand resulted in industries scaling back output. Production was up by 3.7% on an annual basis, but this was below expectations for a rise of 5.0% and represented a slowdown from 9.6% growth the previous month. METI’s forecast of industrial production was more positive, with output rising by 3.3% month-on-month in November and 2.4% in December.[zuperla_single_image image=”23486″]