Markets boosted by rising oil prices

All major indices finished last week in the green as rising oil prices helped to boost energy stocks, while fears of financial instability eased.

In Europe, the Stoxx 600 gained 4.0% and Germany’s Dax added 4.5% after eurozone inflation eased to 6.9% year-on-year in March, down from 8.5% in February. The UK’s FTSE 100 rose 3.1% after fourth quarter gross domestic product (GDP) figures were revised upwards.

Over in the US, the Dow added 3.2% and the Nasdaq rose by 3.4% in a week that saw the Federal Reserve’s preferred inflation gauge rise by a less-than-expected 0.3% in February.

China’s Shanghai Composite edged up 0.2% and the Hang Seng gained 2.4% after premier Li Qiang said China would work to expand its domestic market, improve the business environment, and prevent financial systemic risks.

Last week’s market update*

• FTSE 100: +3.06%

• S&P 500: +3.48%

• Dow: +3.22%

• Nasdaq: +3.37%

• Dax: +4.49%

• Hang Seng: +2.43%

• Shanghai Composite: +0.22%

• Nikkei 225: +2.40%

• Stoxx 600: +4.03%

• MSCI EM ex Asia: +3.31%

* Data from close of business Friday 24 March to close of business Friday 31 March

Markets mixed as global oil output cut

Markets closed with mixed results on Monday (3 April) following a decision by the Organisation of Petroleum Exporting Countries (OPEC+) to cut oil output by more than one million barrels per day. The move could harm efforts to cool global inflation, and has raised new concerns about a further US interest rate hike in May.

The pan-European Stoxx 600 ended the day down 0.1%, whereas the UK’s FTSE 100 gained 0.5%. Energy stocks performed particularly well, with Shell and BP adding 4.5% and 4.3%, respectively. In the US, the Dow gained 1.0% and the S&P 500 rose by 0.4%.

In economic news, the Institute for Supply Management’s manufacturing purchasing managers’ index slipped by more than expected in March to 46.3, the lowest level in nearly three years, as new orders declined.

US core inflation cools

Last week saw the release of the closely watched US core personal consumption expenditure (PCE) index– the Federal Reserve’s preferred measure of inflation. Core PCE, which excludes food and energy, rose by a lower-than-expected 0.3% in February, an improvement on the 0.5% increase seen in January. On an annual basis, core PCE increased by 4.6%, down slightly from 4.7% in January.

Headline PCE, which includes food and energy, grew by 0.3% month-on-month and 5.0% year-on-year, compared to 0.6% and 5.3%, respectively, in January. Food prices rose by 0.2%, goods prices by 0.2% and services by 0.3% month-on-month, while energy prices declined by 0.4%.

Eurozone inflation eases

The eurozone headline inflation rate slowed to 6.9% in March from 8.5% in February, according to figures released by Eurostat on Friday. This was lower than the 7.1% increase forecast by economists and represented the largest drop since 1991. The decline was largely driven by a reduction in energy costs, which helped to ease cost-of-living pressures. Annual energy inflation fell from 13.7% to -0.9%. In contrast, prices for tobacco, food and alcohol grew by 15.4% in March year-on-year.

Core consumer price growth, which excludes food and energy, grew to 5.7% from 5.6% in February, reaching an all-time high. This result, combined with unemployment remaining low at 6.6%, has added to expectations of further interest rate hikes by the European Central Bank. Investors are broadly expecting a 0.25 percentage point increase in May, with up to two more hikes of the same size in the summer.

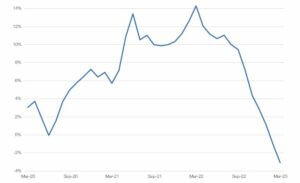

UK house prices see highest fall since 2009

Here in the UK, house prices fell by 3.1% year-on-year in March, the largest decline since July 2009, according to figures from Nationwide. Prices fell by 0.8% month-on-month, the seventh-consecutive monthly decline. The average house price in the UK is now £257,122.

Nationwide house price index – annual % change

Source: Refinitiv Datastream

Separate data from the Bank of England showed the number of mortgage approvals increased to 43,500 in February, up from 39,600 in January. This was the first rise in six months. Meanwhile, net mortgage lending dropped from £2bn in January to £0.7bn in February, the lowest level since 2016 (excluding Covid).

Revised US and UK GDP figures released

Figures released by the Commerce Department last week showed the US economy grew by slightly less than expected in the fourth quarter of 2022. GDP grew at an annual pace of 2.6%, lower than the previous estimate of 2.7% and down from 3.2% in the third quarter. This was driven by downturns in exports, non-residential fixed investment, state and local government spending, and a decline in consumer spending to 1.0%.

Economists have predicted US GDP will grow by up to 3.2% in the first quarter of this year. On an annual basis, expectations are for growth of 0.3 percentage points to 1.2%. Sentiment has been dampened due to recent turmoil in the banking sector.

Meanwhile, revised figures from the Office for National Statistics showed the UK avoided a technical recession in the fourth quarter of last year as GDP grew by 0.1%. GDP in the third quarter showed a decline of 0.1%, a smaller contraction than initially thought. A technical recession is defined as two consecutive quarters of contraction.