Stocks rise as US economy grows

Most major stock markets rose last week as encouraging financial data helped to ease concerns about a global recession and the pace of monetary policy tightening.

Major US indices ended the week higher. Consumer discretionary stocks outperformed thanks partly to a jump in Tesla shares. Performance was aided by higher-than-expected GDP growth and indications from the Federal Reserve of a potential lower-than-expected rate hike of 0.25 percentage points. A statement from the Treasury secretary on falling energy prices and easing supply chain bottlenecks also helped to boost investor sentiment. The S&P 500 rose 2.5% and the Nasdaq added 4.3%.

In Europe, the STOXX 600 gained 0.7%, and the Dax added 0.8% after business activity in the eurozone unexpectedly stabilised in January and consumer confidence rose. The FTSE 100 slipped 0.1% as investors expect the Bank of England to raise its base rate by 0.5 percentage points to 4.0%, its highest level in 15 years.

In Asia, Japan’s Nikkei 225 rose 3.1% on news the Bank of Japan will examine the impact of its yield curve control policy modification on market functioning. Hong Kong’s Hang Seng ended its holiday-shortened trading week up 2.9% with markets underpinned by lunar new year holiday spending and a sharp drop in Covid cases in China. The Shanghai Composite was closed all week for the lunar new year celebrations.

Last week’s market performance*

• FTSE 100: -0.07%

• S&P 500: +2.47%

• Dow: +1.81%

• Nasdaq: +4.32%

• Dax: +0.77%

• Hang Seng1: +2.92%

• Shanghai Composite2: n/a

• Nikkei: +3.12%

* Data from close of business on Friday 20 January to close of business on Friday 27 January

1 Closed from Monday 23 January to Wednesday 25 January

2 Closed from Saturday 21 January to Sunday 29 January

Investors eye interest rate hikes

US indices started this week in the red, with the S&P 500 down 1.3% on Monday (30 January) ahead of the Federal Reserve’s interest rate decision. The Fed is expected to slow its pace of interest rate hikes in light of cooling inflation. Last year, it delivered four 0.75 percentage point increases, followed by a 0.5 percentage point rise in December. Germany’s Dax also fell on Monday following news that Europe’s largest economy shrank by 0.2% in the fourth quarter of last year, leaving Germany on the brink of a recession. The European Central Bank and the Bank of England are due to deliver their rate decisions this week, with markets expecting a 0.5 percentage point hike by both central banks.

The FTSE 100 was down 0.3% at the start of trading on Tuesday following a prediction from the International Money Fund that the UK economy will shrink by 0.6% this year – a 0.9 percentage point downward revision from October. The UK is the only G7 country forecast to shrink in 2023.

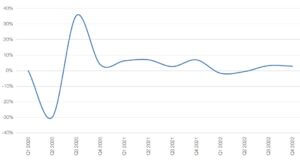

US GDP growth exceeds expectations

Figures released last week showed the US economy grew by 2.9% in the last quarter of 2022. This was slightly higher than economists’ forecasts of 2.6%, but lower than the 3.2% growth seen in Q3. Consumer spending rose by 2.1%, with growth concentrated primarily at the beginning of the quarter. A main driver of this was businesses building inventories, particularly across the manufacturing and utilities sectors.

US GDP – annualised % change from previous quarter

Source: Refinitiv Datastream

Rate increases have had a significant negative impact on the manufacturing and housing markets. Housing-related investment fell by 26.7% on an annualised basis, shaving 1.3 percentage points off overall GDP. The drop comes from delayed or cancelled projects as higher rates increased borrowing costs.

Separate figures showed core personal consumption expenditures (PCE), which excludes food and energy, rose by 0.3% in December, up from 0.2% the month before. This represents a 4.4% rise year-on-year, the slowest annual rate of increase since October 2021.

Meanwhile, new unemployment claims fell to 186,000 in the week ending 21 January, according to a report from the Department of Labor. This represented the lowest level in nine months and a decrease of 6,000 compared to the week before.

Despite the robust figures, many economists expect the US to go into a recession in the second half of the year, albeit a milder one than previous downturns.

Tokyo core CPI rises

Over in Japan, Tokyo core consumer price inflation (CPI) rose by 4.3% year-on-year in January, exceeding the Bank of Japan’s (BoJ) inflation target of 2% for the eight consecutive month. The increase marked the fastest annual gain in over 40 years and followed a 3.9% rise in December. Following the data release, the yield on the ten-year Japanese government bond rose to 0.47% from 0.40% at the end of the previous week.

At its 17-18 January monetary policy meeting, the BoJ concluded that it needs to examine the impact that modifying its yield curve control policy in December has had on market functioning. It added that it is appropriate to continue with monetary easing at this point. The International Monetary Fund proposed on Thursday that the BoJ allow government bond yields to rise more flexibly due to “significant upside risks” to inflation in the near term.[zuperla_single_image image=”23486″]